Credit Suisse Group AG is continuing to see shares decline to record lows due to a surge in investor outflows that have prompted remaining investors to question the bank’s future, as rivals in the vital growth market of Asia appear to be gaining the business fleeing Credit Suisse.

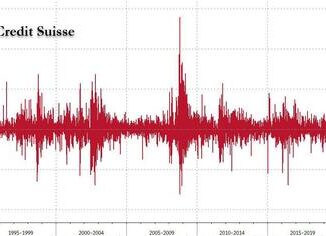

Shares of the bank were down by up to 5% in Zurich Friday, following word Vontobel had cut its price target, noting the bank “urgently” needed to quell the outflows afflicting its wealth management business. The stock has been enduring its longest losing streak since 2014, declining for nine days straight.

On Wednesday, Credit Suisse revealed that clients had withdrawn roughly 84 billion francs ($89 billion) over the first six weeks of the fourth quarter, and the outflows were not declining. The statement noted the wealth management unit was being particularly hard hit, amounting to 10% of the assets under management.

According to a Bloomberg report Thursday, the outflows are being directed into rivals such as UBS Group AG and Morgan Stanley. Both firms have seen significant amounts of new business in Asia, which is seen as one of the most important new growth markets for wealth management. By assets, UBS runs the largest private bank in Asia, outside of onshore China, while Credit Suisse is the second biggest according to a 2021 ranking by Asian Private Banker.

Andreas Venditti, an analyst at Vontobel, noted he was “stunned” by the outflows. He said that amid the elevated funding costs, he felt it likely Credit Suisse will post another loss next year, as he cut his price target for the bank from 4 francs to 3.5 francs.

By 3:04 P in Zurich, Shares had fallen 4.5% to 3.39 francs.

The Daily Financial Trends