Growing oil product oversupply and government liberalisation efforts are unlikely to lead to any sharp reduction in Chinese refining capacity in the near future, supporting the country’s crude import demand and fuel exports, participants at the Argus Crude Live virtual conference said.

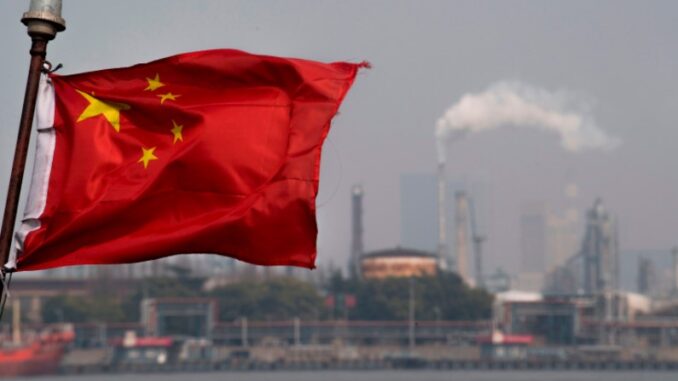

China’s downstream market has undergone major changes in recent years, including the partial liberalisation of crude imports in 2016, the expansion of the independent refining sector and the recent emergence of large, petrochemical-oriented private-sector refiners such as Hengli Petrochemical’s 400,000 b/d Changxing refinery in Dalian and Rongsheng’s 800,000 b/d ZPC plant in Zhejiang province.

But many of the refinery expansions were planned at a time when oil demand was expected to grow much more strongly than now seems likely following the emergence of the Covid-19 pandemic — leaving China’s product market struggling with oversupply and sending oil companies scrambling to capture a share of the growing petrochemical feedstock market, conference participants said.

The discussions were held under Chatham House rules, which preclude media from identifying the participants.

Government policy is split — between market liberalisation and the need for self-sufficiency in oil products, as well as between efforts to curb air pollution while also protecting economic growth and employment post-Covid-19. This is encouraging policymakers to take only cautious steps to open up oil markets, with no more than a handful of refiners likely to receive product export rights — even at the risk of exacerbating domestic oversupply.

China has added around 2.7mn b/d of refining capacity in the last five years, drawing more crude eastwards. These expansions, together with price mechanisms that guarantee refiners’ margins in the domestic market, helped support global crude demand and prices during the early stages of the Covid-19 pandemic last year.

The government is unlikely to relinquish its control over product prices, although it may allow room for more market signals such as the new Shanghai crude futures contract or sales by independents, conference participants said.

Beijing is looking to shut some older crude processing capacity to limit oversupply and offset the recent expansions. The more lightly-regulated and sometimes inefficient Shandong independent refining sector may be first in line for consolidation, although less-sophisticated state-run plants are also at risk, especially as new pipeline infrastructure brings competition to landlocked markets.

But the independents that are most at risk of closure tend to operate at relatively low utilisation rates, limiting the impact of the consolidation drive on overall crude demand. And the government’s priority is to avoid the prospect of fuel shortages, even at the expense of oversupply and rising exports, potentially adding to pressure on refiner margins elsewhere in Asia-Pacific.

by Kevin Foster – Argus