The boys are, in rare form having fun about celebs and non-influencers. Is it just saying that we don’t need to get to work on the solution? We cover ran an article that says we can get rid of 90% of the critical minerals required if we all take a bus. Get rid of cars, and use only smaller ones—this- Not going to happen with current technology. Just look at California with the budgets and failed mass transit systems.

We need all forms of energy, but nuclear and nat gas are the most critical clean, low-cost energy we can use.

Have a great weekend and we will see you on Monday morning!

Celebrities call on UK banks to stop financing new oil, gas and coalfiel

Tesla ‘Weaponizes’ Price-Cuts To Crush EV Competition

We May Not Actually Need All That Lithium

Nuclear Power? Have No Fear—Our Clean Energy Future Is Radioactive.

API: Biden administration must fix broken permitting process that prevents U.S. energy development

Highlights of the Podcast

00:00 – Intro

2:51 – Celebrities Call on UK Banks to Stop Financing New oil gas and Coal Field

5:50 – API Biden administration must fix a broken building process that prevents U.S. energy development

10:01 – Tesla Weaponizes Price cuts to crush the EV competition

12:27 – We may not need to actually need all that lithium

14:08 Nuclear power? Have no fear Our clean energy future is radioactive

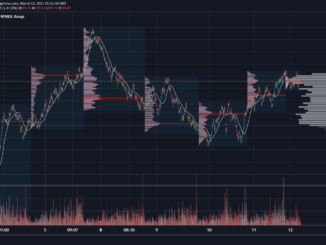

19:51 – Market Update

22:45 – Outro

Other Sandstone Media Energy Podcasts – Check them out! Sponsorships are available, or get your own produced by Sandstone Media.

David Blackmon LinkedIn

The Crude Truth with Rey Trevino

Rey Trevino LinkedIn

Energy Transition Weekly Conversation

David Blackmon LinkedIn

Irina Slav LinkedIn

Armando Cavanha LinkedIn

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:15] What is going on. Everybody, welcome into another edition of the Daily Energy News Beat Stand Up here on this gorgeous Friday, January 27th, 2023. As always, I’m your humble, humble correspondent Michael Tanner, coming to you from an undisclosed location in Dallas, Texas. You made it to the end of the week. [00:00:33][18.2]

Michael Tanner: [00:00:33] Guys, I appreciate you joining us here on This Week. We hope it was a good week. I hope it wasn’t too bad. I can tell you it was. It’s been a long couple weeks for me, Stu, So I am looking forward to seeing seeing this through. [00:00:46][13.5]

Michael Tanner: [00:00:47] The man on the other end is the man, the myth, the legend, the executive producer of the show and the purveyor of the show, and the director and publisher of the world’s greatest website, www.EnergyNewsBeat.com. Stuart Turley, My man, How are we doing today? [00:00:58][10.4]

Stuart Turley: [00:00:58] Know neighborhood. I’m back in Bear country already. [00:01:00][2.0]

Michael Tanner: [00:01:01] You are back you feel right at home. We fixed your sound issues so hopefully we don’t have any of those issues. But again, we appreciate everybody showing up here on this Friday. We’ll try to keep it quick. But we actually got a lot of great stories. The first one, we’re going to run nuclear power. Have no fear. Our clean energy future is radioactive. It’s a great title, by the way. It’s a great title for an article. [00:01:22][21.3]

Michael Tanner: [00:01:23] But nuclear power back in the news. We’ll talk about what that means. Next up, we have celebrities call on UK banks to stop financing new oil, gas and coal fields. It’s just as you will say, there’s just a lot of good one liners in their API. Biden administration must fix broken permitting process that prevents U.S. energy development, followed up by Chevron announcing they will spend $75 billion of stock buybacks each week. [00:01:51][28.3]

Michael Tanner: [00:01:52] That’s not good. Or is it? We’ll cover what that means. Finally, we’ll talk about Tesla weaponising price cuts to crush EV competition. And finally, we may not actually need all that lithium so great stories lined up still will kick it over to me for finance oil pretty steady here at about 8118 that gas down to about $2.85. [00:02:12][19.7]

Michael Tanner: [00:02:14] So, you know, not a not a great day for natural gas. We’ll cover the storage injection numbers and we’ll wrap it up and said, you on your way, guys. But first, check us out online. www.EnergyNewsBeat.com for all these stories reside. Hit the description below and after the pleasantries those do. Let’s kick this off. Where would you like to begin? [00:02:31][17.6]

Stuart Turley: [00:02:32] Well, let’s have a little bit of fun here. Let’s start flying across the pond here. David, let’s go over to U.K. You can’t buy this kind of entertainment. There’s two people in this kind of world that I don’t like, celebrities and politicians. This one is kind of actually fun, though, Michael, the title of the article, Celebrities Call on UK Banks to Stop Financing New oil gas and Coal Field. I’m sorry. Famous names, including Stephen Fry, Emma Thompson and Mark Rylance, joined activists and businesses in calling on UK’s five big banks to stop financing new oil and gas coal exploration. [00:03:17][45.2]

Stuart Turley: [00:03:18] Oh, Michael, isn’t anybody M tried to live without oil. Yeah, they tried to heat their house. Not okay. I just thought I’d ask. Curtis says they want to raise public awareness around the dangerous relationship between UK banks and the fossil fuel industry. Michael, let me ask you this real. This is a trick question right here. What company lost $7.2 trillion in the first half of this year of last year? [00:03:48][29.9]

Michael Tanner: [00:03:49] I think it was like the UK bank. [00:03:50][1.0]

Stuart Turley: [00:03:50] Right as it was BlackRock. Oh, okay. Yeah. Yeah. Okay. Now, it was all ESG funds. What was the only ones that did well? Oh, going into energy. Oh, yeah. Do them rich people like staying rich? [00:04:08][17.4]

Michael Tanner: [00:04:09] No, No, they don’t. I love this quote. “Members of the public are being invited to join forces with celebrities, politician campaigners and business leaders by signing the open letter”. My question used to is, Will you be signing the open letter? [00:04:21][12.7]

Stuart Turley: [00:04:22] I am not a politician nor a celebrity. But listen to this one right here. Curtis Group says this was it. Despite clear guidance from the IEA International Energy Agency, that we cannot develop new oil and gas fields if we are to limit global warming below 1.5 degrees. Oh, my goodness. [00:04:41][19.2]

Michael Tanner: [00:04:42] Yeah, it’s, it’s just just remember, when you do science, do you pledge to not only campaign for change, but also switch to banks that do not finance fossil fuel expansion. So we’ll be doing an audit of your bank accounts here very soon. [00:04:54][11.9]

Stuart Turley: [00:04:55] This is right here. Right here. Curtis says, We hope this weird, wonderful coalition of activists and actors, businesses and brands, celebrities and climate champions put a fire in their banks to stop setting fire to the world. [00:05:08][13.4]

Michael Tanner: [00:05:10] I mean, it’s, it’s, it’s comical, we hope. I mean, any time I mean, I would love I mean, who in this world wants to be associated with activist, actors, businesses, brands and celebrities? I mean, who actually is like, yo, I want to be associated with that? If you meet somebody and they say they want to be an influencer. Huge red flag. Huge red. [00:05:28][17.8]

Stuart Turley: [00:05:28] Flag. Run, Run as fast as you can. [00:05:31][2.3]

Michael Tanner: [00:05:31] Okay. I’m surprised anybody listens to us. It’s almost creepy. People listen to us. [00:05:35][3.6]

Stuart Turley: [00:05:36] We’re legends in our own mind. What’s next? Okay. It takes a village to raise an idiot. [00:05:42][5.9]

Michael Tanner: [00:05:42] Okay? [00:05:42][0.0]

Stuart Turley: [00:05:47] It is a good thing I was raised by a village. Okay. API Biden administration must fix a broken building process that prevents U.S. energy development. Well, let me throw this at you. That’s the American Petroleum Institute, Michael. But they’re doing a pretty good job stopping solar and wind as well, too. So if you’re going to be incompetent on everything, you might as well be incompetent on everything. [00:06:14][27.0]

Stuart Turley: [00:06:14] So quote in here, that’s just great. “Abby shares the administration’s goal of reducing greenhouse gas emissions throughout the economy while meeting the U.S. consumers needs”. But it is just even worse than that. The certainty of project developers need to make significant capital investments in energy and underscores that statutory reform, permitting reform, it’s the weaponized the permitting process, Michael. [00:06:42][28.1]

Stuart Turley: [00:06:43] And that’s that’s what it all is. And you and I have talked about legislation through regulation. Well, this one just really the API got a lot love. You know, the American Petroleum Institute, they they fight for everything they possibly can. [00:06:57][13.5]

Michael Tanner: [00:06:57] Oh, of course. I mean, they’re lobbyists. Of course they’re going to have to. I mean, if they weren’t doing that, they’re not doing their job. I do think it’s funny that their PR team failed. I mean, did you not? We knew last night that Chevron was doing $75 billion worth of stock buybacks. Not that that’s a bad thing. Maybe wait a few days to announce this because yes, I there was a little just a hint of irony. So, I mean, I’m not hiring the PR whoever is doing PR over at API, you know, you know, you’re fired as was you happy you’re fired. [00:07:28][30.5]

Stuart Turley: [00:07:28] We were even talking before the show. I missed that. [00:07:31][2.6]

Michael Tanner: [00:07:33] I mean, it’s unbelievable. I mean, it’s it’s you know, I that’s about all I want to say before I get myself more in trouble. I would not be serious. They need a standard operating procedure. That’s what they need. They need a standard operating procedure. It’s a joke. It’s a joke. Right? [00:07:50][17.7]

Stuart Turley: [00:07:51] All right. Let’s go to the next one. [00:07:52][1.3]

Michael Tanner: [00:07:52] I want to say this. This as much, we poke fun at them, but they are correct in that everything. I don’t think the permit process to drill new oil and gas wells has very severely been impact maybe a little bit on BLM lands, but I would say the majority of the permitting issues that they’re talking about and bringing to light, and rightfully so, are the larger projects. [00:08:15][23.0]

Michael Tanner: [00:08:16] The carbon captures, the LNG terminals, things like getting Freeport turned on, like things that take years that require a NEPA process. They they specifically mention here under the current NEPA process, the average environmental impact statement which is needed for a mine which is needed, right? [00:08:30][14.2]

Michael Tanner: [00:08:31] Hostility which is needed for these large, large projects takes four and a half years to complete 25% of the impacts, even more than six years. So it’s reducing those times can move these projects along. Now you need these long, you do need maybe about a year. I mean, trust me, I you know, when I was back in school, you know, homework, fun, I took a class that was specifically on mining project evaluation enemy. [00:08:56][24.7]

Michael Tanner: [00:08:56] These are 20 year projects to get one mine open from start to all of the permitting processes, the all of the different you know you have to put together like a 600 page document that then you have to like shuffle around or called. I forget what the actual names are, but it’s I mean, then you then you go to develop the mine for 50 years and then you have a 25 year reclamation process. So, I mean, these projects are just absolutely massive and they’re absolutely right in that regard. [00:09:22][26.1]

Michael Tanner: [00:09:23] When it comes to the actual drilling for oil gas, I don’t think we’ve severely been impacted. BLM has always been slow. They’re actually auctioning off offshore leases and nobody are taking that. [00:09:32][8.6]

Stuart Turley: [00:09:32] So why would you? [00:09:33][1.3]

Michael Tanner: [00:09:34] Exactly. So I think, you know, you know, fire your PR team. But I do think they’re actually they’ve got a point here. [00:09:40][6.6]

Stuart Turley: [00:09:42] What’s next? New Tesla to. [00:09:46][3.8]

Michael Tanner: [00:09:46] Me. Hey, hey, maybe hire me. All I’ll say is I’ll give you a you know, it’ll be just easy advice like this. Hey, just wait a week. Just wait a week. [00:09:53][7.8]

Stuart Turley: [00:09:54] That only cost them 600,000 for that one car. Yeah, we’re. [00:09:57][2.7]

Michael Tanner: [00:09:57] Cheap. We’re. Yeah, we. [00:09:58][0.9]

Stuart Turley: [00:09:58] Are. [00:09:58][0.0]

Michael Tanner: [00:09:59] We’re cheap. [00:09:59][0.2]

Stuart Turley: [00:10:00] But we’re easy. Okay. Tesla Weaponizes Price cuts to crush the EV competition. Tesla plans to report fourth quarter sales results after the market close on. Kids day. That’ll be cool to watch. Investors seek updates on the 2023 demand outlook after the company slashed prices worldwide. [00:10:21][21.1]

Stuart Turley: [00:10:22] You remember we talked about that the other day when Chinese were actually going into their stores and demanding rebates and they started just throwing riots around in China. People get a little grumpy when they all say and announce a sale on a Tesla. The day after you drive it off. [00:10:38][16.9]

Michael Tanner: [00:10:41] No. [00:10:41][0.0]

Stuart Turley: [00:10:41] And now Tran said, No, wait a minute, Tran said. I want to make sure I’m not getting thrown out. Getting it thrown out? Oh, the guy’s name is Tran. So only Tran family dream. That’s right. [00:10:52][11.3]

Michael Tanner: [00:10:53] 32 year old California psychotherapist. Oh, I bet he’s fun at parties. Oh, do I bet he’s fun at parties? I bet he’s the most fun dude at a party. Well, actually, I bet you he’s that guy. Well, actually, you say some or he’s all he. . [00:11:09][16.2]

Michael Tanner: [00:11:09] He’s either that or he’s one up guy where he’s always done something better, or. Or he’s this guy. Well, so tell me more. Like, literally trying to psychoanalyze the. I bet. I bet that dude sucks. [00:11:19][10.2]

Stuart Turley: [00:11:20] I bet he goes around with a portable couch, throw people on the couch and try to diagnose them. What do you think? [00:11:26][5.4]

Michael Tanner: [00:11:26] Just blows up a mattress. So how does that make you feel? [00:11:29][2.9]

Stuart Turley: [00:11:31] Do you love your mom? Was it the edibles? Oh, we’re going to have to check that out. [00:11:36][5.6]

Michael Tanner: [00:11:38] I love I love how the quote from Tran is there’s no way they they literally all they don’t is they’ve quoted him as there is no way. When you heard about that. [00:11:45][7.8]

Stuart Turley: [00:11:46] That’s what that was. I’m just trying to get that through. It was like what?, that was a smoothing moment. [00:11:53][7.1]

Michael Tanner: [00:11:53] I think it’s, I think it’s great. Tesla already has great operating margin. Cutting your prices a little bit in order to steal market share in the short term is really it in my opinion. I love me. You know, I like the move from Tesla’s standpoint. And if it’s affecting guys like Stanley Tran even better. [00:12:10][16.1]

Stuart Turley: [00:12:10] Oh, absolutely. If it gets a defibrillator out of him, I would pay money to disable that young man. All right, What’s next? Let’s go to the next one. That was pretty funny, though. Well. [00:12:23][13.0]

Michael Tanner: [00:12:24] You can we can acknowledge it was good. Let’s move on. [00:12:26][2.4]

Stuart Turley: [00:12:27] Okay. We may not need to actually need all that lithium. This one, Michael. Okay. You think that we were laughing about getting psychopaths? Talk to us on the street with a portable mattress. Let’s look at this one. This is just a hoot. We may not need that. Actually, all that lithium label. New research shows how simple policies like improving public transit, urban walkability, can significantly reduce demand for problematic materials. [00:12:57][29.9]

Stuart Turley: [00:13:00] Okay, so they’re saying you can get rid of the. The U.S. may need 90% less of these materials if it simply prioritizes things like public transit, Michael. That is ideal thinking at its finest. The U.S. is not like in the Midwest. We drive for hours to work. I mean, it’s just the way it is. You don’t have a chance to have a bus or a car from here to Dallas. [00:13:29][28.5]

Stuart Turley: [00:13:30] It just doesn’t work that way. People in L.A., they drive an hour each way. I mean, it it’s not feasible in our market. So and by the way, like, how long have they been trying to do this quick? Yeah, for a long time. Yeah. It’s not going to happen. So just by going up there and saying a number, Michael. Okay. This is almost like the Amazing Kreskin again. I’m going to think of a number, Michael. If we all walk, it’s going to save 95% of everything. I don’t know. That was. I could have written that article. All right, let’s go to the next. All right. Nuclear power. Have no fear. Our clean energy future is radioactive. [00:14:11][41.1]

Michael Tanner: [00:14:12] It’s good title. It’s a good title. It’s a good title. [00:14:14][2.1]

Stuart Turley: [00:14:15] You know, just go sit in the corner and glow. The tagline under it is, it would be nice if solar and wind could give us all the power we need, but we’re going to need nuclear. Here’s what it would look like. And here’s what standing in the way. This was actually a really good article, Michael, when you sit back. [00:14:32][16.5]

Stuart Turley: [00:14:32] Paul Debar was a distinguishing visiting fellow at the Center of Global Energy Policy at Columbia University. He says no one who’s a real engineer could even imagine anything beyond about 80% wind and solar. I think it’s far less than 80%, said Paul. And he’s is right. He says somewhere between 20 and 50% of our energy needs to be constantly available and renewable. That’s the first time that I have heard say that, and that’s why I thought it was important you sit back and kind of go. [00:15:07][34.8]

Stuart Turley: [00:15:08] You and I have always said, we need wind, we need support. We need no. We need oil and gas. We just need power. This guy was the first one that I have heard and I’m going to give him. You know, he needs to be promoted to our guy in an honorary position of authority. So are we going to give him a free ticket from the air not getting thrown off the island so he would get hey. [00:15:33][24.9]

Michael Tanner: [00:15:33] He needs a free ticket for sure. I mean. [00:15:35][1.8]

Stuart Turley: [00:15:36] I mean, think about that, Michael. Yeah. [00:15:37][1.8]

Michael Tanner: [00:15:38] A distinguished visiting fellow at the center of Global Policy at Columbia University. I mean, if that does it tell you all you need to know about this guy? I don’t know what else does. [00:15:45][7.5]

Stuart Turley: [00:15:46] So anyway, I kind of liked it. [00:15:48][2.5]

Michael Tanner: [00:15:49] Yeah. Yeah. All right. We’ll see what else you got. [00:15:52][2.7]

Stuart Turley: [00:15:53] We got Chevron coming around the corner. Do you want to take this? [00:15:56][2.4]

Michael Tanner: [00:15:56] Let. Let me take this. Yeah. This is great. This is great. This is great. So, I mean, I was laughing because, I mean, if this isn’t a middle finger to the Biden administration, I don’t know what is. Headline read Chevron Returns 75 billion to Shareholders as White House Fumes. Chevron will launch a massive $75 billion share buyback and raise its dividend. The Dow Jones energy giant announced late Wednesday. So this came last night on the news comes ahead of the fourth quarter earnings due on Friday. [00:16:32][35.5]

Michael Tanner: [00:16:32] Chevron stock advanced Thursday. The $75 billion stock buyback represented 20% of the shares outstanding at current price levels. It will also boost its quarterly dividend by 6%. The $75 billion buyback program will begin on April 1st of 2022 and does not have a fixed expiration date. I mean, that’s absolutely unbelievable. Here’s what White House press assistant’s press secretary Abdulla Husain tweeted. So this is how we’re getting our news now. Twitter. Okay, This is this is where we have to go to comment now. Twitter. Okay. [00:17:04][32.0]

Michael Tanner: [00:17:05] This is how American politics is done over Twitter. We’re a company that claimed not too long ago that it was, quote, “Working hard to increase oil production, handing out 75 billion to executives and wealthy shareholders is sure an odd way to show it”. I mean, I doubt any of these executives have any stake in the company. Like I don’t have a Bloomberg terminal. Unfortunately, we should. Bloomberg If you’re listening, give me a free terminal. [00:17:27][21.7]

Michael Tanner: [00:17:27] And then if you do, I would look up how much insider percentage they’ve had and I would be like, you know sponsored by Bloomberg get a lot of free money press, I should say. But I doubt any of these executives. I doubt Michael Wirth has any real equitable or any real ownership in like actual like ownership. He doesn’t own much stock. He probably owns a couple hundred thousand shares. I about it’s not much these guy these executives don’t own anything these companies they work at that could be a crime in and of itself. Having a CEO that has no stake in the company is, oh, it’s just a large corporation. Let’s just give them a fact. No, they do that. That’s one of the big issues in oil and gas is there’s a lot of these management teams that I don’t want to name names. We go look this stuff up publicly. Bloomberg this is a call we could pull this up now. [00:18:14][46.8]

Michael Tanner: [00:18:14] But, you know, the management teams, they’re not very invested. I mean, if there’s one thing private companies do right, is the incentive structure is more aligned to management. Right. Which they’re on the line. You know, in a public company, you know, like its its Vanguard the is the owners it’s BlackRock, it’s State Street. It’s all of these huge hedge funds that they own everybody. I mean it’s the funny part is BlackRock is they own everybody you know they make ESG non ESG tech you know you know military. I mean, they own everything. [00:18:48][33.8]

Michael Tanner: [00:18:49] Literally, they own everything. So when when they tweet, when, you know, you know, handing out $75 to wealthy shareholder, I mean, you put it back to BlackRock, who’s then going to invest that in ESG funds, it’s going to lose money. I mean, it’s a sick cycle. It’s a sick cycle. Share buybacks from oil and gas going into BlackRock’s account to then be wasted on some stupid windfarm off the coast of, you know, Antarctica, because apparently there’s a good wind stream down. They’re going to pipe the wind up through batteries. I mean, I’m sure there’ll be some great, great spend on that. Seriously, what will probably happen or what is going to happen with this money? [00:19:24][35.5]

Stuart Turley: [00:19:25] So you know, we’re going to get some fan mail from a flounder over that one. [00:19:29][3.8]

Michael Tanner: [00:19:29] Yeah, I mean, sponsor us. BlackRock will change our tune. We’re capitalists, we’re like you, we’re capitalist. We’ll sing whatever song makes us the most money. Hey, there’s no difference. Me, me, Larry Fink will say whatever it says to get that money in. [00:19:42][12.5]

Stuart Turley: [00:19:42] There you go. [00:19:42][0.4]

Michael Tanner: [00:19:43] It’s only a half. That’s only half of a joke because there’s some truth and some non truth to that. Let’s quickly cut all the mostly debt. Let’s quickly cover oil and gas prices on oil. We’re at 8119, coming off about a five 500,000 barrel build in crude oil production to prices did stay fairly strong. [00:20:01][18.3]

Michael Tanner: [00:20:02] Stock market was up overall off of 2.9% GDP growth which is very good. High GDP growth means we’ll probably have more commerce. More commerce means more fuel. More fuel is good for prices. So I think that’s, you know, stabilizing. We were all the way up above 82 for a little bit today, settling, as I mentioned, as we record this at 639, about 8119. Now, gas prices continue to tumble down to $2.84. [00:20:23][21.7]

Michael Tanner: [00:20:25] You know, we have a weak storage print. We had an actual withdrawal of or actual withdrawal of 91 Bcf. The street was expecting basically 94. So it’s a little bit weaker than expected. But to be honest, due last year we had 270 drawn. So there’s just ample supply out there. Nat gas is getting crushed right now. I hate to say it’s weather, but it is where they had some people at work today. Ask me, quiz me, grill me about nat gas. I said, I know. I hate saying it. I hate saying it. But it’s whether he can’t it’s you know, because nat gas is a localized product. [00:20:54][28.6]

Michael Tanner: [00:20:54] You know what’s going on in Europe with natural gas. Does it really affect us? Unfortunately, because it’s supercharged. We know with the whole Freeport issue with the can’t, no one’s got regasification facilities to take all this LNG or distribute it, the LNG export terminals, especially here in the United States. So it’s all just regionalized the problems that are there’s nat gas price. What’s going on here? It’s just affecting the United States. Elsewhere, it’s still higher and there’s not much to to interact. Crude, on the other hand, is a global product. [00:21:21][26.6]

Michael Tanner: [00:21:22] Now we’ve got two different benchmarks, but that global product you see much more more ubiquitous to use a fancy, big word for everybody. So, you know, that’s really I think that’s really all that’s going on in the finance sector game. It was a good week still. We had a lot of great articles, a lot of great stuff happened. Next week is nape. I will not be there. Somebody has to actually work while you guys are all down there at NAPE. But a lot of I only kid a lot of people will get worked on at nape so I will try to be there in the fall. So Stu, will you be at NAPE? No, you’re not going? [00:21:51][29.3]

Stuart Turley: [00:21:52] No, not this time. But I am planning on going to. [00:21:54][2.5]

Michael Tanner: [00:21:55] We get the fall. Well, we got to be, we’ve got to be doing live podcast at the fall one. [00:21:59][3.8]

Stuart Turley: [00:21:59] We’re going to be at that, but we’re also going to try to get sponsorships for the oil and gas World Poker Championship in Vegas. I’m working on that deal right now. [00:22:09][10.0]

Michael Tanner: [00:22:09] Like oil and gas. Poker. [00:22:11][1.3]

Stuart Turley: [00:22:12] Poker. [00:22:12][0.0]

Michael Tanner: [00:22:13] But what is this like? People who work in oil and gas is gambling huge sums of money. Gambling. They’re gambling. In two weeks, they rate. [00:22:19][5.9]

Stuart Turley: [00:22:19] It’s the world oil and gas. So we’re we’re going to go see if we can get sponsored, read, you know, do live podcast. [00:22:27][7.5]

Michael Tanner: [00:22:28] Yeah. I mean, that would be fun. That would be fun. I would I would love to do a podcast with people gambling behind me. [00:22:33][5.2]

Stuart Turley: [00:22:33] Oh, yeah, we’re in. Great. That’s why I bought this. [00:22:36][3.0]

Michael Tanner: [00:22:37] For maybe like, I’m doing that every day, so I do. You got anything else for these people? One of the words you should be looking out for this weekend. [00:22:43][6.2]

Stuart Turley: [00:22:44] Staying alive. All right. [00:22:45][1.0]

Michael Tanner: [00:22:45] Staying alive. Hi, guys. Well, with that lovely comment, let’s get out of here. Start your weekend. Hopefully it’s early in the day. If not, we appreciate the hard work to all the oil and gas guys go and linemen going out and working this weekend. [00:22:59][13.3]

Michael Tanner: [00:22:59] We appreciate it with that. We’re out of here. Done for the week, folks. We’ll see you Monday then. [00:22:59][0.0]