The U.S. Has Billions for Wind and Solar Projects. Good Luck Plugging Them In. (NYT)

Plans to install 3,000 acres of solar panels in Kentucky and Virginia are delayed for years. Wind farms in Minnesota and North Dakota have been abruptly canceled. And programs to encourage Massachusetts and Maine residents […]

Electricity prices surged 14.3% in 2022, double overall inflation: US report

EU’s War Anniversary Anti-Russian Sanctions Package: 121 Businesses and; Individuals

The European Union has rolled out with fresh sanctions on Russia, which comprises the 10th package, marking one year since the Ukraine invasion. “New EU sanctions over Russia’s war in Ukraine adopted on Saturday target […]

Why Were California’s Natural Gas Prices Almost 6 Times Other Parts of US?

Many Bay Area residents may have noticed their natural gas prices soared without warning. Consumer Investigator Chris Chmura finds out why. At Mark Zinman’s Moraga home, his gas bill just ignited change. “When I got […]

Pioneer Natural Resources Considers Buying Explorer Range

Pioneer Natural Resources Co., one the largest independent US oil producers, is considering an acquisition of Appalachian natural gas producer Range Resources Corp., according to people familiar with the the matter. Texas-based Pioneer is weighing […]

America’s Largest Power Grid Faces Worsening Reliability Risks

A new report reveals the US’ largest power grid is shuttering power generation units faster than new supply can be brought online, threatening electric reliability in 13 states that stretch from Illinois to New Jersey […]

Highlights of the Podcast

00:00 – Intro

04:37 – The U.S. has billions for wind and solar in projects

08:41 – America’s largest power grid faces worsening reliability risks

10:39 – U.S. 2022 power plant emissions fell on switch from coal to gas from the EPA

12:43 – Why are Californians natural gas prices almost six times higher than the other parts of the U.S.?

14:51 – Electricity prices surged 14.3% in 2020 to double overall inflation

17:15 – The EIA expects retail electricity sales will decline due to a milder summer this year, compared to 2022 and about 10% fewer cooling degree games

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Daily Energy Standup Episode #69

Michael Tanner [00:00:14] What is going on. Everybody, welcome into another edition of the Daily Energy News Beat Standup here on this gorgeous Monday, February 27, 2023. As always, I am your humble correspondent, Michael Tanner, coming to you from an undisclosed location here in Dallas, Texas, joined by the executive producer. Producers show the purveyor of the show and the director and publisher of the world’s greatest Web site energynewsbeat.com, Stuart Turley, my man, how are we doing today?

Stuart Turley [00:00:37] This beautiful neighborhood down here in Dallas. It’s great sun when we’re filming it.

Michael Tanner [00:00:42] It really is. I’m back from sabbatical, so I appreciate everybody tolerating Stu. Hopefully I’ll just move with my lovely presence back. I was I was joking with with somebody at work today. I was I heard on Friday, I was I’m on sabbatical, much like Aaron Rodgers is in that darkroom. Did you hear about that?

Stuart Turley [00:01:00] No, I didn’t see it.

Michael Tanner [00:01:02] Apparently, he went this is the quarterback of the Packers, apparently, to decide whether or not he wants to play football for $50 million. Okay. So this remember the decision he’s making, right? No money or make $50 million being the quarterback of the Packers. So remember, that’s the decision. In order to make that decision, he goes to some darkness retreat. You’re in a 300 by 300 square foot room with a bed, no lights. I don’t think it’s called a darkness retreat. And basically it’s like three days of you’re supposed to experience darkness. So I was actually in the shack next to him and it was fun.

Stuart Turley [00:01:35] You know, experiencing darkness means a lot to different people. So, you know.

Michael Tanner [00:01:40] It’s it’s a little it’s a little weird. It’s a little weird. He’s got to go to a darkness retreat to figure out if he wants to make $50 million. I mean, I I’ll hell, I hope you make that decision. I’ll do it for half.

Stuart Turley [00:01:53] Yeah. There you go. I got nothing on that. I don’t want anything to do with darkness.

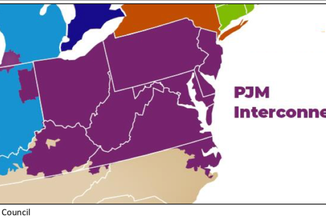

Michael Tanner [00:01:58] Luckily, the stories that we have are excellent today. Stu, you did a great job this weekend of keeping up. There’s a lot that has happened this week, and to be honest, normally it’s a little bit dull on the weekends, but we had some really hot Friday news in the M&A space, which we will cover. But here’s a quick rundown of the stories we’ve got today. First, the US had billions for wind and solar project. Good luck plugging them in. This is actually out of The New York Times. It will be fascinating to hear what they what they say because you’re right, we’ve allocated billions to wind and solar, but it’ll be interesting to see how they’re able to actually get connected to the grid. The next story that we have is in 2022, power plant emissions fell on the switch from coal to gas. That’s according to the EPA going green. Still, as we like to say, natural gas is clearly being now shifted and becoming widely recognized as the clean fuel that is. So we’ll dive into what the EPA said in that report next. We have why California natural gas prices are almost six times higher than other parts of the US is absolutely insane. If you’re out there in California, I would be outraged. We’ll dive into to why it’s six times higher, really. Next up, electrical prices surge 14.3% in 2020 to double overall inflation, according to a new U.S. report. I mean, that’s just mean. Energy inflation hurts everybody, not just and especially the disproportionate impact communities astute talks about so often. Next, we have America’s largest power grid facing facing worsening reliability record. That’s the PJM Interconnection, which includes New Jersey, Massachusetts, a little bit of New York and Manhattan, but mainly Ohio, West Virginia, mainland Virginia, Washington, D.C. and parts of Kentucky. So the grid is absolutely horrible. Still will cover what’s all going on in that sector. He’ll throw it over to me, will lightly cover what’s going on in the crude oil and natural gas markets. Natural gas, actually some bright news on Friday. And then we will talk about the M&A deal or the potential M&A deal between Pioneer and Range Resources. I know and I have a lot of thoughts on the Q kind of I want to get into a little bit of the psychology of how this stuff leaked out. So we will get you that story and then get you out of here bright and early on this Monday. We appreciate you for checking us out. Before we dive in, did today’s show that began check us out world’s greatest website www.energynewsbeat.com Dashboard Energy NewsBeat.com Best place for all of your energy news do does a great job of curating that check us out dashboard on energy news because it’s our combo of data and news together we’re out of work at V2 so it’s a little slower than expected, but that’s technology, folks. Check us out on energynewsbeat.com I’m out of breath, Stu. Where would you like?

Stuart Turley [00:04:34] Oh, I couldn’t be so fortunate that you’re out of breath. The U.S. has billions for wind and solar in projects. Good luck plugging them in this pretty cool article from like a like you said, from The New York Times. There’s a couple of big things that has happened around the world, and this one is really sparking it. There are more than 8100 energy projects. The vast majority of them are wind, solar and batteries. Our friends over there at Fry Battery out of Norway are coming in to take care of this as well, too. But here’s the problem. This is from our perspective. The interconnection process has become the number one project killer, said Piper Miller, vice president of market development at Pine Gate Renewables, a major solar power and battery developer. Michael, It’s a brain trust issue as well. Two things really that are in this article. The EU is having to print money to catch up because now the brain trust, just like free energy coming across the pond, is now taking up a lot of this dollars and they’re having to create the same thing to attract people to go to Europe. The brain trust people are fighting for these project engineers. Michael, You can’t get people approved to work on all of these projects. Wind, solar. The supply chains are not there. You may have the money. You may not get it done. It’s going.

Michael Tanner [00:06:05] To. I mean, think about this. I mean, it’s just that PJM interconnection, the one that stretches all the way from Illinois and in New Jersey, that that will actually I think we should probably cover next. Right. Because it fits right in. But think about this. They’ve announced a freeze on new applications until 2026, so we can work through the already backlog of thousands of proposals, mostly for renewable energy. So exactly the interesting part is it’s not just about, hey, can we build and spin up a wind farm? It’s where does the actual electricity tie into the grid? You’ve been on it for years, so you don’t hurt yourself patting yourself on the back.

Stuart Turley [00:06:39] But here’s the thing. Like Merideth Angwin, who shortened the grid she brought up and David Blackman just talked about this in their podcast as well to the grid. And then I talked about it with Don Dirks in my podcast. You have to add 180% when you bring in wind or solar for additional uptime guarantee instead of the normal 20%. So it is just nuts on this.

Michael Tanner [00:07:11] Michael Big about this. I love halfway down the article. It is one of the bigger titles is imagine if we paid for highways this way a potentially bigger problem for solar and wind, and that is in many places around the country. The local grid is clogged, unable to absorb more power. That means that if a developer wants to build a new wind farm, it may not just have to pay for a simple connecting like, but also for deep or else upgrades elsewhere. Get this. Still, these costs can be unpredictable. In 2018, EPD North American Renewable Energy Bill proposed a 100 megawatt wind farm in southwestern Minnesota. I estimate would have to spend $10 million to connect it to the grid. But after the grid completed its analysis, EDP learned upgrades would likely cost upwards of $80 million, and it canceled the project. You know what this does do? It creates a whole new problem. When proposed energy projects drop out of the queue, the grid operator often has to redo the studies for other pending project and ship costs to other developers, which could trigger more cancellations and delays. Dun dun dun.

Stuart Turley [00:08:06] Six things you said in there, Michael. There’s six things. I mean, the number one that I just said a second ago was there’s a brain trust missing from these people that can go through and analyze power, physics and everything else. That’s the number one job. It used to be it, folks. Now it’s brain trust for energy, trying to get things on the grid. Let’s go to the next one here. Great points, Michael. You did good.

Michael Tanner [00:08:34] I think you should go America’s largest power. I think we better stick with the interconnection here.

Stuart Turley [00:08:39] Oh, I saw. I’m trying to read it. America’s largest power grid faces worsening reliability risks. This one, Michael, you and I have talked about this for a long time. PJM Interconnect established a new study Friday that examines the alarming trend of state and federal decarbonization policies, meaning present increasing reliability risks during the transition due to potential mismatch between resource requirements. Here’s the key outlines. Thermal generators are retiring at a pace rapid pace due to government and private sector policies. The retirements are risking of outpacing the construction of new resources. The report warned, quote, Michael, for the first time in recent history, PJM could face decreasing reserve margins. Should these trends continue those reserve margins is what I’m talking about, that you normally have 20% and you have to add 180 in order to do the renewable. This is nuts. The energy transition is going to be brutal.

Michael Tanner [00:09:51] Yeah, I think it’s I think it’s it’s interesting considering that they can’t even evaluate these studies quick enough and we’re retiring fossil fuel or natural gas or coal plants which have their issues, but we’re retiring stable what we would call baseload energy. Right. And trying to replace it with something that we. Can’t even study properly.

Stuart Turley [00:10:13] Exactly. And and so the money has I mean, which came first? Congressional and printing of money or being able to install these things?

Michael Tanner [00:10:23] I chicken or the egg.

Stuart Turley [00:10:24] The straight, you know, the. Okay.

Michael Tanner [00:10:26] So well, the printing of the money came first, but.

Stuart Turley [00:10:30] Yeah. And then that makes inflation happen because of graft. Okay, so let’s go to the next one. You U.S. 2022 power plant emissions fell on switch from coal to gas from the EPA. Michael this is part of a very, very important the EPA and third paragraph down says emissions of smog components from nitrogen oxide and sulfur dioxide last year dropped four and 10% respectively, compared to 2021. Emissions of mercury, neurotoxin, which can accumulate in the environment and some kinds of fish fell 3%. This is huge, Michael. And you know. And you know why? Natural gas. Hey, let’s boom everything we can and go to natural gas. I’m all good.

Michael Tanner [00:11:21] Yeah. Again, you were on this at COP 26. You had this. They they flipped that natural gas will be clean. You know, they’re not outright saying in the press release natural gas is why we’re down and emissions are cut. But they’re alluding to it. They’re not saying it was wind and solar. They’re just saying we got rid of coal. Well, what did you replace it with? It wasn’t in the peat. It wasn’t any of the projects in the PJM Interconnection. Trust me, there were four years out in eight coming on to the grid. So the sleight of hand that they’re doing and are in the process of doing is for us obvious. Hopefully it’s obvious for you guys as well. But they’ll they’ll realize eventually. I mean, they can’t deny. They can’t you know, our work is far from done, but the data proves we’re on the right track. That’s a quote from the EPA administrator. Oh oh.

Stuart Turley [00:12:12] Oh. The data proves we’re not knuckleheads.

Michael Tanner [00:12:15] So actually looking at data, at least, though, they feel a little bit more comfortable that they’re at least looking at data and they’re not outright denying it.

Stuart Turley [00:12:24] You mean they got bandaids on their servers that they had problems with last year?

Michael Tanner [00:12:28] But that is the IEA we’re talking about. The EPA will differ, but yes.

Stuart Turley [00:12:33] They use the same servers. They’re all interrelated. All right, here we go. Let’s go around the corner here. They in Arkansas, they’re interrelated. Is that the new term? All right. Why are Californians natural gas prices almost six times higher than the other parts of the U.S.? This, to me, just crack me up. This was a local news and the video is on here. Michael. And this guy did a great job saying about the whole thing, about how California is trying to isolate itself from fossil fuels. And it’s our beloved hair monger. I mean, Governor Newsom is just destroying the energy policies. They have to bring in natural gas from Canada and then they imported it. Let me cover a couple stats in this article, Michael, at Mark Zimmerman’s Morgan at home, his bill just ignited change. When I got the bill, I was a little alarmed. So I started turning down the thermostat using less gas. December’s Fijian bill was 575 of that 400 was for gas. Zimmerman’s furnace got a new setting. That’s a lot of money just for gas. That’s not your electricity. That’s your.

Michael Tanner [00:13:51] Gas. It’s it’s pretty unbelievable. I mean, to give you an idea, I think, you know, you know, Texas, probably because they’re a deregulated market, I’m fairly sure, has some of the higher electricity costs relative to other parts of the country. I’m only paying like 200 bucks. You know, granted, I’m and I’m a little boujee. I keep the A.C. on. I like it chilly. I like it chilly.

Stuart Turley [00:14:14] Well, you got to it’s.

Michael Tanner [00:14:15] How I like.

Stuart Turley [00:14:15] Is around. So but you know, when you sit back and kind of my Dallas house is same thing a couple hundred bucks my places up in in Oklahoma couple hundred bucks to run home. So I mean, it’s like you know.

Michael Tanner [00:14:28] Yes. Because you’re you’re hooked up to hydro there. I mean, we would yeah, it’d be the perfect place for a bitcoin mine and propane.

Stuart Turley [00:14:35] Yeah. Yeah. So yeah, let me some propane especially at these prices. So.

Michael Tanner [00:14:40] No kidding.

Stuart Turley [00:14:41] Anyway, I just. All of these stories go together. Now. This other story rolls in together. Michael, this is my last story for this section. Electricity prices surged 14.3% in 2020 to double overall inflation. Oh, but inflation’s transitory. U.S. report. And so the the dive goes in. Consumers paid 14.3 more for electricity double than the six. Point five increase according to consumer price increase. And if the hyperlink in here is amazing on the Consumer Price Index summary, food goes through the whole thing. Food at home, food away, energy, energy, commodities. In the interim, you know how much inflation rate shelter is just amazing and energy is just kicking the Bahamas out of all this.

Michael Tanner [00:15:35] And I love this. I love this quote from Tyson Slocum, director of Public Citizen’s Energy Program, said, Domestic energy prices are, quote, tethered to global calamities. Okay. So that’s you clearly know where what side of the aisle he falls into because he’s blaming the entire crisis on the Ukraine Russia war, which we know is not. Let’s second order here. But look, but look, look, look what he said. This is what I love to do. He also said this, The Inflation Reduction Act is expected to help fund energy investments, but, quote, it’s still heavily tax incentive focus, he said, which puts it out of reach for many consumers. Oh, so even these even the people that should love the inflation reduction understand that it’s just massive tax cuts for large corporations to go, quote unquote, develop renewable projects, which we’re going to which are going to sit for 5 to 10 years in right in the GM interconnection, because we don’t have anybody who could do the environmental impact studies to get them done. It’s their insane, stupid definition of insanity is doing the same thing over and over and over again and expecting a different result.

Stuart Turley [00:16:38] Oh, and what happened to the EVs when for when President Biden went ahead and put in and said, hey, we’re going to make sure that in the Inflation Reduction Act is a lot of the tax credits for EVs. Well, everybody raise their prices. The almost the dollar amount that the tax deduction was, guess who gets to pay the bill again in the consumer. So, all right. Disproportionately impacted communities and the consumers. All right, let’s go. I’m done, man. I’m wiped out. I’ve got to go back to the gem. Just get my heart.

Michael Tanner [00:17:12] Yeah. Interesting. It’s just another random quote. The EIA expects retail electricity sales will decline due to a milder summer this year, compared to 2022 and about 10% fewer cooling degree games. I’m going to go out on a limb and disagree with that.

Stuart Turley [00:17:26] I think in two ways. If you ever known a weatherman to be or weather person or them weather, be correct.

Michael Tanner [00:17:35] And I just don’t trust the EIA. So I think I think I think what they’re doing is trying to show you are going to use lost electricity.

Stuart Turley [00:17:43] My young apprentice has grown up. I am so proud of you.

Michael Tanner [00:17:47] Yeah. Okay. But do I think they’re messing with the servers? We can get into that whole conspiracy later. I just think. I don’t think they’re looking at the data.

Stuart Turley [00:17:54] All right, You’ve convinced me. I think it was incompetence. I agree.

Michael Tanner [00:17:58] Don’t attribute mal intent. What? You can’t just attribute it to pure stupidity. I remember learning that early on in my career, and I thought that was smart, because you’re probably just idiots. That’s easier to that’s easier to comprehend. Then there’s so.

Stuart Turley [00:18:11] You can get serious, But that’s the third time you’ve convinced.

Michael Tanner [00:18:14] Now I’m with you on Nord Stream. Oh, you know, according to a random dude on Substack.

Stuart Turley [00:18:20] I had a great talk with Tom Kirkman. That’ll be coming around.

Michael Tanner [00:18:24] It’ll be a good one. He’s over to me now in finance.

Stuart Turley [00:18:27] And it’s all you, baby.

Michael Tanner [00:18:28] I mean, we’ll keep it fairly short because there’s just we have to talk about the Pioneer News. But first, oil price is currently trading 7645. It’s been a few days, actually, again, since I’ve been on the show. So actually we load out at about $74 over on the 22nd. We’ve seen a pretty steady two day rise, though I expect things to be fairly mild this week. Again, people are expecting US economic numbers to come in, not quite as strong as we would have hoped. I think that’s what’s lagging prices down. I know Russia oil flows are beginning to decrease in our appetite and demand is still there. So it’ll be interesting to see how that balance plays out. You know, as far as where oil prices could go this week, I mean, again, I think we’re well, I think we’re rangebound between somewhere between 74 and 80. I think we’ll see 80 occasionally. I think we’ll see 70, 72 occasionally. But I think we’re rangebound somewhere between 74 and $78. It quite frankly, you should be able to make money if you’re an oil and gas producer and you’re sad about that, like go home. Like your assets should be good enough to make money at 75 there. If they’re not, I’m sorry, they’re just not great assets. Now, moving over to natural gas, we’re 250. I’m you know if you’re you know, and some regional spot prices are a little bit lower than if you’re in West Texas. You’re a little bit you’re somewhere in that one. The 150 range Appalachia is even seen less than a dollar because of all the amount of transportation issues they have up there. So, you know, is your stuff economical there? No, not really. Like I’m with you. Like those those wells aren’t making that much money. I did see still gas, natural gas well get permitted in Oklahoma for mile long lateral $26 million rumor Ophelia.

Stuart Turley [00:20:02] What what field The end of it.

Michael Tanner [00:20:04] I don’t know. I just saw it on Twitter and there was a there’s a new four mile long lateral. Wow. I doubt there. I doubt that thing’s going to get drilled right now that at these prices, do the math on that. Those prices ain’t going to work.

Stuart Turley [00:20:16] No, I was going to say it depends on what field it’s in. Scoops, gap, you know, scoop or stack.

Michael Tanner [00:20:23] I just want to hear you say Scoop Stack again. No, I don’t. I know it was in Oklahoma. I think it was Woodford. I think it was Woodford Field. I think it was a Woodford.

Stuart Turley [00:20:32] I believe that’s a scoop stack.

Michael Tanner [00:20:34] No one really uses the scoop stack terms anymore.

Stuart Turley [00:20:36] I still just shows you my age.

Michael Tanner [00:20:39] Does old.

Stuart Turley [00:20:41] Wise one. Yeah. I came in on the covered wagon when the Sooners did.

Michael Tanner [00:20:46] I’m reading a new book on the Mayflower. I had no idea. You. You. You were on the Mayflower?

Stuart Turley [00:20:51] I was.

Michael Tanner [00:20:51] You captained it?

Stuart Turley [00:20:52] No, I was. I was always.

Michael Tanner [00:20:56] The one who. Plymouth Rock.

Stuart Turley [00:20:57] No, I was the slack. Your first mate or something. And that was it.

Michael Tanner [00:21:02] All right. Natural gas, as I mentioned, $2.50. You know, it looks like it’s going to be a little bit of a colder a cold front moving in. I think it’s why you’re seeing prices rise. Inventories did not quite come in as expected. You know, inventories are well above what we what their average is. Again, we saw a weaker draw than expected. So overall, I think there is ample supply out there. So, again, do I think we’re going to see $3 in a week? Not really buy. I think with the roll over from winter, as we get closer and closer to the what I would call the spring roll over, will we go to injection? I mean, things could get even nastier. I mean, we could hit a real big slump this summer with natural gas prices. And it might it will be pretty interesting to see how low this thing could go. I mean, do we see a buck 50 this summer? I don’t know.

Stuart Turley [00:21:46] Well, I did say when it gets to a buck 50, that’s my strike price.

Michael Tanner [00:21:51] That’s when you’re buying.

Stuart Turley [00:21:53] Everything I got.

Michael Tanner [00:21:55] Which we’re not. All right. Speaking of low natural gas prices, Stu, this is this is a fun story. Okay, So Friday morning hits. We don’t record the show anyway because we actually record Sunday through Thursday. Inside baseball tip for all you made it this far. You’re true fan. So we’ll we’ll get you a little inside baseball will wake up Friday morning to news pioneer natural resources considers buying range resources Corporation. My oh my. Here we go. Here’s Tyler. That’s Tyler article Pioneer Natural Resource Corporation, one of the largest independent U.S. oil producers, is considering an acquisition of Appalachian natural gas producer Range Resources Corporation. According to people familiar with the matter, Texas based Pioneer is weighing a deal for its smaller U.S. rival as it seeks further consolidation in the sale industry, The people said, asking not to be identified, discussing confidential information. Deliberations are ongoing and there’s no certainty the companies will reach an agreement, People said. I think this is hilarious. I think there’s so much to do on this pioneer natural resource. Read this. A Texas based oil company is considering buying an Appalachian natural gas producer. That’s not good. It’s do, in my opinion, and I don’t mean not good. I think it’s an interesting combination that provides little to no value, to pioneer and all the upside of cashing out the range resources. So here’s my thing. When you attempt to acquire any business, there’s a few things you need to agree upon or or that need to work in your favor. You need to feel like you feel good about. One is the value. You don’t feel like you’re overpaying for anything. Now you can never overpay for great someone like Pioneer. If they were to offer themselves up to Chevron, they are great. There’s no, you know, 20, 30, 40%. You can’t overpay for great. There are certain companies that we really like that if they were to offer themselves in an M&A deal, the value that they would get far exceeds their market cap because they’re great, right? You can always overpay for good, though. They always overpay for great.

Stuart Turley [00:24:01] Said about me.

Michael Tanner [00:24:02] But you can underpay for good. You can feel like this company is perfect, but I’m going to back. So you have to feel good about the value. Whether or not you’re buying great, good or bad, whatever. Second is, hopefully there’s some what I would call economies of scale. There is some sort of advantage that you can achieve from a business side that will allow you to achieve a return greater than the value in which you’re valuing it. Let’s say you’re going to buy him for a buy. Think something for $1,000,000,000. Well, you better hope that at some point this acquisition will generate you $1,000,000,000 and economies of scale, some, you know, contiguous business. You know something that you do that when adding this company’s resources in your portfolio allows you to lower your operating expense or allows you to operate more efficiently. And, you know, we could make up any sort of but, you know, I think most of the familiar the term of economies of scale making it easier for you to lower your costs and make more money. And then third, you know, is some some operational knowledge or some, you know, you know, again, I think it just comes back to economies of scale. But but but the other thing you look at is do. Do you know anything about this business? You know, Stu, like, you know, you have a business, you go out and buy a business. You wouldn’t go out and buy a. I’m trying to think you would now. You wouldn’t go buy a Subway franchise? Sure. A Subway franchise could be valuable. But if that time I’m just making an example. Time out. What experience do you only experience would be? I ran a business before and know I know enough about accounting so that I’m not getting scammed by account. I know enough about, you know, revenues and, you know, cost of goods in Hey, I’m sourcing my ham from this spot. I should probably go over here to get a little bit of a deal. But at the end of the day, you don’t know the dynamics of the sandwich business. You don’t know the dynamics of the franchise business and how the individual royalties that each of the different franchises takes and blah, blah, blah down the rabbit hole. And eventually it’s like, well, I just I’m just a good business owner. So the real question is do good business owners, can they just buy businesses and learn that? So I say all that to say, you go over that criteria of acquiring a business. This doesn’t check pioneer buying range checks. None of those boxes the value. Who knows what the value is? The value might be the only thing they agree upon because of these low natural gas prices, and they’re lower in Appalachia. So let’s assume they’ve agreed upon the value. They’re at the same value, Doctor. They both feel like there’s good value. Well, number two, where’s the economies of scale? Pioneers consolidated. And they literally in the article, Texas bass player is weighing a deal for its smaller U.S. rival as it seeks further consolidation in the shale industry. What I didn’t know the shale industry was in Appalachia. I thought that was the gas fields. I mean, yes, it’s shale gas, but. But that’s not. But when you say shale, you’re talking about West Texas baby like this is from routers or I don’t know who this is from. Is this. This is some Bloomberg this is some, you know, energy reported. It doesn’t really know what he’s talking about. He just knows that that the term shale is not he knows it. Right. So what he’s talking about is the West Texas Midland Basic baby. It’s time. Acreage, right? $10,000 an acre. That’s not what it’s going on in Appalachia. That’s old people, new market logic, trees you have to worry about. You have to pay to get rid of trees. I mean, no biggie. So the economies of scale aren’t there. There’s nothing that Range owns that’s going to help Pioneer produce its West Texas assets better. And right now I think Pioneer owns that will make producing Appalachia natural gas range, which was better besides more people, besides more layers of management, besides now, instead of three people, you have to report to its five. You know that that’s what it’ll become. It’s going to become more of just a corporate nightmare because again, pioneers attempting to acquire rate. So there’s no economies of scale and there’s zero operational knowledge to try to tell me that boom, we can go over and produce an address. I doubt it. I think the dynamics are completely different, you know? Right. So the only thing that looks cool is that you be the sixth largest oil and gas producer by volume. If you acquired range, you’d be the sixth company over a million BOE a day. So maybe there’s that. It’s a little bit of an ego play. Scott Sheffield likes to make you old so that I’m done with my monologue, but this deal makes no sense to me and I’m very interested in why this was leaked.

Stuart Turley [00:28:13] I think you are dead on right on many of those things. But let me tell you why I would look at a strategic versus tactical. And what you’re describing is tactical by saying that everything that Pioneer needs is going to augment it immediately off of it. But from a strategic the Appalachia play is fantastic if a couple of things happen. So you are right in your analysis. But with my conversation with the CEO of CNN X, Nick, he did say that there are some things coming around the corner that they’re working on and he publicly can talk about compressed natural gas as well as LNG from the wellheads in the Appalachia because of the price. There’s no pipelines going on in that area.

Michael Tanner [00:29:05] Exactly.

Stuart Turley [00:29:06] So hang on. So compressed natural gas at the wellhead does make sense for everything else. I mean, there is a tremendous surge for this. So, yes, you are right from a tactical but from a strategic, it makes sense so that you would if I was looking at like Warren Buffett, I I’d strip out all the middle management and go for the long term strategic play. Warren Buffett went for the long term strategic play with oxy and oil.

Michael Tanner [00:29:39] Though oil.

Stuart Turley [00:29:40] Carbon capture.

Michael Tanner [00:29:42] I, I don’t go like I’m hard pressed to believe Warren Buffett got his money back already. And how did he get his money back? Because oil went to a hundred bucks.

Stuart Turley [00:29:51] But go. Let’s go. Paul, some of the articles, he said he’s in it for the trillion dollar business. That’s carbon capture. So he those people were thinking strategic rather than tactical. And I agree in the short run with your tactical by the way, I’m just trying to give you an offset.

Michael Tanner [00:30:07] You’re right. I’m not even sure if it’s a strategic. Egypt move. I think it’s a ego move. I am on my you know, remember, he wasn’t the CEO of Pioneer has come back in recently as the CEO and taken out parsley, which his son owned. You know, obviously, they didn’t talk about it. It was all above board they ever talked about it at Thanksgiving. So never once he came up strategic.

Stuart Turley [00:30:29] Ego. Strategic was a game that I used to play when I was. Yeah, so strategic. I was not a bad game that was comparable to chess.

Michael Tanner [00:30:38] I am just I don’t get this. And I think this also brings up another interesting, you know, note is who leaked this and that only there’s three there’s four parties that could have leaked this. There’s Pioneer. There’s whoever pioneer hired to do their investment banker analysis. You know, I don’t know who they hire, who they work with, Range resources, whoever Range Resources hired at a bank. I’m going to eliminate the bank because the banks, this is their job is to be involved in potential M&A deals. And if they talk, they lose all they lose credibility. Yeah, because within that four person, within those four parties I talked about, do they know who leaked? Like it’s not the Scott Sheffield knows who leaked this, you know, ordered it by his team. He called them. Go ahead.

Stuart Turley [00:31:29] Where’s Paul Pelosi or Nancy Pelosi if they were leaking it?

Michael Tanner [00:31:32] I don’t know. Or rage and rage. Resources CEO knows who. They all know who leaked it. And my opinion is this. This was leaked by Pioneer in order to gauge market interest on what this will look because they understand Treasury with an out it’s a little bit of an out there you may be right maybe it’s a long term strategic move. Scott Sheffield sitting there and saying now we could get into the no appellation gas markets at these prices. They’re willing to sell at a valuation that we really like that, you know, in with, you know, add another dollar to the strip price and all of a sudden this is a you know, for X we projected for x return. Again, I don’t know what their financial model looks like. Right. That could be it could be a very strategic think. That’s where it probably is. So you’re probably right on that point. Yeah. What do they do? Do they So they leak it and what happens? Stock goes down. Stock drops four percentage points on Friday. Range Resources stock up one or two percentage points. What does that mean? That tells you the market on its face doesn’t like the deal for Pioneer and loves it for rain. Right. It’s why. Well, Range Resources is not even the premier operator out in Appalachia. You’ve got two companies. You mentioned one. What’s his last name really?

Stuart Turley [00:32:46] It’s the Dallas stick dial.

Michael Tanner [00:32:49] So there’s. Yeah, that’s his book.

Stuart Turley [00:32:51] That’s his book. Even got me sign.

Michael Tanner [00:32:53] He’s the presidency of Synnex. They’re probably number two out there. Number one, Z, Q t Rice Brothers, you know. Okay. I mean, they’re not even they’re the third. I mean, they’re number three. That’s still big, but they’re not even the big dog, you know. So again, my question becomes why I think Pioneer leaked this. And then when they saw their stock go down, they have to release a press release. And this is hilarious. This this comes Friday night. This comes Friday night. It’s one since Pioneer Natural Resources Company today announced that the company is not contemplating a significant business combination or other acquisition transaction. Literally, that’s the press release. You know, I could have writ, wow. You know, like, you know, I know a company that could have written that even they do okay work maybe, but you know what I mean through it it is probably was leaked by them. This is a hilarious press release. I find this whole conversation hilarious because they’re probably are talking about it and probably somebody at. And so what this press release tells me is that one of two things. One, this was ordered from above to test market interest or this was just literally something that’s getting tossed around in inside Pioneer, somebody, you know, Project Veritas style or, you know, got a little too friendly with somebody who maybe they shouldn’t have and just was like, oh, yeah, we’re trying to buy rage, boom. Next thing you know, it’s in an article and they’re getting their handcuffs on them. So there’s two options. And I think it was a strategic leak in order to gauge market interest. You know, they can overcome a 4% drop in the stock price, but that tells you what everybody feels about that combination versus, hey, we’re just going to make the decision and see what happens. All the Oxy buying Anadarko, you know, when they found out real quickly that the market, the street didn’t like that deal, it took $100 oil to really turn that around. So that’s, I think, one of the more factors, one more fascinating stories in the oil and gas rumor mill space that have as that has happened. And just your guys’s thoughts, if you have any, let us know what is at energynewsbeat.com we have an email spot hit us.

Stuart Turley [00:34:52] Yes questions at or fill out of any of the forums notified immediately on energynewsbeat.com

Michael Tanner [00:35:00] Yes sir what else we got to do. That’s all I have.

Stuart Turley [00:35:03] Well there are some more sanctions that are coming around the corner. You know me I love some good sanctions there. Going to sanction the more on private people in Russia and then they are going to continue ratcheting up. Not only on diesel and downstream products from Russia, they’re going to also increase again on nuclear. Russia has 50% of the enriched uranium around the world. And so not only are they going to mess up, the oil markets are going to go after the nuclear market.

Michael Tanner [00:35:39] Fine, fine. But with that fun stuff, guys, we appreciate you tuning in with us today. We’ll let you get out of here, get back to work, start your Monday. We hope it’s a quick one. And sorry for all the Range Resources, folks, that if this merger actually does go through, you’ll have now nine bosses. So have fun. Okay. You only have to deal with just a couple. That would be appreciated, guys, for Stuart Turley and Michael Tanner. We’ll see you tomorrow.