Commodities from Iron to crude to copper to soybeans soared after China made a significant change to the zero Covid policy that has caused nothing but trouble in the world’s second-biggest economy.

Almost all commodities, whether agriculture, energy, or metals, traded higher following the news of a 20-point playbook for officials that aims to reopen the economy, Bloomberg reported. One of the most notable shifts, laid out by the National Health Commission, is the amount of time travelers with inbound flights to China are required to spend in quarantine slashed to just five days in a hotel or government facility, followed by three days at home. The current rule is ten days is a total of ten days in quarantine, with a week in a hotel, then three at home.

The shortened quarantine length sent crude futures in New York and London up more than 3%. Iron ore in Singapore jumped as much as 8.2%, copper trading in London rose as much as 3%, and agricultural commodities gained across the board.

In a further pivot from zero Covid, the National Health Commission will discard a controversial system that punishes airlines for bringing infected passengers into the country. The new playbook is for all authorities and local governments to follow in containing future Covid outbreaks.

Remember, we pointed out (read: here & here) there were rumors on social media about Beijing preparing to roll back draconian zero Covid measures earlier this month.

This morning’s most significant moves in the Bloomberg Commodity Index (BCOM) basket are nickel, crude, gasoline, copper, and soybeans.

BCOM is up more than 1.5% on Friday. The basket of commodities has been in a trading range for most of the year, and the news of the biggest overhaul of China’s virus approach since the pandemic is risk positive despite mounting global concerns about recession.

Commenting on the news is Daniel Hynes, senior commodity strategist at Australia and New Zealand Banking Group Ltd, who said commodity “bulls have been waiting for such a trigger … these events may be enough to wash out all the bears and set up a strong and sustained rally.”

Today’s news will “further fuel speculation over a broader relaxation of China’s Covid control measures, which is bullish for energy and commodities,” said Vandana Hari, founder of Vanda Insights in Singapore.

Saul Kavonic, an energy analyst at Credit Suisse Group AG, said if China were to reopen fully, it could increase oil demand by 500,000 barrels a day, just as OPEC+ reduced production and Russian supplies dwindled. Zero Covid has suppressed China’s crude and crude products demand this year, but that could soon all change.

Besides commodities, the yuan strengthened by more than 1%.

A basket of emerging-market economies jumped the most in six years on China easing quarantine rules.

And in Asian equities, the Hang Seng China Enterprises Index jumped a whopping 8% on the news as airlines and casinos soared.

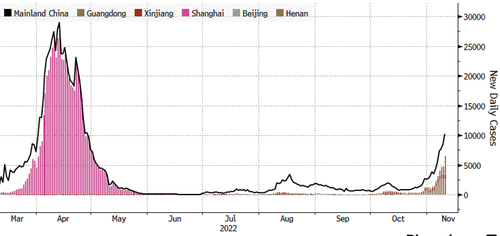

Finally, we note that these easing actions take place despite surging cases across the country. The country reported 10,729 new cases on Friday.

China can’t afford to keep crushing its economy via zero Covid policies…