China has tightened emissions benchmarks for coal-fired power plants under its national compliance carbon market on the back of wider adoption of carbon accounting systems and introduced an overall baseline measurement for annual carbon emission intensity, according to an industry consultation issued by the Ministry of Ecology and Environment, or MEE, Nov. 3.

The tighter benchmarks from the MEE, which currently operates China’s national carbon market, underscore the gradual evolution of the market structure of its emissions trading system. Ongoing efforts to make the system more robust are expected to result in more regulations in the coming years.

China’s national carbon market currently covers only the power generation sector, which accounts for about 40% of the nation’s emissions, and coal-fired generation utilities account for over 97% of its power sector emissions, according to S&P Global Commodity Insights data.

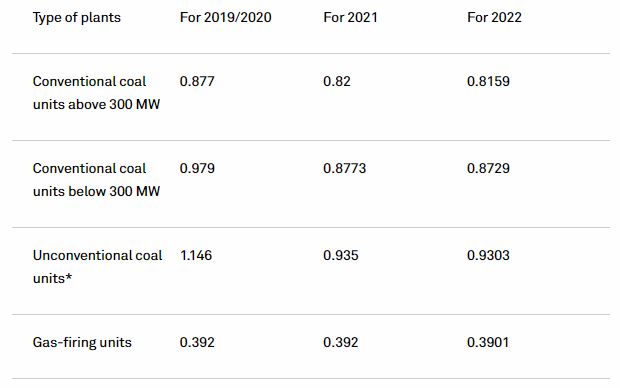

Coal-fired plants are assigned an intensity-based emissions benchmark depending on the type of their generation units, and the respective outputs.The benchmark determines the amount of carbon emissions they are allowed to emit for each megawatt-hour of electricity generated.

Coal-fired plants with emission intensity exceeding the benchmark need to offset their emissions by purchasing certificates called China Emission Allowances, or CEAs, and entities that have an emission intensity below the benchmark are entitled to sell CEAs.

The first set of emissions benchmarks for coal plants were issued for the compliance period comprising emissions in the two calendar years of 2019 and 2020. Under the new consultation that covers emissions in the calendar years of 2021 and 2022, the emission intensity benchmarks have been significantly tightened.

Compared with the 2019-2020 benchmarks, for 2021, the emission intensity benchmarks have been tightened by 6.5% for conventional units above 300 MW capacity, 10.4% for conventional units below 300 MW capacity, and 18.4% for unconventional coal units, the consultation document showed.

For 2022, the emission intensity benchmarks have been tightened by 7% for conventional units above 300 MW capacity, 10.8% for conventional units below 300 MW capacity, and 18.8% for unconventional coal units, the consultation document showed.

The lower emission intensity benchmarks are a result of overestimation in the first compliance period, and now reflect actual emissions and wider awareness and proliferation of carbon accounting systems as only 66% of generation units adopted actual measurements in their emission reporting in 2019, compared with 93% in 2020, the MEE said in a statement released together with the consultation document. For generation units that did not adopt actual measurements, their annual emissions were estimated using a set of industry-wide reference values, and the results tended to be relatively high compared with actual emissions.

This is illustrated by the tighter benchmarks for smaller and unconventional units that have established stronger emission accounting and reporting capabilities, the MEE consultation document showed.

The consultation document said the 2021-2022 compliance period also sets out separate emission intensity benchmarks for cogeneration plants that provide heating and power supply, with a separate set of benchmarks for heating-related emissions.

For this compliance period, cogeneration units are allowed to get more free emission allowances when they are operating at a relatively low load to reduce burdens on power companies that support residential heating, a top priority to safeguard energy security and people’s livelihood, MEE said in the statement.

However, market participants said overall emissions obligations for coal plants in the compliance period of 2021-2022 remain lax and are easily achievable despite the new benchmarks, due to overarching energy security concerns, rising inflation, and high fuel costs, allowing power plants to ensure sufficient energy supplies.

TABLE: New emissions benchmarks for coal plants in China’s compliance carbon market (Unit: mtCO2/MWh)

*Unconventional refers to coal gangue or coal water slurry

Source: China’s Ministry of Ecology and Environment

Policy clarity boosts liquidity

Similar to the first compliance period, China’s second compliance period will also adopt a two-year reporting cycle retroactively for 2021-2022 CO2 emissions obligations to be met by Dec. 31, 2023, the MEE said in the consultation document.

The MEE had delayed guidelines for the second compliance period for several months, leading to market uncertainty and low liquidity in the trading of CEAs. The policy clarity is expected to boost liquidity in the coming months, although the immediate impact on trading volumes and prices Nov. 4 was not very significant.

The MEE also introduced a new measurement called “balancing point intensity” for 2021 that is the actual average emissions for each unit of power produced for a given year and given type of generation units.

If the benchmark emission intensity equals this number for 2021, total free emission allowances assigned to generation units of a certain type will be exactly the same as their total annual emissions, the MEE said in the statement issued with the consultation, implying that actual and target emissions are “balanced” at this level.

Setting the benchmark intensity below this balancing point implies a deficit of free emission allowances in the current, second compliance period, the MEE said in the statement. For example, compared with the balancing point of 2021, the actual intensity benchmark was 0.1% lower for conventional units above 300 MW, 1.6% for conventional units below 300 MW, and 2.9% for unconventional units, the consultation document showed.

This number is an indicator of how stringent a given year’s emissions targets are and is likely to be used as a policy tool to tighten or loosen annual emissions caps, and act as a broader market indicator for the trading of CEA’s.