ExxonMobil has slashed its 2025 global oil and gas production estimate to 3.7 million boe/d, even as it focuses on growing output at the Permian Basin and in Guyana, the company’s top executives said March 3.

Production will remain flat from 2020 levels through 2025 at 3.7 million boe/d, the company said during its Investor Day 2021 webcast. That is down from the 5 million boe/d production estimate for 2025 ExxonMobil released last year in its 2020 Investor Day, just as the coronavirus was beginning to take its toll on global oil demand and prices.

While global production will remain flat, the company’s operations in Guyana and the Permian Basin will ramp up over the next several years.

ExxonMobil expects its Permian operation, which produced 370,000 boe/d in 2020, to average 400,000 boe/d this year and potentially 700,000 boe/d by 2025, assuming favorable market conditions, Neil Chapman, ExxonMobil’s senior vice president of upstream, said on the webcast.

That is down from the 1 million boe/d target the major had set for 2024 just a couple of years ago.

A major ExxonMobil objective for the Permian this year is to achieve double-digit returns while maintaining five to seven rigs in the play, where it has a resource potential of 10 billion boe with 70% higher-margin liquids at oil prices less than $35/b WTI. As well, it also aims to decrease emissions 50% from its Permian operation by 2025 versus 2016 levels, Chapman said.

ExxonMobil currently has eight rigs working in the play, compared with 57 a year ago, according to investment bank Tudor Pickering Holt.

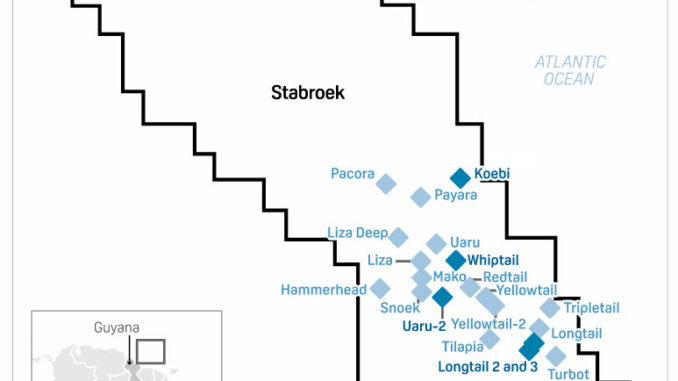

In Guyana, ExxonMobil operates the country’s offshore Stabroek block, which produced the country’s first oil under a partnership with Hess Corp. and China’s CNOOC in December 2019.

The block ramped to peak first-phase output in the fourth quarter of 120,000 b/d, although two additional projects are under development that will begin production in 2022 and 2024, respectively. Those projects will utilize floating, production, storage and offloading vessels with capacities of 220,000 b/d each.

The partners envision more than 750,000 b/d from five FPSOs by 2026, as well as a sixth Guyana project producing by 2027 from Stabroek, which currently has a resource potential of more than 9 billion boe. The projects aim to deliver more than a 10% rate of return, and potentially more than 20%, at an oil price less than $35/b – and zero routine flaring by 2030.

“It’s possible that 10 FPSOs will be needed to develop the resource we’ve discovered so far,” Chapman said. “We expect the potential of the basin to be more than double what we’ve already discovered,” or more than 18 billion boe.

50% reduction in American dry gas

Even as climate-change initiatives and goals are gaining ground in the company’s priorities, upstream investment remains a critical part of its forward plan.

“The upstream will need continuous investment going forward,” Andrew Swiger, ExxonMobil senior vice president, said during the webcast.

The company’s chief aims for the next several years are to grow its cash flow and earnings and cut costs, Swiger said, while working toward commercialization of lower emission technologies. It will continue to high-grade its portfolio, and retain capital investments that generate the highest returns.

“That’s the foundation on which we’ve established the low-carbon futures business,” company CEO Darren Woods said on the webcast.

For instance ExxonMobil will reduce its North American dry gas position 50% by 2025 – which it considers a lower-value asset, Chapman said. The company took a total impairment charge of $19.3 billion in Q4 to reduce the carrying value of dry gas assets in the US, western Canada and Argentina.

ExxonMobil’s total 2021 capex will remain at the $16 billion-$19 billion level released last month in the company’s Q4 conference call, as well as its earlier-stated longer-term 2022-2025 average of $20 billion-$25 billion. At that time, ExxonMobil also said it expects permanent structural cost savings of $6 billion per year by 2023.

Energy transition opportunities

Oil and gas is expected to play a smaller role in the shift towards a lower carbon footprint, with demand focused mostly for making petrochemicals and transportation fuels so the “cost of supply will be absolutely critical,” said Woods, adding that its upstream strategy is key.

Woods noted that International Energy Agency data showed in 2019 that oil and gas accounted for 55% of global energy demand, the equivalent of about 98 million b/d of oil.

In 2040, oil is expected to have a 48% share, with demand at about 75 million b/d of oil and natural gas, under a scenario used by the United Nation’s Intergovernmental Panel on Climate Change.

While the lion’s share of ExxonMobil’s reduction in greenhouse gases come from the upstream sector, in the downstream and chemical sectors, the company is “very focused on energy efficiency”, said Jack Williams, ExxonMobil’s senior vice president for downstream and chemicals.

“It’s the best way to reduce greenhouse gas emissions,” he said.

ExxonMobil is also shifting the product mix from its refineries and petrochemical facilities toward higher margin products by reducing output of fuel oil and gasoline and increasing output of diesel and jet. In Singapore, it is turning uneconomic fuel oil into higher value lubricants and distillates.

Refining product upgrades are underway around the world, including adding a hydrofiner to the Fawley refinery in the UK to increase diesel output, adding light, sweet crude processing capacity at the Beaumont, Texas, plant to match increased Permian output, and connecting its other two US Gulf refineries to its Permian crude assets.

ExxonMobil’s previously announced creation of a new business unit – ExxonMobil Low Carbon Solutions – is focusing on creation of hydrogen and using carbon capture and sequestration technologies to mitigate carbon emissions.

While the carbon sequestration project underway at Rotterdam is cutting edge today, the new business unit is looking to find uses for captured carbon beyond sequestration, such as in steel and cement as well its application for e-fuels.

“It’s promising, but there’s a long way to go,” said Swiger.

inviz ticker=XOM]