Daily Standup Top Stories

OPEC+ Shows No Sign of Changing Oil Output at Meeting Next Week

The OPEC+ coalition is showing no signs of adjusting oil production next week, staying the course amid turbulence in financial markets. Group leader Saudi Arabia has said publicly that the 23-nation alliance should keep supplies […]

Reuse of coal plants can cut small modular nuclear reactor development costs by 35%: report

Dive Brief: Nearly one-fourth of the current U.S. coal-fired fleet is scheduled to retire by 2029, providing opportunities to site advanced nuclear plants, specifically small modular reactors, or SMRs, a Washington, D.C. think tank says in […]

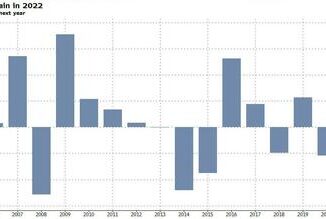

The Countries Bailed Out by China

A new report published by the AidData research lab at Virginia’s College of William & Mary sheds some light on the usually nontransparent practice of Chinese bilateral emergency loans. The researchers that also hail from the World Bank, […]

The New Candidate Countries For BRICS Expansion

The Russian Foreign Minister, Sergey Lavrov has stated that ‘over a dozen’ countries have formally applied to join the BRICS grouping following the groups decision to allow new members earlier this year. The BRICS currently […]

Ohio River Disaster As Barge Hauling 1,400 Tons Of Methanol Smashes Into Dam

Three large barges, one carrying 1,400 tons of methanol, were wedged against a dam and partially submerged, on the Ohio River in Louisville, Kentucky, following their detachment from a tugboat. The Louisville Metropolitan Emergency Services […]

US rakes in $263.8 mln from Gulf of Mexico drilling rights auction

Gulf offshore drilling operation A U.S. government auction of oil and gas drilling rights in the Gulf of Mexico generated $263.8 million in high bids, the most of any sale in the region for […]

Highlights of the Podcast

00:00 – Intro

04:22 – U.S. rakes in 263.8 million from Gulf of Mexico drilling rights

07:06 – OPEC+ shows no signs of changing oil output at meeting next week

10:39 – New candidate for countries for BRICS expansion

14:08 – The countries bailed out by China

15:14 – Re-use of Coal plants can cut small modular reactor development costs by 35% report

17:26 – Ohio River Disaster As Barge Hauling 1,400 Tons Of Methanol Smashes Into Dam

18:14 – Market Updates

21:33 – Acquisition add 600 Montney locations in Alberta or over 20 years of premium drilling inventory

22:22 – Outro

Follow Stuart On LinkedIn and Twitter

Follow Michael On LinkedIn and Twitter

Video Transcription edited for grammar. We disavow any errors unless they make us look better or smarter.

Michael Tanner: [00:00:14] What’s going on? Everybody, welcome into another edition of the Daily Energy News Beat Stand Up here on this gorgeous Thursday, March 30th, 2023. As always, I’m your humble correspondent, Michael Taylor, coming to you from an undisclosed location here in Dallas, Texas, joined by the executive producer of the show, the purveyor of the show and the director, publisher of the world’s greatest website, EnergyNewsBeat.com, Stuart Turley, my man, how we doing today? [00:00:38][23.9]

Stuart Turley: [00:00:39] Its a beautiful day in the neighborhood, I’m already ready for the weekend. [00:00:42][2.3]

Michael Tanner: [00:00:43] It is. I mean, it’s only a three day week for us. Do we have a show we took yesterday off because we just had a lot of things going on and couldn’t consolidate. Tomorrow will be our weekly recap, so make sure to check that show on on Friday. But this is technically Friday for us Stu, so we will make sure to send you guys out with a bang and speaking of that, do you have some absolutely banger articles lined up for us and a real interesting mix. [00:01:04][21.2]

Michael Tanner: [00:01:05] First off, we’ve got Us rakes in 263 million from Gulf of Mexico, drilling rights, auction, Chaching Chaching. And they said oil and gas was dead Stu will cover all what happened in this latest offshore oil and gas auction by the United States government. So it’ll be interesting to see what all that means. [00:01:26][21.2]

Michael Tanner: [00:01:26] Next up, we have OPEC shows, shows no signs of changing output at a meeting next week. It’s going to be a very interesting meeting to see what they what conclusions they come to. Oil currently trading at $72. It’s going to be really interesting to see if they want to keep it there. So Stu, will dive into all of the predictions before next week’s OPEC meeting. [00:01:43][16.9]

Michael Tanner: [00:01:43] Next on the menu, we have The New Candidate Countries for BRICS expansion. Dun dun dun. As always, Stu.will, we’ve this in to energy, but it’s kind of scary what’s going on on the international stage right now. So, Stu, we’ll dive into all that. [00:01:57][13.5]

Michael Tanner: [00:01:57] Next we have The countries bailed out by China. Talk about another spooky story. So China coming to the aid of a lot of different people still. We’ll dive into that story. [00:02:06][9.1]

Michael Tanner: [00:02:07] Next up, we have Re-use of coal plants can cut small modular reactor development costs by 35%, according to a new report this is awesome. Stu will do a deep dive into specifically what this means if you’ve all listened to the show, you know, Stu is a huge fan of that modular nuclear reactor technology, so he will dive into all of that. [00:02:26][19.4]

Michael Tanner: [00:02:27] He’ll kick it over to me and we’ll quickly cover some finance related issues in the oil and gas market, specifically where prices are headed, both on the oil side and the gas. I’d drop in on an unexpected draw from their crude oil reserves yesterday. [00:02:40][13.5]

Michael Tanner: [00:02:41] As you guys are listening to us today as we’re recording this, EIA expects the drop of the natural gas side of about a 50 Bcf draw. So I’ll cover that. We had a little All Canada merger and acquisition between Crescent Point and Spartan. I was a Spartan down corporation, 1.7 billion up there in the Albertan the Montney which is considered their their Wolfcamp A slash Sprayberry if you had to peg that now everyone loves the Montney is huge up there so good pick up for Crescent point we’ll cover slightly what that deal terms look like and maybe Alpine if we if we like it if we have time. [00:03:16][34.7]

Michael Tanner: [00:03:16] And then we’ll let you guys get out of here, get on your way and start your Thursday. And before I kick it over to Stu for the first article again, guys, check us out. World’s greatest website www.EnergyNewsBeat.com Hit the description below. All of the articles we’re about to cover are courtesy of that website. [00:03:30][14.0]

Michael Tanner: [00:03:31] Stu does a great job of keeping that updated. We have a great team behind that, making sure all of the stories are available the moment they crack. You will always have access to the latest shows Dashboard.EnergyNewsBeat.com It’s our data news combo. Get it while you still can. I’m out of breath though. Stu. Where do you want to begin. [00:03:49][17.8]

Stuart Turley: [00:03:50] Before we get started, do you know what Canada and Oklahoma State OSU have in common? [00:03:55][4.5]

Michael Tanner: [00:03:55] There’s a lot I could say, but I won’t. [00:03:56][1.1]

Stuart Turley: [00:03:57] Okay. When Canada, when you’re at a Canadian hockey match and all you hear is blah, blah, blah, blah, oh, Canada. And then you go blah, blah, blah. When you go to an Oklahoma State football game, it’s Blair. Oh, yes, you both and nobody knows the song. And they say, Oh, you’re Canada. [00:04:17][20.6]

Stuart Turley: [00:04:18] Okay, let’s get on to this thing here. Real first, first one coming around the corner. U.S. rakes in 263.8 million from Gulf of Mexico drilling rights. The Bureau of Ocean Management, OBM, offered 73 million acres in US Outer Continental Shelf. The auction was the first in the oil rich area since 2021. [00:04:43][25.6]

Stuart Turley: [00:04:45] Exxon snapped up more than 60 shallow water blocks. Good for them. Wait a minute. Hang on. I’m getting a phone call. Yeah, Yeah. Okay. Yeah. On the phone. That was President Biden. He was grateful for the political donations. And yes, he was so happy that he got 263.8 million. In his political funds. Nice. All right. Come on around the corner. Well, I. [00:05:16][30.3]

Michael Tanner: [00:05:16] Think it’s interesting. I think it’s first to say, I think there’s something that was noted in this article. You said that Exxon snapped up more than 60 shallow, shallow water blocks. Right. What they what analysts are saying is that they could be preparing for a carbon capture storage project. That’s what those locations could be. [00:05:31][15.4]

Michael Tanner: [00:05:31] The company only came out, though, yesterday and today and said, quote, We are only evaluating the seismic and subsurface geology for future commercial potential. How nice would that be? They $15 million or whatever they paid, you know, let’s say $10 million for whatever that those 60 locations were, $20 million and if that’s solely only for science, man, that’s some expensive science. I wish I had that type of scientific budget. [00:05:57][25.4]

Stuart Turley: [00:05:57] But if it’s for us, you know, or stroke genius. [00:06:02][4.6]

Michael Tanner: [00:06:03] It’s genius. [00:06:03][0.3]

Stuart Turley: [00:06:04] It is genius because then you’re going to be able to sell those as carbon credits, and then that’s going to pay for itself. It’s genius. Absolutely. [00:06:12][8.0]

Michael Tanner: [00:06:13] You know, they’re 5 to 10 year leases. You’re talking about royalty rates of 18.75%. The shallow water leases are 12.5 percentage points. The interesting part is do is that Chevron, while Exxon’s was snapping up all the shallow water blocks, Chevron is bidding on deepwater tracts. Right. 15.9 million on one deepwater tract. It’s going to be an expensive well, I’d love to see the fee on that bad boy. [00:06:36][23.3]

Stuart Turley: [00:06:37] Oh, no kidding. [00:06:37][0.6]

Michael Tanner: [00:06:38] A million. [00:06:38][0.2]

Stuart Turley: [00:06:39] That would be huge. You know, in the Gulf accounts for 15% of oil production and 1% of natural gas production. Wow. I thought it was a lot more than that on that gas. [00:06:50][11.3]

Michael Tanner: [00:06:51] Yeah, I mean, it’s. It’s oil out there, baby. There ain’t much gas. You don’t want gas out there. You’re spending $250 million on a wells. Do you don’t want gas? [00:06:58][7.4]

Stuart Turley: [00:06:59] No. You want them give me their crude. [00:07:01][1.1]

Michael Tanner: [00:07:01] Maybe with that big crude. You bet. All right. Well, next. [00:07:05][3.5]

Stuart Turley: [00:07:06] OPEC plus shows no signs of changing oil output at meeting next week. This one I heard Novacek, who is the energy minister for Russia, Go. Hey, why do I need to do anything? He called up and said, Hey, I don’t need to do anything. And that was a translation of what he said. There’s absolutely no reason for them to worry about it at this point. I think that they’re going to sit back and make some decisions. They’re a lot smarter than the Fed that has no clue how to curb inflation. But they got a good idea on pricing and figuring it out. [00:07:44][38.3]

Michael Tanner: [00:07:45] Well, I think I think they did it to add some color to that. You know, in 14 traders and analysts polled by Bloomberg voted unanimously. That’s going to be no change from that Opec+ Joint ministerial monitoring committee. [00:07:58][13.0]

Michael Tanner: [00:07:58] Good quote from the president of rapey, an energy group. Love, love those guys. They hire a lot of minds. Econ guys love them. Bob mcnally I suspect they’ll be keeping their heads down and eyes open. [00:08:08][9.4]

Michael Tanner: [00:08:08] Quote unquote. It’s too soon for any firm conclusions that would trigger a recommendation to call minister a meeting before June 4th, much less adjust the quota, even in the face of these slumping crude prices. So I’m sort of with if I was I was not included in the Bloomberg poll. They didn’t they didn’t bother to call me. But if they did, I’d have been on. Nothing’s going to happen. I’m with them. [00:08:28][19.4]

Stuart Turley: [00:08:28] Oh, we need. [00:08:29][0.8]

Michael Tanner: [00:08:29] To lobby. Do we need to be on that committee? All right. We need to be one. [00:08:33][3.8]

Stuart Turley: [00:08:33] Of those analysts they’re calling. Oh, absolutely. They can’t afford us. When you sit back and, you know, you sit back and take a look, the Saudi minister, Prince bin Salman, particularly clear. He says, quote,. [00:08:47][14.0]

Stuart Turley: [00:08:48] The quota limits amounted to 2 million barrels a day cut in production when they were agreed to in October. They’re here to stay for the rest of the year. And it was just put out, I believe, in an article yesterday that Russia has completely regained all oil sales outside of sanctions. They have 100% fixed the sanctions in the issue. [00:09:12][23.6]

Michael Tanner: [00:09:12] Interesting. So the article that we’re about to cover in my segment that says they’re down 300,000 barrels a day is a scam. [00:09:18][6.2]

Stuart Turley: [00:09:19] The dark flow. [00:09:19][0.5]

Michael Tanner: [00:09:20] Oh, let’s find out. I do think we’d be remiss if we didn’t point out in this at the end of it, I got to love this. They go expectations for the return of $100 a barrel crude, which was widespread across the industry at the start of the year, have cooled in recent weeks. [00:09:35][15.3]

Michael Tanner: [00:09:35] This is my favorite part yet major traders, including Trafigura Group and Gunvald Energy, are still predicting a rally for the second half of 2023. No kidding. The world’s largest energy traders are hoping and thinking oil’s going to be higher with the. [00:09:51][15.9]

Stuart Turley: [00:09:52] Do. [00:09:52][0.0]

Michael Tanner: [00:09:53] I more colorful term, we’d say, if this if there weren’t kids listening. [00:09:57][4.1]

Stuart Turley: [00:09:58] Now, the only thing I have gotten right lately is that I said we have no idea what It’s the same. [00:10:06][8.0]

Michael Tanner: [00:10:07] These are the same guys that had nickel in a way that we covered a couple of weeks ago that had. Nicole in a warehouse that was just bags of empty stuff. So, I mean, the due diligence going on over on a trim figure is just top notch. [00:10:18][11.6]

Stuart Turley: [00:10:19] Yeah. The only thing I had that was intelligent lately was the fact that I said we have no no idea of the impact of oil demand coming back in China. I said it may be ho hum. Who knows how it’s going to do? I’m not going to put a number on it. [00:10:34][15.3]

Michael Tanner: [00:10:35] So China, what’s next? [00:10:36][1.4]

Stuart Turley: [00:10:37] What’s next? China? New candidate for countries for BRICS expansion. We’re on a China roll here now that we go through the Russian foreign minister story or a longer chart lover Laura Lavoro. Boy, I butchered that name up. Nice. Has stated that over a dozen countries have formally applied to join BRICS group following the group’s decision to allow new members this year. [00:11:05][28.4]

Stuart Turley: [00:11:06] The BRICS currently includes Brazil, Russia, India, China and South Africa. There’s about six different articles that happened in the last two days, Michael, about China negotiating with Iraq, Iran, Saudi Arabia, and they are all one thing in BRICS and BRICS plus. And this is huge because they’re going to go around SWIFT, which is the international monetary system. [00:11:31][25.1]

Stuart Turley: [00:11:31] They’re going to create all of different purchasing mechanisms. And again, as we’ve talked about for several times, is move the petrodollar away. Concerning BRICS expansion, Lavrov says that Algeria, Argentina and Iran have all already applied well as own. Saudi Arabia, Turkey, Egypt and Afghanistan are interested along with Indonesia. [00:11:56][24.9]

Stuart Turley: [00:11:58] Indonesia is expected to make the formal application in the G20 summit in Bali. Very interesting and telling article come in around the corner, Michael. This is a huge, huge, huge deal. [00:12:10][11.6]

Michael Tanner: [00:12:10] I think the scariest is getting Saudi Arabia in there because then all of a sudden you have almost a I mean, even with Russia in there, you do, but you almost have a self-sustaining you really have a self-sustaining entity. If you can really then lock up basically the I mean, what they say in this article said that there’s 70% of the world’s proven oil reserves. Be able to lock that up in BRICS. Well. [00:12:33][22.3]

Stuart Turley: [00:12:34] Here’s here’s my thing. And that is a the US becomes totally insignificant the second thing is OPEC and and OPEC plus are they’re going to be figureheads. They’re going to meet just for the party. You know, there’s there’s not going to be anything they really can do. OPEC and OPEC plus just become figureheads. So there’s there’s going to be no reason for them to even be in existence. [00:13:00][26.4]

Michael Tanner: [00:13:01] So question for you. Why doesn’t the United States showing BRICS? Oh. [00:13:06][4.7]

Stuart Turley: [00:13:07] Because they hate us. [00:13:07][0.7]

Michael Tanner: [00:13:08] Would they ever let us know? [00:13:09][1.1]

Stuart Turley: [00:13:10] The treaty that the Biden administration is working out with the WHO right now is typically how things are going to go and they are giving every all of our control on a pandemic to the who. [00:13:26][15.6]

Michael Tanner: [00:13:27] Is on first. [00:13:27][0.6]

Stuart Turley: [00:13:28] And not the band, The Who, the World Health Organization, which is a bunch of criminals. And I mean, they’re one step below 4G. I mean, this is just ridiculous that we are going to be giving away patent rights. We have to give away 20% of all of our medical supplies to the WHO. I mean, not the band that home to the World Health Organization. [00:13:52][24.4]

Michael Tanner: [00:13:53] I get that if you ever heard Abbott and Costello, who’s on first. [00:13:56][2.7]

Stuart Turley: [00:13:56] I did. I’m ignoring you. So let’s go. [00:13:58][2.4]

Michael Tanner: [00:14:01] Or you get us banned off YouTube. [00:14:02][1.3]

Stuart Turley: [00:14:04] I don’t care. We got Rumble. Okay, This next one is The countries bailed out by China Rural. I’m going to just touch on this one. It’ll be in the show notes. But this was put out by Statista. The countries using emergency loans from China by number of years utilized between 2020 21. And this really does kind of show that you have Argentina, you have that looks like Colombia, and then you have Russia, you have several African countries, and China goes in with the BRICS and Rhodes and they lock you up into energy contracts and everything else. [00:14:48][43.7]

Stuart Turley: [00:14:48] This is frightening. Not only is China printing money to give away to folks, that is The Sopranos on steroids. If you ever think The Sopranos were tough, this is going to be really tough and one to watch. So let’s go to the next one here. You got any thoughts on that for I shut it down. [00:15:08][20.1]

Michael Tanner: [00:15:09] I’ve got nothing about China that scare me. [00:15:11][1.7]

Stuart Turley: [00:15:12] Yeah. Rats Rug Re use of Coal plants can cut small modular reactor development costs by 35%. In this report, nearly one fourth of the current U.S. coal fired fleet is scheduled to retire by 2029, providing opportunities for site advanced nuclear plants, specifically small modular reactors or smart. A Washington, DC think tank said recent report Reactors can reuse coal plant systems. [00:15:42][30.6]

Stuart Turley: [00:15:43] And I’ll tell you what this is. This is beautiful and you just step out the coal furnace. You drop in the nuclear small modular reactor and you’ve got already you’ve got the transmission lines, you got the water that you can heat in the steam. You’ve got everything else sitting there. You got anything that you need for electric generation, All you need is a power and poof, there it goes. [00:16:08][25.5]

Michael Tanner: [00:16:09] There’s two things this report says that 80% of evaluated coal plants have the, quote, basic characteristics. So I’d be interested to know what these basic characteristics are, but quote unquote, basic characteristics needed to be powered by ness and more, according to this Department of Energy study. [00:16:24][14.4]

Michael Tanner: [00:16:24] There’s also something very interesting, which I’m a big fan of. Reusing coal plant sites could also have labor force advantages with. With 77% of jobs transferable to nuclear plants with no new workforce licensing required, that’s huge because you can then keep those same people employed. It’s a little bit more sustainable. [00:16:42][17.5]

Stuart Turley: [00:16:42] Everybody wins. Absolutely. This is huge and great news. [00:16:47][4.3]

Michael Tanner: [00:16:47] Coal miners lungs are already bad. We’ll let them get cooked with the radiation so that we can get power. [00:16:52][5.1]

Stuart Turley: [00:16:54] So when they cough and they cough up flame, it’s glowing. Nice. Yes, Yes. That’s a good they could use it for a fishing lure and they got that going on. Okay. Let’s go to the next one. I do want to just give a shout out to the poor folk in Ohio. [00:17:11][17.9]

Stuart Turley: [00:17:13] Ohio. You know, we did those boots on the ground stories with Dr. Chalmers and Matt Cody with the Oilfield Workers Association and our team. They just had another bad one. Three large barges carrying 1400 tons of methanol were way wedged against a dam and partially submerged. Yeah, Unbelievable. [00:17:36][23.3]

Stuart Turley: [00:17:37] The only reason I’m bringing this up is our hearts and prayers go out to the folks in Ohio. The water is Bill Cosby would say, come on in, the water’s fine. No, the EPA is saying the water is still drinkable. No, it’s not. Your water is safe to drink, the water agency said in a Facebook post. Bo hockey. Anyway, thanks. I’m done ranting now , now it’s off to you. [00:18:04][26.9]

Michael Tanner: [00:18:05] Well, apparently the water is safe to drink, according to a Facebook post. [00:18:08][3.2]

Stuart Turley: [00:18:09] No, no, I’m afraid not. [00:18:11][1.6]

Michael Tanner: [00:18:11] All right, well, we’ll get you out of here on finance quickly, guys. Oil currently trading down 70 to 90. That gas was down to about a dollar 90 billion contract rules. Over to tomorrow, though, So it’ll be trading about $2.17. So, again, weakness on both sides. Overall market was actually up about one and a half percentage point. Nasdaq up about 1.8 percentage points. [00:18:31][20.2]

Michael Tanner: [00:18:32] Our dollar index up about a quarter of a percentage point. Ten year yields down ten year and 3010 year and two year yields are fairly flat, down about a 10th of a percentage point on the crude oil side. I think there’s a couple of things working both in both on the supply and the demand side. First, you have to remember we had an unexpected crew draw today. [00:18:49][17.7]

Michael Tanner: [00:18:50] Let’s go over to the EIA report forecasted 3.1 million barrel build We saw today at 10:00 a -7.5 million barrel difference, which indicates a crew draw very high. The swing in the right favor. I guess if you if you with the drop in prices and are trying to hold prices up. [00:19:09][19.1]

Michael Tanner: [00:19:09] This was a good move for you. We also saw some of the biggest draws in terms of refined products from gasoline stocks. That’s a good sign that demand is kicking up as we moved into the summer, which will be a great support for prices. [00:19:20][11.6]

Michael Tanner: [00:19:21] Now, just because there’s crude oil, does it mean there’s gasoline? And that crunch we’ve seen doesn’t necessarily affect oil prices, but it may affect gas prices if there’s enough tightness in this gasoline market. [00:19:33][12.0]

Michael Tanner: [00:19:33] So I think that’s something to watch going forward is the amount of what’s actually the throughput between that crude oil moving to the refineries. You can track this. There’s some tool, I think it’s Dashboard.EnergyNewsBeat.com where you could buy track some of this stuff. So I’d recommend checking it out and leaving your feedback. [00:19:50][16.7]

Michael Tanner: [00:19:50] But you know, being able to slice and dice and understand that the flow on the gasoline refined product side is going to take some time from that crude oil side. So we may see crude be oversupplied, but that doesn’t mean we’re going to be oversupplied in in in in in gasoline. It can work that way but I think there’s going to be some. Interesting. Interesting plays off each other. [00:20:12][21.3]

Michael Tanner: [00:20:12] Moving over to natural gas. $2.17 is what it will be. Trades is what it’s trading at currently in terms of that new front month contract. And we settled just under $2, which is about the lowest we’ve seen in in a little over 15 years. I think I was reading some number out there. I mean, I’ve seen $2 $2 gas in in a while, guys and so unfortunately, unfortunately were there. [00:20:33][21.1]

Michael Tanner: [00:20:34] There’s a couple of things. Again, I love looking at nat gas intel. First thing is we’re expecting somewhere between a 40 or 50 and an 80 Bcf draw. As you’re listening to this, you’ll probably already have heard the crude or the natural gas storage draws. So somewhere in that, okay, said that 48 to 60 Bcf range last week or last year we had about a 15 million barrel bill or 50 million build, a billion cubic feet build. So seeing that draws actually going to be a both a bullish thing and hopefully hold prices up but it’ll be interesting to see how that number drops. [00:21:05][31.2]

Michael Tanner: [00:21:05] I think the only other interesting things to to point out is we did have a some M&A action north of the border AU Canada at Crescent Point Energy Corporation has entered into a definite agreement with Sparta Delta Corp to acquire its oil and liquids rich Montney assets in Alberta for 1.7 billion. You guys an idea as I mentioned in the open, the Montney is kind of the premier premier play up there. [00:21:31][25.4]

Michael Tanner: [00:21:31] And one of the key highlights do acquisition add 600 Montney locations in Alberta or over 20 years of premium drilling inventory. I’m going to go out on a limb and say they don’t have 20 years of premium drilling inventory. But what do I know? [00:21:48][17.1]

Stuart Turley: [00:21:48] I don’t know. [00:21:49][0.4]

Michael Tanner: [00:21:49] You know, to give you an idea, they’re paying for this in cash. So that’s 1.7 billion in cash, cash money. Hopefully there are deposits that at Silicon Valley Bank. [00:21:57][7.9]

Stuart Turley: [00:21:59] Retro. [00:21:59][0.0]

Michael Tanner: [00:22:01] Wrote RO So you got anything else Stu? [00:22:02][1.6]

Stuart Turley: [00:22:03] That that’s a good show. [00:22:04][1.0]

Michael Tanner: [00:22:05] Well, we’ll let you guys get out of here. Start your day we appreciate your checking is out World’s greatest energy podcast for Stewart Drilling. I’m Michael Tanner. We’ll see on Monday, folks. Enjoy the weekly wrap tomorrow. [00:22:05][0.0]