Authored by Simon White, Bloomberg macro strategist,

Measures of global central-bank tightness and inflation show that both are peaking.

It might not seem like it after today’s upside surprises in European inflation data, but global inflation is probably in the process of peaking. The pandemic led to an unprecedented synchronised supply and demand shock, with inflation rising everywhere. However, a synchronised shock is also likely to lead to a synchronised cooling — we seem to be on the cusp of this now.

The Global CPI Diffusion Index captures the percentage of countries around the world where inflation is in an uptrend. This index is at its maximum, a level it has only reached twice before, in 1974 and 2008. On both occasions it rapidly fell after reaching this level, with Global CPI (the median year-on-year CPI of countries around the world) following suit.

Peak global inflation is meeting peak central-bank hawkishness.

There have been intimations from the Fed that it is looking to slow the pace of hikes and soon pause (or stop) raising rates, while the central banks of Australia, Canada and Europe are beginning to err slightly more dovishly.

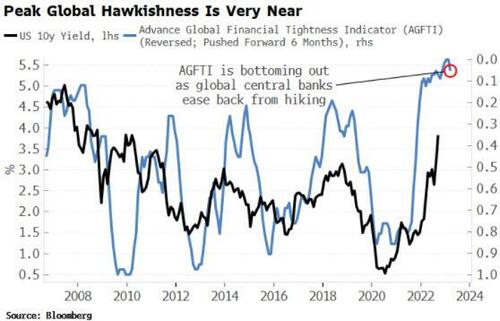

My Advanced Global Financial Tightness Indicator uses interest-rate futures markets to gauge global monetary conditions over the next six months. After rising relentlessly over the last 18 months, it now looks to be rolling over, implying that peak global hawkishness is here or very close. US yields should continue to fall, especially as a US recession becomes apparent.

Like any assessment there are risks.

Inflation is proving to be more sticky than most expect. But it only needs to become less sticky to allow central banks to ease back on their hawkishness.

This does not mean they will become dovish overnight, but it does signal an inflection point.

Bonds should find it easier to rally than sell off in this environment, while stocks will be stuck in a bear market until we see a clear upturn in excess liquidity. That’s not likely until peak global hawkishness morphs into unequivocal global dovishness.

Even if this is peak global inflation, though, that doesn’t mean it’s beaten, nor that we won’t see another peak in global hawkishness.

Countries are likely to be battling elevated inflation for years; this will be a long game. Financial assets will struggle, and sustainable real returns will continue to be elusive until inflation is returned to a low and stable regime.