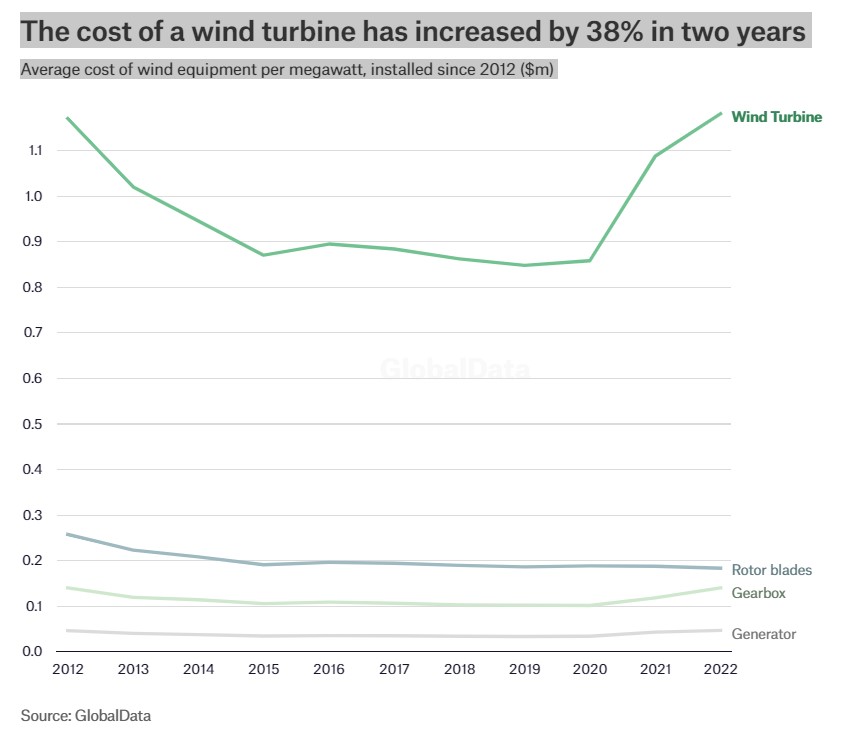

The Covid-19 pandemic, global supply chain crisis and war in Ukraine have all played havoc with global commodity markets. For commodity traders, it has been big business: across the sector – which includes hedge funds, banks and big traders like Glencore – profits soared to $115bn in 2022, according to a study from consultancy Oliver Wyman. This is around 60% higher than in 2021, and three times higher than before the pandemic. For manufacturers in the wind industry, these soaring prices are not such good news. Soaring commodities prices equals soaring manufacturing costs. The cost of a wind turbine is 38% higher than two years ago.

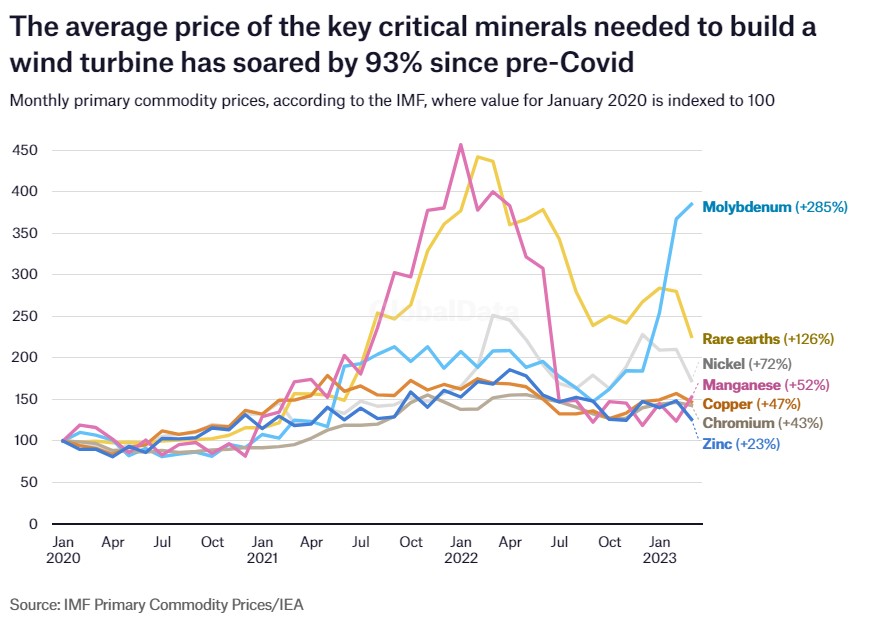

Source: GlobalDataBeyond the steel used to build the tower, the most significant mineral requirements in the wind industry are copper, zinc, manganese, chromium, nickel, molybdenum and rare earths, according to the International Energy Agency.

The price of each of these metals increased significantly between January 2020 and March 2023, ranging from a 23% price increase for zinc to a 285% price increase for molybdenum (which is currently undergoing a “perfect storm” of supply and demand disruptions). The average price increase of these seven metals over the period is 93%.

The impact of these soaring commodities prices can be felt keenly among wind industry manufacturers.

Data from Energy Monitor’s parent company GlobalData shows that the average cost required to build 1MW of wind turbine capacity has increased by 38% over two years. This is a marked contrast to years of steady price declines as technology improved and processes became more efficient.

The same data shows that the price of the gearbox and generator – which are key components of the overall wind turbine – have also both increased by 38%.

These cost increases are pushing up wind developers’ deployment bids and industry experts are calling on European governments to raise ceiling prices for renewable energy auctions in response. Some countries, such as Germany, have started to do so.

Editor’s note: Energy Monitor is producing a series of data insights that are being distributed to delegates at WindEurope’s 2023 annual event in Copenhagen, Denmark, from 25–27 April as a daily “Number of the Day”. Energy Monitor is WindEurope’s Intelligence Partner for this event.

Source: EnergyMonitor.ai