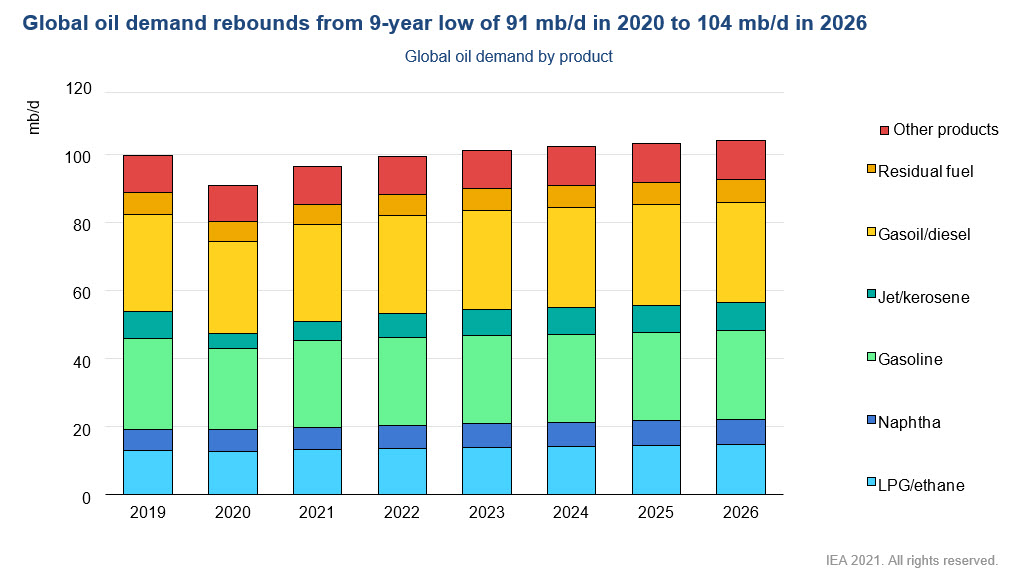

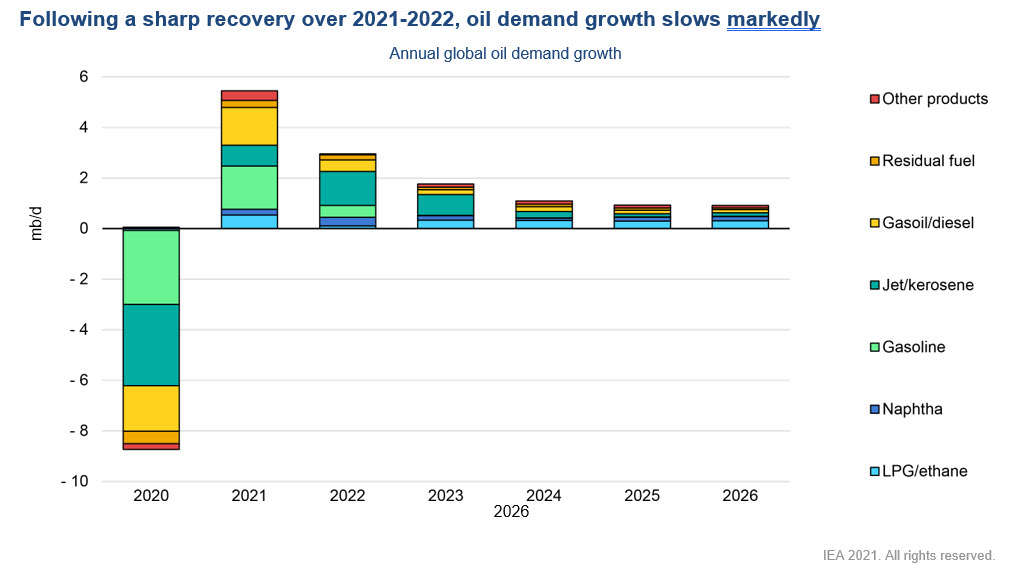

Energy News Beat Publishers Note: There are some real nuggets in the full International Energy Agency (IEA) and the U.S. Energy Information Administration (EIA) STEO released this morning. The bottom line: Global economic growth in 2021 will have a strong recovery, and gradually taper off through 2026. Petrochemicals will continue to lead oil demand and gasoline has peeked due to the influx of EV’s. There will be a constant demand for oil, even with the global green movement. Long-term investing in oil and gas look good. The Saudi’s have the right path forward – pursue both green and oil production. We will push out a more detailed comparison later.

The International Energy Agency (IEA) key points

A new normal for oil markets?

The global economy and oil markets are recovering from the historic collapse in demand caused by the coronavirus (Covid-19) pandemic in 2020. The staggering inventory surplus that built up last year is being worked off and global oil stocks, excluding strategic reserves, will return to pre-pandemic levels in 2021. And yet, there may be no return to “normal” for the oil market in the post-Covid era.

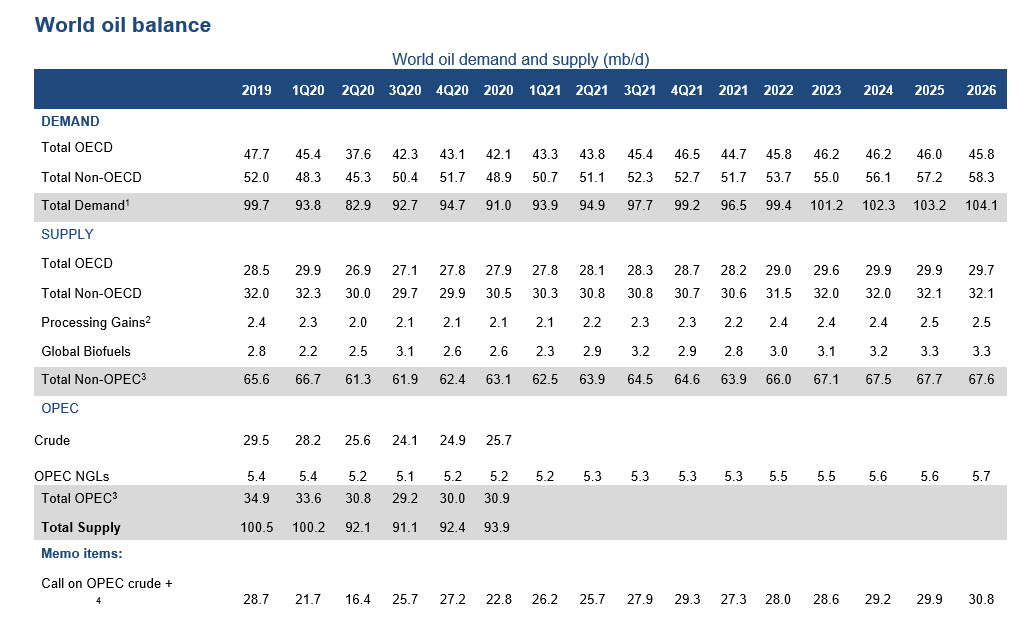

As a result, by 2026, global oil consumption is projected to reach 104.1 mb/d. This would represent an increase of 4.4 mb/d from 2019 levels. Oil demand in 2025 is set to be 2.5 mb/d lower than was forecast a year ago in our Oil 2020 report

Implications for industry

Fast-evolving government plans to accelerate transitions towards a more sustainable future have created a high degree of uncertainty that is testing the oil industry. It is crucial to invest in the upstream sector even during rapid transitions in which it would still take years to shift global transport fleets away from internal combustion engines to electric vehicles and other low-carbon alternatives. Some sectors – such as aviation, shipping and petrochemicals – will continue to rely on oil for some time.

U.S. Energy Information Administration (EIA) STEO released this morning.

In its March Short-Term Energy Outlook (STEO), the U.S. Energy Information Administration (EIA) expects Brent crude oil prices will average $64 per barrel (b) in the second quarter of 2021 and then fall to less than $60/b through the end of 2022. Higher crude oil prices in March and April are primarily a result of lower crude oil production from members of the Organization of the Petroleum Exporting Countries (OPEC) and partner countries (OPEC+), as announced at their March 4 meeting.

In February 2021, OPEC+ cuts, combined with supply disruptions in the United States, contributed to monthly global petroleum inventory withdrawals that EIA estimates totaled 3.7 million b/d, the largest monthly withdrawal since December 2002. The Brent crude oil futures price averaged $63/b in early March leading up to the OPEC+ meeting, and the OPEC+ announcement put further upward pressure on crude oil prices.

The front-month Brent futures price briefly surpassed $70/b in intraday trading in the days following the announcement, not only because of the announcement but also because of an attack on the Ras Tanura oil facilities in Saudi Arabia on March 7. As a result of the extension of OPEC+ production cuts, EIA expects draws on global petroleum and other liquids inventories of 1.8 million b/d and 0.6 million b/d in the first and second quarters of 2021, respectively.

The sustained OPEC+ production curtailment through April suggests that supply will remain constrained in the near term, even as demand continues to increase. As a result, EIA expects that further inventory withdrawals to meet rising crude oil demand will keep crude oil prices elevated through at least the end of April. EIA’s forecast of downward oil price pressure and increased crude oil availability has several key uncertainties.

The speed of actual demand recovery, based on COVID-19 vaccination rates and the degree to which travel and employment conditions return to pre-COVID norms, remains an important uncertainty on the demand side. At the same time, the degree to which OPEC+ production cuts will continue after April remains a source of uncertainty on the supply side, especially because increasing crude oil prices will encourage OPEC+ participants to agree to production increases in later meetings or to relax compliance with the existing agreement. Finally, the responsiveness of U.S. tight oil production to higher oil prices is also uncertain.