Investment into ethical focused funds continued to demand a bigger portion of the investment world in 2021, but not without some struggles as clean energy funds lagged in a more pro-value environment.

Looking at the total net inflows into equity funds last year, environmental, social and governance (ESG) funds continued to be popular with investors, taking £6 out of every £10 invested in IA Global funds in 2021, data from Calastone found.

The theme also managed to demand a bigger share of inflows in other equity sectors, such as fixed income where Calastone analysts said ESG had become a “meaningful driver”.

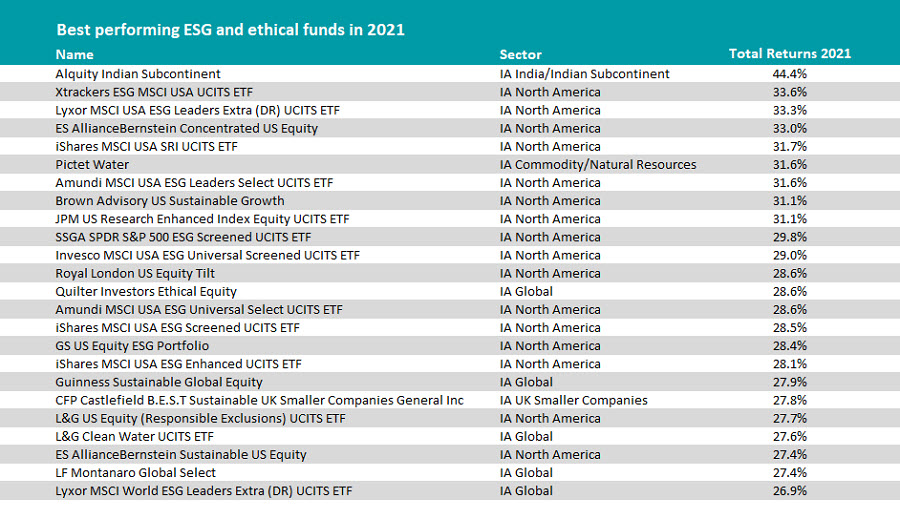

Looking at the performance of this part of the market last year, Trustnet ranked the performance of all Investment Association (IA) funds that have an ESG or ethical approach and found that the Alquity Indian Subcontinent was the best performing fund, making 44.4%.

The fund is not ESG explicit but it does consider the three factors, pulling it into the study. The fund did very well in comparison to non-ESG funds as well, coming through as the only non-energy fund in 2021’s top 10 performers.

The IA India/Indian Subcontinent sector had a very strong year due to the country’s strong economic rebound, massive vaccination program and accommodative monetary policy, plus mounds of global liquidity.

More ESG-explicit funds that performed well last year included: Pictet Water, Brown Advisory US Sustainable Growth, Quilter Investors Ethical Equity, Guinness Sustainable Global Equity, and L&G Clean Water UCITS ETF.

But while the year has been positive overall for ESG investing, it has not been straightforward. Heading into 2021 sustainable and responsible portfolios had a lot of investment momentum after a combination of heightened awareness on topical issues and the general outperformance from this part of the market during the pandemic. This was partly due to ESG portfolios’ bias to growth stocks, a style that did very well in the post-Covid rally.

Ethical funds are typically more weighted to growth sectors like technology than value sectors like oil and gas or energy as these are usually incompatible with ESG. But these latter sectors were the ones investors sought out rapidly at the start of 2021 as markets and economies moved into a recovery phase from Covid.

Another factor was that the valuations of many popular ESG stocks, especially those focused on renewable energy, were adjusted downwards due to the rotation, having been inflated by the strong appetite for the sector in 2020.

As such, in a year that saw the world’s leaders commune in Glasgow for COP26 to review the climate change crisis, funds focused on cleaner energy struggled.

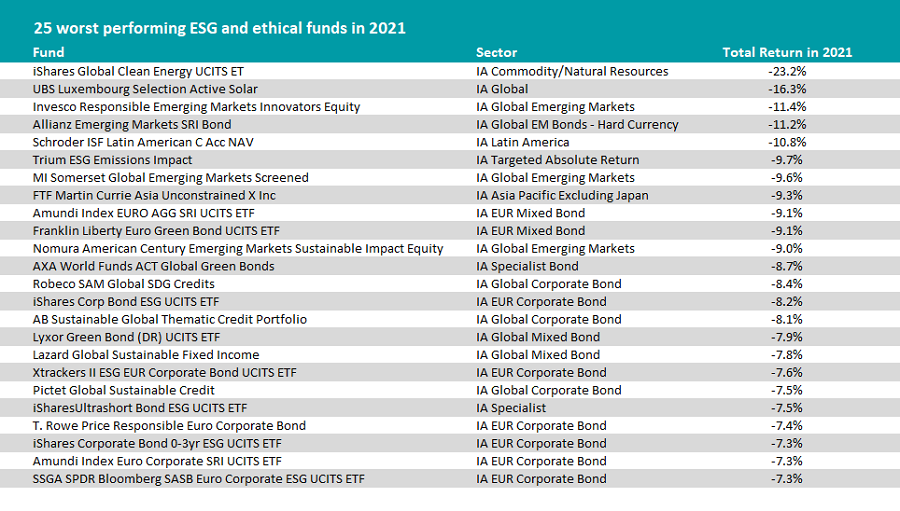

Looking at the worst-performing ESG and ethical funds Trustnet found that the iShares Global Clean Energy UCITS ETF had the worst year, losing 23.2%.

Source: FE Analytics

The $5.3bn (£3.9bn) ETF had been a favorite among investors, tracking the return of the S&P Global Clean Energy Index, which is comprised of clean energy companies from developed and emerging markets.

Other funds that lagged last year included: Invesco Responsible Emerging Markets Innovators Equity, MI Somerset Global Emerging Markets Screened, Franklin Liberty Euro Green Bond UCITS ETF, and Trium ESG Emissions Impact.

As well as the market’s early bias towards cyclical assets, the ESG sector also had to deal with the general market headwind of rising interest rates, which was weighing down growth stock prospects globally.

The ethical space has also faced headwinds regarding government regulation. The aforementioned COP26 did little to inspire a run on renewable energy stocks following the lackluster climate change pledges.

There was a further hit in the US, where Joe Biden’s ‘Build Back Better’ bill which planned to spend $500bn (£369.3m) on climate and clean energy projects was stalled.

Looking ahead to 2022, regulation is expected to remain as one of the key themes for ESG. As more money has moved towards ESG the industry has been asking for more regulation and guidance within the sector about what the phrase constitutes.

Kate Elliot, head of ethical, sustainable, and impact research, Rathbone Greenbank Investments, said that the world is “knee-deep” in regulatory changes, and Britain in particular was working hard to follow or at least mirror the EU on this topic.

There is a plethora of new regulations within ESG under consideration currently, including the formation of the International Sustainability Standards Board (ISSB), Sustainability Disclosure Requirements (SDR), and UK Green Taxonomy. But Elliot said the most important regulations concern standardization, something the ethical sector has struggled with as its popularity has grown.

The new regulation will look at both the data investors are presented with and the information offered to the wider public.

A second theme Elliot identified was the ‘Just Transition’ as she expected climate change to remain a key focus post-COP26.

Elliot said that the transition to a more environmentally friendly society and the economy creates a lot of opportunities for jobs, new industries, and investments globally.

A final theme is a biodiversity, which feeds into broader themes around climate change as well as food supply chains.

Elliot said: “The food system is a major driver of climate change and biodiversity loss. At the same time, incidences of obesity – a key risk factor in cases of severe Covid-19 – are rising across the world, and awareness is growing of labor rights concerns in global food chains. This is an area we intend to focus on again strongly in 2022.”