Energy News Beat Publishers Note (ENB): There is ongoing research with indications that the world’s energy needs are increasing with oil production being shut down, costly green projects increasing, and printing money around the world. This is a formula for more CO2, higher prices, and wait for it … More coal production. That is already going on in China, Russia, India and U.S. coal exports increasing. Will anything the U.S. does impact the pollution of the world? Just asking.

CIF ARA price has increased 155% in one year

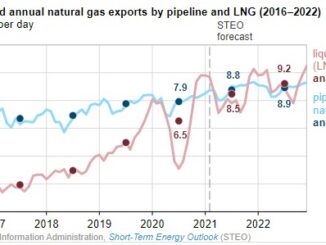

Gas prices also have risen dramatically

Seaborne coal prices have been bullish over the past year, largely rising from pandemic lows last spring as global energy demand resumes and economies strengthen.

The prices are signaling a lack of supply as producers scramble to rehire furloughed workers and reconnect supply chains.

However, there is uncertainty whether the sustained rally will lead to a crash or the prices will stabilize as supply chains catch up.

“People need to get over price and become more concerned about availability,” said a US-based coal consultant. “This market is so inelastic. The demand for energy in Q3 has spiked and they can’t find the coal.”

The US consultant cited a recent conversation he heard from the Asian market, regarding a third quarter tender for material that closed without any offers.

“Producers are already committed, or they smell blood in the water,” said the consultant. “And it’s really, really red.”

On May 28, 2020, the S&P Global Platts spot assessment for thermal coal, basis 6,000 kcal/kg NAR, delivered into Northern Europe was assessed at $37/mt, just 75 cents above its all-time low of $36.25/mt from two weeks earlier.

Exactly a year later, that price has more than doubled, being assessed May 28, 2021, at $94.50/mt, an increase of 155.4%.

“Coal is telling the market something is wrong,” said the US consultant. “The demand for energy is increasing faster than supply. It’s starting to smell like 2007.”

Despite environmental pressures, coal remains the world’s number one fuel for power generation, partly because it’s generally more competitive than gas. Even with the rally in coal pricing this still bears out, as increased gas demand has supported higher coal pricing, particularly in Asia and Europe.

The Platts JKM marker, for LNG delivered into Japan and South Korea, was assessed May 28, 2021 at $10.313/MMBtu, up from $1.938/MMBtu exactly a year-ago, an increase of 432.1%.

The Platts assessment for day-ahead TTF, a benchmark for European gas, was assessed May 28, 2021 at $8.888/MMBtu, up from $1.085/MMBtu on the same date last year, an increase of more than 700%.

US coal exports looming

The backdrop is a surge in economic activity. S&P Global Platts Analytics estimated that global GDP will grow 5.6% in 2021, after declining 3.2% in 2020.

“Infrastructure spending and resurgence in manufacturing is lifting the industrial side of the landscape, while energy should remain supported by accelerating demand growth over summer and tightening supply-demand balances,” wrote Platts Analytics in the May 17 edition of its Global Economic Outlook.

High petcoke prices are also creating more demand for thermal coal, in combination with supply constraints in places like Colombia and even the US, where producers were heard to be struggling to attract workers.

Nevertheless, US thermal coal exports in the first quarter totaled 9.4 million mt, up from 7.5 million mt in the same period last year. According to a European source, “a significant increase in US exports is looming.”

US export prices have also increased, though to a lesser extent. On May 28, Platts assessed FOB Baltimore, basis 6,900 kcal/kg NAR, at $75/mt, up from $56.50/mt a year ago, and FOB New Orleans, basis 6,000 kcal/kg NAR, at $53.05/mt, up from $43.15/mt last year.

Regarding the possibility of whether the rally in coal prices will hold, or a crash is coming, a second US-based coal consultant said he remembered 2007, but adding that the current scenario might be different.

“In 2005, China became for the first-time a net importer of coal, and so the global coal market shifted and there was a big run-up in pricing,” said the second consultant. “This time seems more like a short-term demand spike due to supply having trouble catching up.”