There has been a double whammy of good news/bad news from China this morning.

On one hand, and just one week after China was rocked by violent protests over the regime’s increasingly draconian and deadly covid-zero lockdown measures, Beijing announced further easing of covid measures even as the number of new infections soar. Specifically, China announced the first explicit endorsement from the central government of isolating asymptomatic or mild coronavirus cases at home rather than at hospitals or centralised quarantine facilities. The new measures, outlined on Wednesday by the State Council, China’s cabinet, were foreshadowed by a meeting of the Chinese Communist party’s politburo that emphasised the importance of stabilizing the economy rather than the battle against Covid-19. As such, the market reaction was limited and Chinese stocks were sold on the news having staged a record surge in recent weeks on the rumor.

However, while the latest relaxation of covid zero was welcome, if more than priced in, there was far worse news in the latest Chinese trade data update which not only showed another month of contraction across both exports and imports, but a dramatic plunge in exports, which came far worse than the worst Wall Street forecast; bottom line: exports and imports both shrank at their steepest pace in at least 2-1/2 years in November, as feeble global and domestic demand, COVID-led production disruptions and a property slump at home piled pressure on the world’s second-biggest economy.

As shown below, in November China’s exports contracted by 8.7% Y/Y, significantly below consensus expectations of -3.9% and a huge deterioration to the 0.4% drop in October; the implied sequential export growth dropped to -6.5% M/M non-annualized in November (vs. -3.8% in October). At the same time, imports fell by 10.6% Y/Y, also missing consensus of -7.1%, and also far worse than the -0.7% Y/Y drop in October. Sequentially, imports fell -1.1% M/M in November vs. -3.4% in October.

In other words, exports and imports both contracted at steeper paces in November – and absent the covid crash in early 2020, the fastest pace since 2016 – as external demand weakened and a worsening Covid outbreak disrupted production and cut demand at home.

As Goldman notes, the export weakness broadened across destinations and products. Other than weaker DM demand on global manufacturing slowdown and the ongoing European energy crisis, the contraction of exports partially came from production disruptions in manufacturing hubs in China due to Covid resurgence. The overall trade surplus in November fell to US$69.8bn.

Some highlights from the report:

1. In year-over-year terms, China’s export growth fell markedly to -8.7% yoy in November (vs. -0.4% yoy in October), and import growth declined meaningfully to -10.6% yoy in November (vs. -0.7% yoy in October) (Exhibit 1). In sequential terms, exports dropped by 6.5% sa non-annualized in November (vs. -3.8% in October) and imports fell by 1.1% sa non-annualized in November (vs. -3.4% in October). China’s trade surplus fell to $69.8bn in November (not seasonally adjusted) from $85.2bn in October (Exhibit 2).

2. By major destination, exports weakness broadened in November. The year-over-year growth of exports decelerated across most major trading partners. Among major DM countries, growth of exports to the United States decelerated the most (-25.4% yoy in November vs. -12.6% in October). Growth of exports to the European Union decelerated to -10.6% yoy in November (vs. -9.0% in October). Among major EM economies, growth of exports to ASEAN decelerated sharply to 5.2% yoy in November (vs. 20.3% in October), and the implied sequential growth fell to -7.5% mom sa non-annualized.3. By major category, export growth moderated across most products. The export growth of tech-related products dropped notably (see Exhibit 3). For example, exports of cellphones declined 33.3% yoy in November (vs. +7.0% in October), and export growth of electronic integrated circuit slowed sharply to -29.8% yoy in November (vs. -2.4% in October). Among housing-related products, exports of home appliances fell 22.9% yoy in November (vs. -25.0% in October). Among Covid-related products, exports of computers declined 28.3% yoy in November (vs. -16.5% in October).4. Among major categories, import growth of commodities were mixed while manufacturing related products decelerated (Exhibit 4). Among energy goods, import growth of crude oil decelerated to 28.1% yoy in November (vs. +43.8% in October) with import volume up 11.8% yoy (vs. 14.1% yoy in October). Import growth of coal declined sharply to -26.0% yoy in November (vs. +2.8% in October) with volume down 7.8% yoy (vs. 8.3% yoy in October). Among major metal ores, import values declined on lower prices. For instance, copper ore import value fell 11.6% yoy in November (vs. -14.2% in October) with import volume up 10.2% yoy (vs. +4.0% yoy in October). Among manufacturing related products, imports of machine tools declined significantly in sequential terms (-10.4% mom sa non-annualized).

5. Exports contracted meaningfully in November on Covid-related production disruptions in manufacturing hubs and weak external demand. Import value declined sequentially on the lower commodity prices and weaker imports of manufacturing related products. The export growth surprised notably to the downside, resulting in a weaker-than-expected trade surplus.

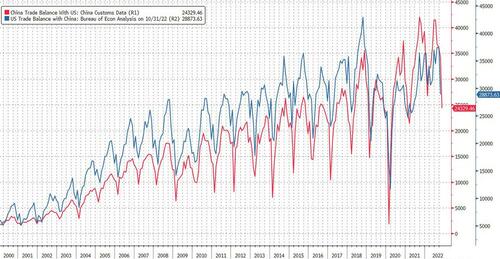

Also of note: the delta between the US reported and China reported trade balance has “renormalized” as the period in which China overreported – which coincided with the covid-lockdown phase – appears to have again ended.

But it wasn’t just covid crippling China – one look at Taiwan shows that traade there was far worse: as Reuters notes, Taiwan’s exports dropped 13.1% by value last month (November) from a year earlier to $36.13 billion, the sharpest fall in almost seven years, the Ministry of Finance said. That was much worse than a forecast for a 6.7% contraction in a Reuters poll, and followed a 0.5% drop in October.

The ministry said global demand was slowing “more and more obviously”, hit by the war in Ukraine, unabated global inflation pressures and interest rate increase cycles in major economies. Ministry official Beatrice Tsai said China’s COVID-19 controls had also hit demand for electronic components, pointing to Apple’s warning last month on lower iPhone 14 Pro and iPhone Pro Max shipments than previously anticipated due to pandemic curbs at a major assembly plant in China’s Zhengzhou.

Taiwan’s total exports of electronics components in November fell 4.9% to $15.15 billion, the first drop in three-and-a-half years, with semiconductor exports down 3.4% from a year earlier.

Firms such as TSMC , the world’s largest contract chipmaker, are major suppliers to Apple Inc and other global tech giants, as well as providers of chips for auto companies and lower-end consumer goods.

Taiwan’s exports to China, the island’s largest trading partner, plunged an annual 20.9% to $13.56 billion in November, after a 9.2% drop in October.

Tony Phoo, senior economist for northeast Asia at Standard Chartered Bank, said weakening demand may continue until the first and second quarters of next year for Taiwan. “If it continues into the second half of next year, Taiwan’s officially estimated economic growth rate of more than 2% next year will be under pressure,” he said.Taiwan’s finance ministry said risks ahead included uncertainty around China’s coronavirus policy and the U.S.-China tech war, adding that December exports could contract in a range of 8% to 12% from a year earlier.

Translation: global stagflationary recession, which is just what the stimulus-starved market is hoping for.