By Wolf Richter for WOLF STREET.

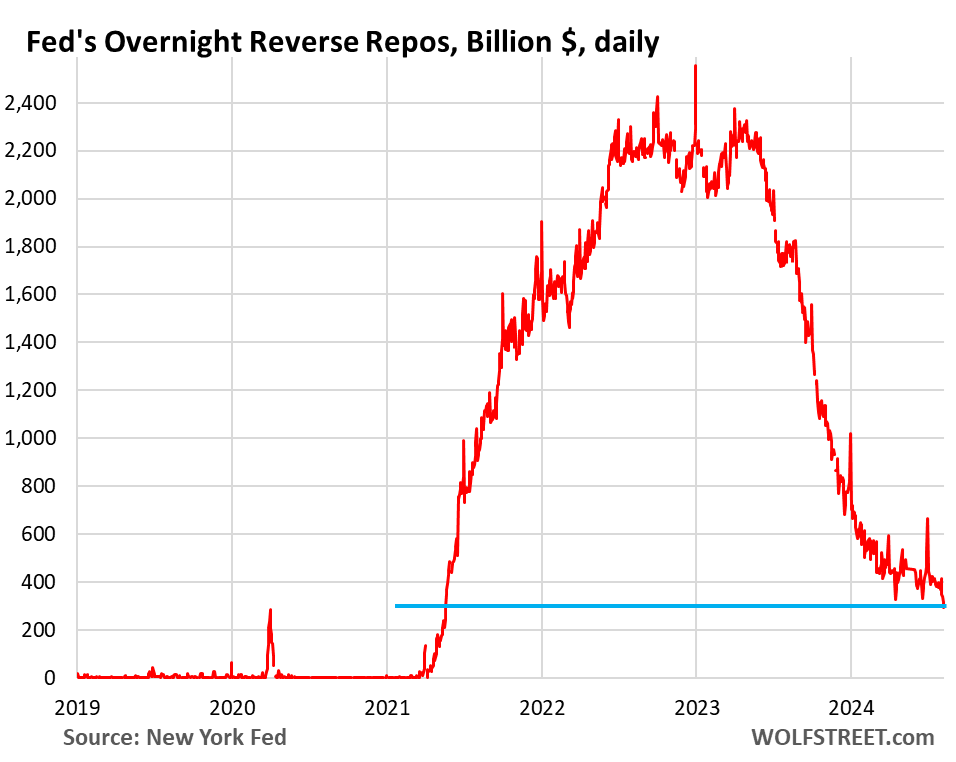

ON RRPs, or Overnight Reverse Repurchase agreements, on the Fed’s balance sheet fell to $292 billion today, the lowest since May 2021, down by over $2 trillion from the $2.3 trillion range in May 2022 through June 2023, and down by $2.26 trillion from the absolute peak at the end of December 2022. They’re well on their way to zero, or near zero, where they were in normal times.

The plunge in ON RRPs is largely a result of the Fed’s QT, which has shed $1.78 trillion in assets from the balance sheet. ON RRPs represent cash that the Fed’s domestic counterparties, mostly approved money market funds, have put on deposit at the Fed to earn 5.3%, a rate set by the Fed as part of its monetary policy rates.

In addition to the QT drainage, a smaller portion of ON RRPs has shifted into the banking system and to reserves, which is cash that banks have put on deposit at the Fed.

Excess liquidity is getting drained.

ON RRPs represent largely excess liquidity that the Fed created during QE that financial markets don’t know what else to do with. The spikes in the chart occurred at quarter-end and at year-end for window-dressing purposes.

ON RRPs have been used mostly by money market funds that have to invest in high-quality short-term instruments. Money market funds have many other options, including Treasury bills and lending to the repo market. They will shift funds to where they can earn a little more and still satisfy their liquidity needs.

Other approved counterparties are banks, government-sponsored enterprises (Fannie Mae, Freddie Mac, etc.), the Federal Home Loan Banks, etc.

ON RRPs have existed for many years, but in normal times, they’re zero or near zero. And now they’re going back toward their normal level.

Nothing has blown up yet.

There was a big to-do early this year in the financial media about the Fed being “forced” to end QT when ON RRPs drop to $700 billion or whatever, because it would draw so much liquidity out of the system that something would blow up.

The Fed leaned against that notion, and Fed governors Waller and Logan, in discussing the future of QT earlier this year, have pointed out that the normal balance for ON RRPs is near or at zero, and they expected QT to continue as ON RRPs reach that level. And nothing has blown up yet.

Draining liquidity is risky and something could blow up…

Liquidity doesn’t always move around the financial system smoothly and equally, to get where it’s needed from where it’s in oversupply. That’s the function of yield; where liquidity is needed the most, yields rise, and where it’s in excess, yields fall, and so cash follows the higher yield to where it’s needed.

But if liquidity doesn’t get there in time, something could blow up. So the Fed has slowed QT as of June to give liquidity time to move to where it’s needed. In July, total assets fell by $43 billion, roughly half the average pace in prior months.

The long-term chart of ON RRPs also shows the effects of the first wave of QE after the Financial Crisis. Excess liquidity with no place to go started building up in ON RRPs toward the end of QE in 2014. The first wave of QE ended in December 2014, after which the Fed kept its balance sheet roughly level until late 2017. QT-1 started in late 2017. ON RRP balances started declining in 2017 and returned to near-zero in 2018.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/