ESG investing gained huge momentum in 2020 and appears poised to continue growing in 2021. In the latest episode of the ESG Insider podcast, we talk to experts from State Street Global Advisors Inc., standard-setting organization SASB, sustainable investment firm Trillium Asset Management LLC and proxy advisory firm Glass Lewis & Co. LLC about the trends that will drive the ESG agenda in the year ahead.

Experts said the new Biden administration will reinvigorate ESG policies in the U.S. They expect conversations about the energy transition to become increasingly nuanced. They’re watching for investors to continue pressing companies on social issues, in particular around COVID-19, worker safety and diversity. And amid this investor demand, they say ESG disclosures and data will continue to develop. Listen to the episode on SoundCloud, Spotify or Apple Podcasts to learn what to expect in 2021.

Trillium Asset Management CEO Matt Patsky pointed to “incredible momentum building” in ESG investing in recent years. “We know that the current administration about to leave office on Jan. 20 really has been trying to do everything they can to try to slow that momentum,” said Patsky, one of several sustainability experts we interviewed for the latest episode of the ESG Insider podcast. “So what 2021 looks like to us — it looks like we will be getting, hopefully, support from the Biden administration on reversing some of those roadblocks and seeing some exponential growth in the adoption of ESG strategies.”

Trillium Asset Management CEO Matt Patsky pointed to “incredible momentum building” in ESG investing in recent years. “We know that the current administration about to leave office on Jan. 20 really has been trying to do everything they can to try to slow that momentum,” said Patsky, one of several sustainability experts we interviewed for the latest episode of the ESG Insider podcast. “So what 2021 looks like to us — it looks like we will be getting, hopefully, support from the Biden administration on reversing some of those roadblocks and seeing some exponential growth in the adoption of ESG strategies.”

Investors face data gaps as they adjust portfolios to EU taxonomy

Investors managing ESG-related funds have until Jan. 1, 2022, to explain how they use an ESG classification system, or taxonomy, to determine the sustainability of their investments. They will also have to disclose what percentage of their investments are in line with the taxonomy. The new regulation is expected to radically change how investors and companies report on their environmental performance, but data is set to remain patchy in the coming years.

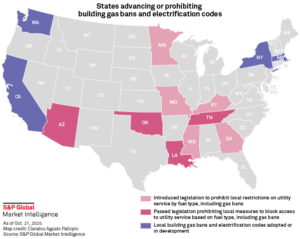

Investors may take fresh look at gas utilities in 2021, analysts say

Investors are likely to take a more nuanced view in the New Year about which gas utilities are truly exposed to climate policy and energy transition risk, some analysts said. Our Chart of the Week, above, shows the U.S. states that are advancing or prohibiting building gas bans and electronification codes.

Exxon

Environmental

Exxon discloses Scope 3 greenhouse gas emissions data for 1st time

Utility CEOs, analysts wary of Biden’s timeline for carbon-free power sector

US would need new policies to deploy carbon capture technology

Social

Japan’s latest push for workforce diversity challenges megabank culture

More than 200 Google employees form union — NYT

Auto insurer’s new round of COVID-19 relief highlights uneven carrier response

Governance

Under pressure in New York, National Grid updates governance structure plans

‘Significant concerns’: US EPA notes flaws in draft Midas Gold mine review

New York Community’s CEO change could jumpstart M&A talks