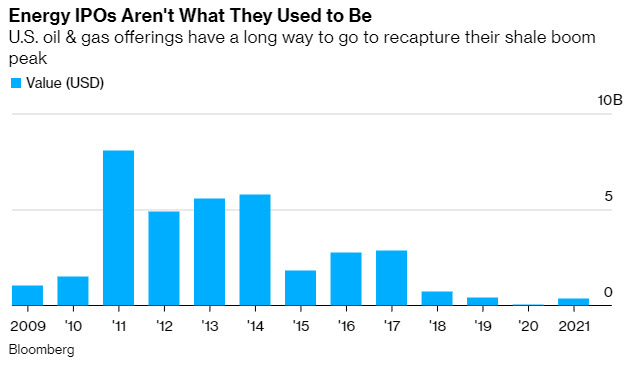

The first initial public offering for a shale driller in almost half a decade will test investors’ desire for an industry that’s still dusting off from last year’s historic energy-market bust.

Vine Energy Inc., which is backed by private-equity giant The Blackstone Group, plans to sell almost 19 million shares on the New York Stock Exchange as soon as this week. With an initial price range of $16 to $19 per share, the issuance could be valued as high as $357 million.

The natural gas explorer is coming to the market as shale drillers grapple with investor pressure to restrain spending and production growth for the sake of shareholder returns and avoiding new supply gluts.

The seven-year-old company is led by Eric Marsh, the former gas chief at EnCana Corp., which drilled the first exploration well in the Haynesville Shale in Louisiana about 15 years ago, according to Bloomberg Intelligence. EnCana is now known as Ovintiv Inc.

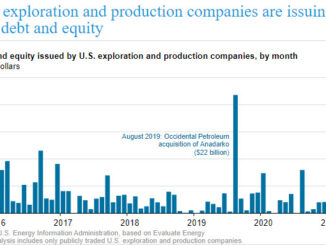

“It will be a great test for appetite in the market for energy companies and underlying valuations,” said Mark Rossano, founder and chief executive officer of C6 Capital Holdings. “Based on how the IPO is received, it could open up additional companies bringing stock or debt to market.”

Vine is the first shale driller to IPO since Jagged Peak Energy Inc. in early 2017. Three years later, Jagged Peak was acquired by Parsley Energy Inc., which has since been taken over by Pioneer Natural Resources Co.

Gas Play

Vine posted a loss of $252 million last year on revenue of $379 million. The company plans to use the proceeds to pay down some of its nearly $1.2 billion in debt and for general purposes as it expands in the Haynesville region, according to a filing with the U.S. Securities and Exchange Commission.

The Haynesville is a sprawling gas field beneath northern Louisiana and East Texas that has swallowed huge sums of drilling capital as marquee explorers such as Royal Dutch Shell Plc unsuccessfully sought to profitably develop its resources. Vine’s peers in the region include the likes of Chesapeake Energy Corp. and Dallas Cowboys owner Jerry Jones’s Comstock Resources Inc.

Although most of the drilling in the Haynesville being done by closely held companies, Vine going public offers investors exposure to the gas-rich shale play split between East Texas and northern Louisiana, said Andrew Dittmar, an analyst at research firm Enverus.

“It’s a niche offering that provides something different than what is publicly available,” Dittmar said.

By