Under QT, the ECB shed €3.1 trillion in bonds and loans. Separately, it wrote up its gold assets by €409 billion, or by 68%, to reflect soaring gold prices.

By Wolf Richter for WOLF STREET.

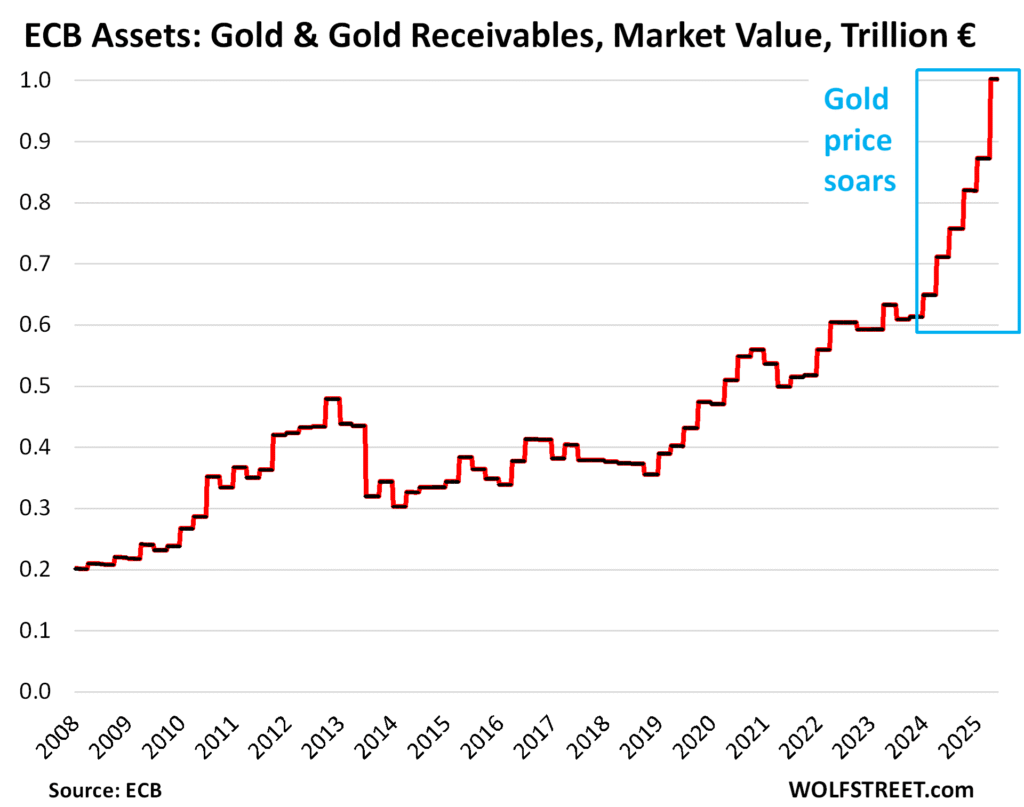

The ECB values its holdings of “gold and gold receivables” at market prices in euros. Every quarter, it adjusts these holdings to market value. In recent years, the price of gold, expressed in euros, has soared, and therefore the ECB’s balance-sheet account “gold and gold receivables” has soared.

At the end of Q1, the ECB wrote up its gold holdings by another €130 billion to €1.00 trillion. Back on the eve of QT at the end of 2022, its gold holdings amounted to €593 billion. Mark-to-market adjustments increased its holdings now by €409 billion, or by 68%.

Note that this mark-to-market of its gold holdings is just an adjustment on paper, does not involve transactions, and has no impact on the markets. Conversely, when the price of gold dropped, the ECB adjusted the value of its holdings down to market, such as by 37% between 2012 and 2014:

The account “gold and gold receivables” is an asset on the ECB’s balance sheet, and these mark-to-market adjustments added $409 billion to its total assets since the end of 2022.

At the same time, under its QT program, the ECB has shed €3.09 trillion of its QE assets (bonds and loans).

This paper-write-up of its gold holdings by €409 billion since QT began explains largely why total assets have dropped less (-€2.54 trillion) than its QT assets (-€3.09 trillion).

Bond and Loan QT progresses: -€3.09 trillion

The ECB had two QE programs:

- Loans to banks: peak in June 2021 at €2.21 trillion;

- Bond buying programs APP and PEPP: peak in June 2022 at €4.96 trillion (mostly government securities and some private-sector securities).

Since the beginning of QT in late 2022, the ECB accelerated the QT program in increments.

The loans to banks under its various loan programs are down to near-zero. The ECB has now shed €2.17 trillion of its loans, with just €24 billion left on its balance sheet, below where they’d been in 2004. So that part of QT is finished (blue in the chart below).

And in December 2024, it stepped away from the bond market entirely by removing the last remaining cap on the monthly roll-off, no longer replacing any maturing bonds, and just letting bonds roll off the balance sheet as they mature.

So far this year, the bond roll-off has occurred at these rates, reflecting the mounts of bonds that matured that month:

- January: -€48 billion

- February: -€62 billion

- March: -€62 billion

- April: -€49 billion.

And it has shed 18.5% of its bond holdings, or €920 billion, bringing them to €4.04 trillion, lowest since April 2021 (red).

The chart below shows the ECB’s holdings of gold (yellow), loans (blue), bonds (red), and total assets (dotted green line). We can see what has been happening since the end of 2022:

The ECB adjusted the value of its gold holdings up by €409 billion to €1.0 trillion to mark them to market, while it shed €3.1 trillion in QE assets, with loans dropping by €2.17 trillion to near-zero; and with bonds dropping by nearly €1 trillion to €4.0 trillion

Shedding €3.09 trillion ($3.49 trillion) in QE assets puts the ECB way ahead of the Fed, which has shed $2.26 trillion in assets under its QT program so far. Combined, they have shed $5.75 trillion in assets under their QT programs. And the Bank of Japan started QT in 2024 and has accelerated its QT this year, two years behind the Fed and the ECB. And smaller central banks, including the Bank of Canada, have also substantially reduced their assets under their QT programs.

We give you energy news and help invest in energy projects too, click here to learn more

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack