Estimated Costs

-

Phase 1 (Pipeline Infrastructure): The initial phase focuses on constructing an 807-mile, 42-inch diameter pipeline to deliver natural gas from the North Slope to Southcentral Alaska. This phase is estimated to cost $10.8 billion to $11 billion. This phase prioritizes supplying gas to Alaskan communities facing a looming natural gas shortage due to declining production in the Cook Inlet basin.

-

Full Project Components: The complete project includes:

-

A gas treatment plant on the North Slope, estimated at $9.2 billion (based on 2022 figures).

-

The 807-mile pipeline, estimated at $12.7 billion (2022 figures, though Phase 1 estimates suggest a lower cost for the pipeline alone).

-

A liquefaction facility in Nikiski, Alaska, with a capacity of 20 million tonnes per year (MTPA), estimated at $16.8 billion (2022 figures).

-

A carbon capture plant on the North Slope to remove and store 7 million tons of CO₂ annually, with costs not explicitly broken out but included in the total project estimate.

-

-

Front-End Engineering and Design (FEED): Glenfarne is funding the FEED process, estimated at up to $150 million, which will refine cost estimates and inform the final investment decision (FID) expected by the end of 2025.

-

Phase 1 Priority: The first phase of the project focuses on delivering North Slope gas to Alaskan communities via the 807-mile pipeline. This is critical as Cook Inlet gas supplies are projected to be insufficient, potentially requiring costly imports. The pipeline is expected to provide a long-term, affordable, and reliable natural gas supply for home heating, industrial needs, and power generation.

-

Pipeline Capacity: The pipeline has a daily capacity of 3.3 billion cubic feet (Bcf), with an average throughput of 3.1 Bcf per day. Multiple interconnection points along the pipeline will allow for in-state gas distribution to Alaskan communities, ensuring accessibility.

-

Economic Benefits: By providing a stable gas supply, the project aims to lower energy costs for Alaskans compared to potential long-term imports, which could double energy bills. It is also expected to support industries such as refining, mining, and manufacturing, and create up to 12,000 construction jobs and 1,000 permanent operations jobs.

-

Timeline: If the FID is reached by the end of 2025, gas deliveries to Alaskans could begin as early as 2030 or 2031, with some optimistic estimates suggesting pipeline construction could start within two and a half years from early 2025.

Export to the Asia Market

-

Export Capacity: The liquefaction facility in Nikiski is designed to produce 20 million tonnes per year (MTPA) of LNG, equivalent to approximately 2.6 Bcf per day of gas, for export primarily to Asia. This capacity positions Alaska LNG as a significant player in the global LNG market.

-

Target Markets: Prospective buyers include Japan, South Korea, Taiwan, Thailand, India, and the Philippines. Specific interest includes:

-

Taiwan: Taiwan’s state-owned CPC Corporation signed a letter of intent (LOI) in March 2025 to purchase 6 million metric tons per year, potentially the largest single off-take agreement in LNG history. CPC has also offered to invest directly in the project and supply equipment.

-

Thailand: Signals indicate potential imports of up to 5 million tons per year.

-

Japan and South Korea: High-level discussions are ongoing, with interest driven by geopolitical factors, including U.S. tariffs and the need to diversify away from Russian and Qatari LNG. Japanese and South Korean development banks have inquired about financing the project.

-

India and the Philippines: Emerging interest, with the Philippines seeking to transition from coal and facing declining offshore gas production.

-

-

Geopolitical and Economic Drivers: The project aligns with U.S. energy dominance goals under the Trump administration, which has prioritized Alaska LNG through executive orders and the National Energy Dominance Council. Asian allies view Alaskan LNG as a way to secure energy supplies, reduce reliance on geopolitically sensitive suppliers (e.g., Qatar, Russia), and potentially gain tariff relief in U.S. trade negotiations.

-

Competitive Positioning: A 2022 Wood Mackenzie analysis estimated the cost to supply LNG to Asia at $6.70/MMBtu, a 43% reduction from earlier estimates, making Alaska LNG competitive with Gulf Coast LNG. Alaska’s proximity to Asia reduces shipping costs and avoids chokepoints like the Panama Canal, enhancing its appeal.

-

Total Gas Production: North Slope fields are expected to deliver an average of 3.5 Bcf per day of natural gas, with the pipeline capable of carrying up to 3.3 Bcf per day.

-

In-State Use: A portion of the gas (not explicitly quantified but likely a small fraction of the total) will be distributed to Alaskan communities via pipeline interconnection points.

-

Export Volumes: The Nikiski liquefaction facility will process up to 20 MTPA of LNG, equivalent to roughly 2.6 Bcf per day of gas, for export to international markets, primarily Asia. This assumes the full project (including the liquefaction facility) is completed, likely following the pipeline’s Phase 1.

-

Carbon Capture: The project includes a North Slope carbon capture plant to remove and store 7 million tons of CO₂ annually, enhancing its environmental profile and appeal to markets with strict emissions standards.

-

High Costs: The $44 billion price tag makes Alaska LNG one of the most expensive LNG projects globally, driven by the remote Arctic location, harsh climate, and need for new infrastructure (unlike Gulf Coast projects that repurpose existing facilities). Securing private investment remains a challenge despite federal loan guarantees.

-

Competition: Alaska LNG competes with cheaper LNG from Qatar, Australia, and Gulf Coast projects. Qatar’s planned capacity expansion by 2027 could saturate the market, though geopolitical concerns may favor Alaskan LNG for Asian buyers.

-

Timeline Risks: While Phase 1 could deliver gas to Alaskans by 2030–2031, the full project (including LNG exports) may face delays due to the complexity of construction and financing.

-

Environmental Opposition: Despite federal approvals in 2020 and 2022, environmental groups have challenged the project’s greenhouse gas emissions, with a supplemental environmental review ongoing as of 2022.

-

Binding Agreements: While LOIs (e.g., Taiwan) and expressions of interest exist, no binding purchase agreements have been announced, which are critical for securing debt financing.

-

Glenfarne’s Role: Glenfarne became the majority owner (75% stake) in March 2025, with AGDC retaining 25%. Glenfarne is leading all development work, including FEED, and has selected Worley for final engineering and cost estimates, leveraging Worley’s 60 years of experience in Alaska’s North Slope.

-

Political Support: The Trump administration has prioritized Alaska LNG, with executive orders in January 2025 and support from the National Energy Dominance Council, enhancing federal backing and reducing regulatory barriers.

-

Asian Engagement: Governor Mike Dunleavy and Glenfarne’s CEO Brendan Duval have actively marketed the project in Asia, with trade missions to Japan, South Korea, Taiwan, and Thailand in early 2025.

Conclusion

Earlier this year, Glenfarne signed definitive agreements with state-owned Alaska Gasline Development Corporation to become the majority owner of the giant Alaska LNG export project.

The project is designed to deliver North Slope natural gas to Alaskans and Alaska utilities and export up to 20 million tonnes of LNG per year.

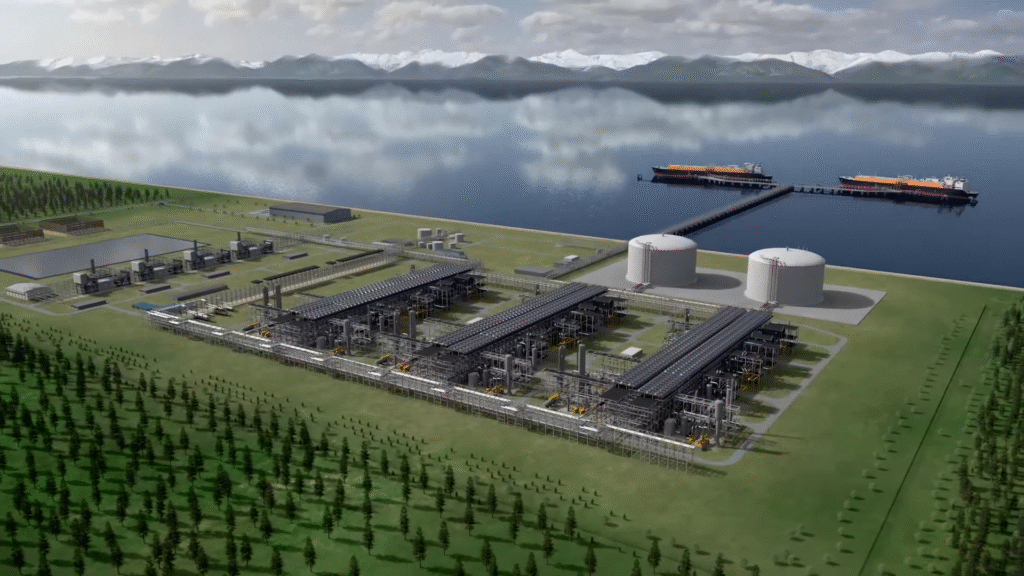

Alaska LNG’s three subprojects include an 807-mile 42-inch pipeline, the 20 mtpa LNG export terminal in Nikiski, Alaska, and a North Slope-based carbon capture plant to remove and store seven million tons of carbon dioxide annually.

Glenfarne Alaska LNG, a subsidiary of Glenfarne, awarded the pipeline contract to Worley.

According to a statement by Glenfarne, this work has already started and will utilize and supplement the extensive package of previously completed engineering work, and update the cost of the pipeline.

The Alaska LNG pipeline is capable of transporting enough natural gas to meet both Alaska’s domestic needs and supply the full 20 mtpa Alaska LNG export facility.

Also, the pipeline will be constructed in two phases.

Phase One will deliver natural gas approximately 765 miles from the North Slope to the Anchorage region. Phase Two adds compression equipment and approximately 42 miles of pipeline under Cook Inlet to the Alaska LNG Export Facility in Nikiski and will be constructed concurrently with the LNG export facility.

Glenfarne anticipates a final investment decision on the Alaska LNG pipeline in 2025.

Besides this contract, Worley has also been selected as the preferred engineering firm for the Cook Inlet Gateway LNG import terminal and project delivery advisor to Glenfarne across the Alaska LNG projects, Glenfarne said.

Concurrently with the final engineering work, Glenfarne has launched a strategic partner selection process to partner with global companies that support Glenfarne’s execution efforts and have complementary expertise to help deliver the Alaska LNG project, it said.

“Glenfarne is pushing Alaska LNG forward with expediency engaging prospective strategic partners. We are particularly proud to be expanding our relationship with Worley to Alaska LNG from our existing partnership on the Texas LNG project,” Brendan Duval, CEO and founder of Glenfarne, said.

AGDC said in March that market interest in Alaska LNG continues to accelerate “rapidly” following the agreement with Glenfarne and President Trump’s executive order identifying Alaska LNG as a national priority.

In March, Taiwan’s CPC Corp signed a letter of intent with AGDC to buy LNG and invest in the planned Alaska LNG project.

Thailand’s PTT and Egco will also engage in further discussions to potentially participate in the development and buy volumes from the planned Alaska LNG project, according to Thailand’s Ministry of Energy.

Besides Taiwan and Thailand, Japan, the Philippines, and South Korea may be interested in buying LNG from Alaska.

Shipping LNG from Alaska to Asian countries would take less time and effort compared to US Gulf Coast LNG export plants, as LNG carriers would not need to pass through the Panama Canal.

We give you energy news and help invest in energy projects too, click here to learn more