You know, when you are growing up, there are several movies that stick in your mind, and you can refer to them on certain topics. Well, for me, right now, it is the Wizard of Oz. I had never even imagined that we would be at the financial and social crisis we are now facing. While we are in a better position than the EU and UK, we are following along the same path as a lemming on the path to the cliff.

So, in the Wizard of Oz, we have the main characters, Dorothy, Tin Man, Scare Crow, Lyon, Good and Bad witch, Oz, and a cast of monkeys and munchkins. So, as we go through this article, reach back into your youth, and see if any of these cast members remind you of current leaders today.

Last week the House Committee on Oversight and Reform, chaired by Carolyn B. Maloney called for a hearing to discuss Exxon, Chevron, BP, and Shell’s record braking profits, discuss the adequacy of their climate pledges, and hear firsthand accounts from survivors of climate change-induced severe weather events.

Just a quick glance at exhibit A shows that their math is a little fuzzy. Two trillion for the major oil companies’ profits and two trillion for the cost of weather and climate disasters. Yes, you heard right, two equals two, but have nothing to do with each other. While many disagree with that statement, let’s go through some key issues.

Yes, climate change happens. But it has been happening for billions of years. We even have records that show us that man has not even had the impact that we are alleged to have done. We are not going to argue that we don’t have a pollution problem, and we need to correct some of our behaviors to correct those negative issues.

Piers Corbyn was interviewed on RT and brought data to the interview, much to the dismay of the news correspondent. “CO2 is not the issue; it is the patterns of the earth’s gravitational pull from the Sun and Moon.” He backs this statement of astrophysics and how it affected the weather. Other climate change experts also base their theories on facts like CO2 is not bad. The earth is healthier with CO2 and subsequently greener.

One of the great responses from Piers was his answer to “What about all of the climate scientists that are saying the climate crisis is real?” His answer: “It’s easy; they’re on the take.” They are taking money for their answers.

In the Committee’s meeting announcement, they published the following:

“In 2021, Exxon’s net profits were more than $23 billion, Chevron reported profits of $15.6 billion, BP netted its highest profits in eight years at $12.8 billion, and Shell brought in $21.1 billion. The fossil fuel industry’s profits have only increased in the wake of the Russian invasion of Ukraine. In the past quarter, since the start of the Ukraine War, five major oil companies raked in $55 billion.

Despite reaping record profits, these companies have not taken the steps that scientists say are needed to prevent the worst climate impacts. Instead, they continue their greenwashing campaign by publicly supporting the Paris Agreement and claiming to be working towards a net-zero future while issuing incomplete and misleading climate pledges and making inadequate investments in unproven energy sources and technologies.”

So, on the agenda, they have victims of “Climate Change,” and bad weather disasters, several professors, and recently defeated Rep. Maloney. There is no opposing, or factual, representation present. In fact, the committee even says that the executives of the oil companies have failed to show up several times in the past. When the executive’s representatives were asked, they said they never got the invitations. They are intentionally leaving opposing conversations out of the hearing.

Looking at this one committee hearing, it is a good representation of the typical Biden Administration thought processes. The Secretary of Energy is considering banning exports and even potentially releasing more out of the SPR. Both of those items are catastrophic and can inflict pain on the United States’ energy security.

What are Investors and decision makers thinking?

People are getting nervous about the economy and their 401Ks. Getting the news today that 8.3% inflation, and the FED is concerned about even how they can make any hope for a soft landing.

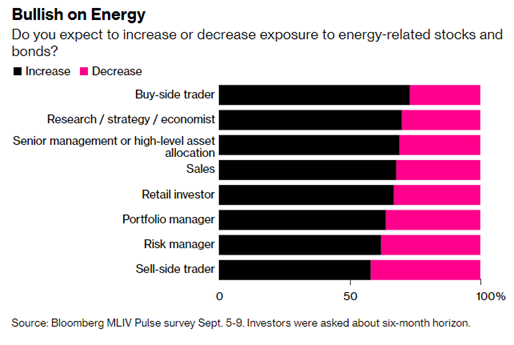

Bloomberg published the article “Fuel-Shortage Risks Make Investors Bullish on Energy Stocks, Survey Shows.”

“Energy stocks and bonds are poised to get a fresh boost from investors positioning to benefit from the surging electricity prices and fuel shortages expected later this year.

Two-thirds of respondents to an MLIV Pulse survey — which includes portfolio managers and retail investors — plan to increase exposure to the sector over the next six months. They see electricity and natural gas prices driving global inflation and expect that Russia will choke off flows of natural gas to Europe, leading to shortages of key fuels this winter.”

“Years of under-investment during the attempt to transition away from the fossil fuels have left global supplies unable to satisfy the post-pandemic rebound in demand.

“It’s ultimately the revenge of the old economy: if you don’t invest in the old economy, it comes back to haunt you,” said Jeff Currie, head of commodities research at Goldman Sachs Group Inc. “The only way you’re solving the energy problem, in the long run, is through investment – and oil companies are the conduit for the CAPEX to solve the problem.”

Bloomberg’s article summarizes what investors are looking for when hedging against inflation and high taxes coming around the corner. The administration is already planning on going after everyone in the United States, or why would you need 87,000 gun-carrying IRS agents?

The demand destruction caused by inflation and taxes still does not look like it will permanently drag down oil, and the price support levels are between the $84 and $135 range.

The Bottom Line

There is a “Great Energy Awakening” underway, and we are seeing European social unrest, world inflation, and food policy protests. You can see the Dutch farmers and the inflation numbers going through the roof. The banning of fertilizer, and lack of the key portion of natural gas, is causing food inflation and panic to take hold.

The number one contributor to inflation is bad energy policies and the subsequent lack of energy. While the Biden Administration is trying to blame Putin with his “Putin’s Price Hike” and point the finger at Trump for his failed energy policies, all of this was on the road to happening even without the invasion of Ukraine.

I call this blame game by the Administration the “Truputin Effect.”

So, getting back to the Wizard of Oz. Would the heroine, Dorothy, be the energy resource that can pull the United States out of a looming economic disaster? Would the Biden Administration be the Straw man looking for a brain? Would Yellen be the cowardly lion, or Secretary Granholm be the Evil Witch of the West?

I will let you ponder these images, and please reach out and let me know your thoughts!

Thank you

Jay R. Young, CEO, King Operating.

Please fill out the form, and I will answer all questions.