Authored by Simon White, Bloomberg macro strategist,

China’s faltering recovery implies US CPI’s downwards trend is unlikely to reverse soon enough to prevent the Fed from cutting rates early.

We’re coming to the crunch point.

We’ll find out how immovable the Fed’s “higher-for-longer” aim for rates is when up against what is often the unstoppable force of the market, which has been consistently reluctant to price in the “longer” part of the Fed’s policy wish.

September is now pricing a full 25bps rate-cut (and June rate-hike odds have plunged from 20% to less than 5% this morning)…

Yet now that the Fed is quite possibly done hiking, and the economic lesions from tight monetary policy are beginning to appear, the duel between the central bank and the market will soon be forced to a conclusion.

What would give the Fed cover to keep rates steady is a re-acceleration in inflation. It is the deceleration in inflation (it’s ok to dabble in third derivatives sometimes) that has guided the market’s pricing of a Fed pivot.

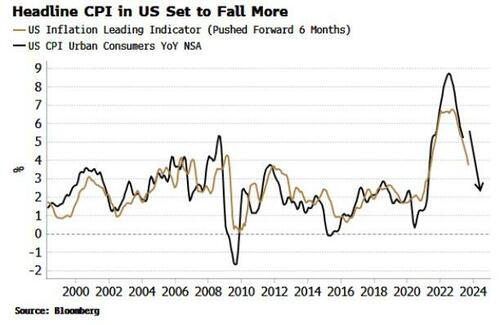

The pace of inflation’s fall has not let up and continues to give backing to the market’s belief this will be enough to allow the Fed to reverse course.

Headline inflation has fallen as energy and food prices have eased. But core inflation has been more stubborn. We can split core PCE up into cyclical and acyclical components. Cyclical inflation is more influenced directly by Fed policy, while acyclical is primarily guided by non-domestic factors. Cyclical inflation has barely budged from its highs, while almost all of core PCE’s fall has been driven by acyclical factors.

Indeed what we find is, given its size and influence on global prices, acyclical inflation is heavily driven by China.

And it’s because of China that the market might finally be the victor on where rates go next. While the country turned a corner at the beginning of this year, its recovery continues to stutter.

This means it is less likely to give any notable support to global prices – and therefore US acyclical inflation – in the coming months.

On the other hand, the reasons why the Fed may be forced to cut as soon as September, when the market expects – recession, credit tightening, debt ceiling – are mounting.

With no China to significantly upset the inflation apple cart, the weakening US inflation outlook inferred from the leading indicator in the chart above is likely to be realized, allowing the Fed the cover it needs to give the market what it’s been hankering after all along.

Loading…