There is a lot going on around the world, and this week is no exception. The gang covers Iran and Stu even complements Iran in its strategic policies to protect their cash flow while making the United States insignificant.

Tesla and Bitcoin – Boy there is some fun.

Full un-edited transcript: Not responsible for any additional jokes in the transcription.

Michael Tanner [00:00:05] Oh, what’s going on, guys? Another week, another energy news report, gas here on this gorgeous recording this Monday, May 17. Twenty twenty-one type stands about eleven o’clock Central Time. As always, humble correspondent Michael Turner coming to you from an undisclosed location here in Bear Country, joined by the executive producer of the show, the show, and the director and publisher of The World’s greatest website, Energy News B dot com, Stuart Turley. How are we doing, man? Good weekend.

Stu Turley [00:00:33] Oh, is A. We had some great team-building, Michael, in Bear Country. We did do a thousand pounds of cement. You and Connor did fabulously, had great work, man.

Michael Tanner [00:00:43] We all had team building in more ways than one. Don’t get me wrong, guys. We were. We were. Yeah. We actually keep the show pretty short today. Stu’s got some stuff in the international news desk for us to cover Iran. Sounds like the sanctions don’t really mean anything. So we’re going to let him cover that. I do want to chat with Elon Musk coming out about Bitcoin and basically saying it’s not green. I think it’s probably actually will start. And then a couple of weeks I’m going to be releasing later this week the first of a random series we’re calling energy news. Lance, Michael, Rantes. It’s going to be where I sit down, usually me maybe there will be a guest, but we’re just I’m just going to really just top is it fires me up that I need to dive into and spend a lot more time discussing this. The first one is going to burn oil and gas and the relationship with technology is going to come to sit down with me. And it’s going to be pretty wild. I a lot of thoughts, I think.

Stu Turley [00:01:37] Is it family-friendly, Michael? I mean, when you rant, you go, oh, in

Michael Tanner [00:01:43] a wealthy, family-friendly I don’t know, find out after the show. But now we released at some point next week. I haven’t thought of it yet, but we’ve got it on the docket. As always, all of these stories for you, the world’s greatest energy news website, energy news, because to truly publisher of that website, Mant website looks good, man. It’s fully back and rolling, man. I’m, you know, how’s the readership look? Are we starting to see a bump up a little bit?

Stu Turley [00:02:15] Oh, absolutely. Google is starting to love it. It is funny to see how it’s tracking for click-through rates we’re seeing up into the twelve percent, which is just really good for a news page. So twelve percent, twelve percent on the Clippers did. That’s way above that average. So really cool statistics. Yeah.

Michael Tanner [00:02:38] Maybe, maybe if I was a company I should hire the people to get us to do that for my website. Hey, we settle the sales pitch. Yeah, that’s right. But with that CEO calls up, let’s start let’s cover this little bitcoin Elon Musk scam thing, and then we’ll dive into the international news desk. But you guys get out of here. So where’s the tweet-tweet basically wise? Let’s see, Elon Musk, let me just Google this Elon Musk Bitcoin

Stu Turley [00:03:10] boy, boy, why you look at that, he threw a lot of panics. I saw that tweet tweet, and it was like all of a sudden, holy cow, people were going nuts. That man can control the market.

Michael Tanner [00:03:21] Oh, he knows exactly. He knows exactly what he’s doing. Let’s go to Twitter. Let me pull this up. Let me just pull this up. Here we go. Tesla in Bitcoin. Tesla has suspended purchases from Elon Musk. Twitter account verified. Tesla has suspended vehicle purchases using Bitcoin. We are concerned about the rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which is the worst emissions of any fuel. Cryptocurrency is a good idea on many levels. We believe it is a promising future, but it cannot come at the cost to the environment. Tesla will not be selling any bitcoin as we intend to use it for transactions soon as mining transitions to more sustainable energy. We’re also looking at other cryptocurrencies that use less than one percent of bitcoins energy transactions. Point being done, the underdog. Somebody’s got to unmask, right? Right. Why this do so? Why is he come out and say this while? Depends, Stu, the conspiracy theories could probably give you a bunch of different scenarios of why he came out, what’s his angle? Is it the fact that he wants to drive the price down so he can buy more Bitcoin? He can continue to buy the dip, as they say? Yeah. Is it will I take him? Is it face value, is it did he realize what you know, Stu, myself, people in the energy business who understand sort of the value chain of energy consumption would tell you, you mind Bitcoin off computers, which are plugged into the wall, which those electrical which are plugged into the electrical grid, which is electrical grids, are 90 percent coal. And especially because what is it, percent? Of Bitcoin. Mined in China, 75 percent of the world’s bitcoin mining is done in China, which is 80 percent of their grid is coal.

Stu Turley [00:05:14] And they are the largest polluter in the world, even out polluting the major five combined.

Michael Tanner [00:05:24] So I don’t think this is a conspiracy theory. I think Elon Musk, somebody showed him the research and he was like, oh, this isn’t good now. I think. You know, the idea of now we can quibble about the increasing use of fossil fuels, I don’t necessarily agree with we should be concerned about that increase. But what I don’t want to quibble. I don’t want to quibble here.

Stu Turley [00:05:52] You not quibble. Hello.

Michael Tanner [00:05:55] So I’m also interested. What are these other cryptocurrencies? Less than one percent of bitcoins, energy transactions, which the only way to get other cryptocurrencies is, is it to mine? I I don’t know how that works. I’m not a cryptocurrency expert. Stu, do you have a fake? Do you have a fake Twitter account that monitors crypto for us and not?

Stu Turley [00:06:14] But I am a minor mentally.

Michael Tanner [00:06:17] It’s true. It is true. So. What does this mean or what does this mean for the energy business? This means one thing. This means companies. Like crucial energy services companies that are doing very fascinating things with taking flair gas and converting them into high energy use, stuff like Bitcoin mining and fascinating technologies, fascinating technologies, and I wonder someone needs to send Elon Musk, some of these companies that do this because I think he would be all about it. I’m taking flared natural gas that would be emitted recycling it and mining Bitcoin for my own company. I’m surprised he hasn’t figured out this sooner.

Stu Turley [00:07:01] You know, from a technology standpoint, Michael, there are some things that are still kind of hanging out. There is some of the pads in the Permian are not close enough to high-speed Internet. And so if you’ve got the flaring going on over here, how do you get the power from the flaring on the well, which requires planning all the way to a high-speed thing? So there’s still some fuzzy things in technology-wise in the field which have

Michael Tanner [00:07:29] to be hooked up to the Internet, to my Bitcoin.

Stu Turley [00:07:31] That’s exactly. And have to. I don’t know, it just depends on the bandwidth as well. So, you know, having to help out and doing some of that and stuff, there are some this is almost like green or other things or like Yazji for companies that they can’t even prove it. So there’s a lot of second questions to that next layer that are out there, Michael.

Michael Tanner [00:07:59] So here, how much Internet you speed to dial to mind Bitcoin when bitcoin mining, you only need an Internet connection for data cinching, which requires very little in terms of connection and strength. There have been instances in which systems have mined Bitcoin successfully, which is low as 500 kilobytes, which is nothing dial-up speeds.

Stu Turley [00:08:15] Now, that is that’s the first time I’ve heard that. But I don’t believe

Michael Tanner [00:08:20] it’s on Google. You don’t believe Google. You’re saying that you not believe

Stu Turley [00:08:25] now Dr. Google. I don’t like it now. And the reason is you got a server sitting there, even though it’s taking a limited amount of bandwidth, it’s still cranking power. So you can’t even though it says that I don’t believe that bandwidth agrees.

Michael Tanner [00:08:43] Mining Bitcoin in today’s age is a stupid idea. Unless you have banks of servers running at light speed. Don’t mind. Bitcoin is a terrible idea. Yep. Hooking up your lap, buying a laptop and letting it run to mine. A Bitcoin is

Stu Turley [00:08:56] not somebody from China. Put that number out there

Michael Tanner [00:09:01] when they’re not on Google so they won’t see it. So. Oh yeah. See he won’t see it. What else happened, Colonial Pipeline updates their back on it looks like they’re back online. You know, I highly recommend checking out a podcast we did last week which sort of talks all about security. It’s the company said on Twitter, I love this company, said on Twitter that it’s delivering millions of gallons of gas per hour to the markets. It serves over Texas, Louisiana, Mississippi, Alabama, Tennessee, Georgia, North and South Carolina, Virginia, Maryland, Delaware, New Jersey, D.C. STu, you’re from Texas. Did you with their gas shortages where you were no good?

Stu Turley [00:09:44] You know, I thought it was kind of funny. I did see the almost six dollars a gallon in California. And so, you know, I kind of made a joke about it last week. We’ll see six dollars. And I was going to get a picture of that as it rolled over six dollars to show you. Since you constantly belittled me,

Michael Tanner [00:10:03] everything in Texas makes sense. It makes sense. Even though even the energy grid shutdowns.

Stu Turley [00:10:09] Oh, yeah. Oh, shut up. Oh, you just put my head in the carpet on that one. Nice job.

Michael Tanner [00:10:18] I twisted. I put the knife in, I twist. Oh, that’s really all I’ve got. Earnings were lame really. Earnings came out great for everybody. There are very few insights other than when oil prices are high. Guess what? The earnings are good. Everyone’s paying down debt. Everyone is trying to get NetApp under even under one. I mean, these guys sound like a broken record. I sell forty and not forty-four. Earnings calls of support for earnings calls are a snooze fest. And nothing does they’re conserving capital, nobody’s hiring I mean, we’re in this period where these companies are making money. Don’t really need to hire people because they don’t need to grow production because prices are rising. Yep, and they’re taking all this excess cash, returning it to shareholders net debt to pay down debt, I mean,

Stu Turley [00:11:12] which they should have been doing all along.

Michael Tanner [00:11:15] But what’s funny is that somehow every other industry works if Tesla came out on their earnings call and said we’re going to start paying down debt, their investors would flee.

Stu Turley [00:11:27] Right, would flee. Tesla is a little bit of an odd duck from the standpoint that they make most of their money off of the hip hop hypocrisy of carbon credits, bitcoin and carbon credits. Go figure that one out.

Michael Tanner [00:11:42] Have you seen the movie, the TV show Silicon Valley?

Stu Turley [00:11:46] No, but I need to I know you give me that recommendation.

Michael Tanner [00:11:49] There’s this scene in there. I won’t do the whole bit. But there’s a scene where they’re giving their first incubator pitch. They’re giving their investors. And there’s this guy just on his cell phone and they get to the slide where he goes revenue. And then all of a sudden, this absolutely goes, no, no, no, no, no. What do we? No, no, no, no, no, no. Don’t talk about to talk about revenue, because when you talk about revenue, that it becomes real. So if you avoid talking about revenue, then you can be whatever you want and I’ll leak. I’ll get in the show. It’s one of the absolute funniest scenes of all time. Van Vertigo came out, blah, dove into him yourselves. Do your research, read the TED case yourself. I’m not giving you financial advice anymore. Cash trial by fire. No, they’ll be for a rant, I just there was nothing interesting. So what you want me to do lie to, you

Stu Turley [00:12:45] know, you’re not going into politics right now? No, I’m

Michael Tanner [00:12:49] not. Why would I? You would. Ryan already doing that. I’m just department.

Stu Turley [00:12:52] Oh, man. We’re not going into politics. We’re talking about how to frack a whale in Texas.

Michael Tanner [00:13:02] Hey, I saw this Twitter thing the other day where there’s a tiger loose on the trail in Houston.

Stu Turley [00:13:07] Oh, nice. That used to be so put a tiger in your tank.

Michael Tanner [00:13:16] All right. International news desk, what do we got?

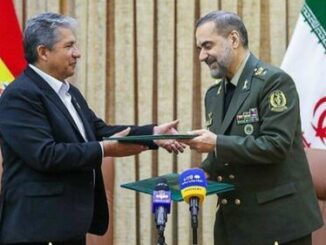

Stu Turley [00:13:19] I’ll tell you what, you can’t buy this kind of entertainment. Our buddies over in Iran again are at it like this time. It’s a little bit funnier. There are three articles we ran out on the news energy Newsbeat. First one, Iran has put a proposal to Saudi Arabia to run Iran oil through Saudi Arabia. They only if they do that, they’ll quit throwing rockets around and funding things. All right. Do you believe anything they say? And how funny is this? I just

Michael Tanner [00:13:56] think Iran.

Stu Turley [00:13:58] Do you remember Baghdad, Bob, when they had the early one on? I don’t know if you remember that, but that was one of the wars. He stood up there and said there are no American troops. They just bomb anyway. OK, Baghdad, Bob is a forerunner to their folks. Now, the next one coming up is very simple. The Iran negotiations and the nuclear deal. Bloomberg put this one out and I thought it was pretty funny. There are some nuggets in that article and it shows that here’s the Iran nuclear deal and then the nuclear I mean, The New York Times match that up in a different sense. And they said this morning that, oh, by the way, Iran never stopped creating you’re enriching uranium. I’ve been saying that all along. And here’s you know, they were listening to our podcast, evidently. So here’s all of the oil production coming down. And then all of a sudden when the election was going on, you can see when I don’t want to get into politics, but there is somebody that is now the czar for green energy was meeting with Iran that started going back up. That is in the Bloomberg article. And so you start going back up when you’re still in care in John Kerry, it matches up. When John Kerry was talking to the Iranians, all of a sudden it started going up even before Trump lost the election. Pretty interesting nuggets. So you take a look at that. They don’t care what the U.S. says anymore with what they’ve done with the China that we covered three weeks ago. They’ve got the deal with the Chinese to sell outside of OPEC and OPEC. Plus, they have been brilliant in how they have made the sanctions worthless. The U.S. policy has been made worthless. The Iranians can do anything they want. Very interesting. Three articles, Michael.

Michael Tanner [00:16:10] No, I mean, you lay it out in a really interesting way, if you’re not worried about Iran, you know, it’s kind of like the Ryan race. But if you worried about China, you’re an idiot. You’re not worried about Iran. And you’re an idiot because and they’re looking they’re out for blood

Stu Turley [00:16:28] and they’re the underlying thing that will affect supply outside of OPEC and OPEC. Plus because of OPEC and.