Houston-based Callon has updated its operational capital budget to a range of $790 million to $810 million for the full year, up from previous guidance of $725 million published in February.

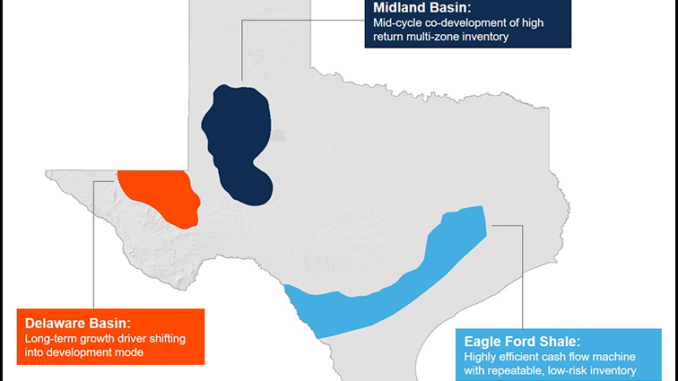

Production guidance of 101-105,000 boe/d remains unchanged from the last forecast, underscoring the impact of rising OFS prices in the oil patch. Callon operates in the Eagle Ford Shale, and in the Permian Basin’s Midland and Delaware sub-basins.

The revised spending guidance “is the product of inflationary service cost pressures that have resulted in average price increases of approximately 20% related to key drilling and completion items over 2021 levels,” management said in an operations update. “This represents incremental inflation of approximately 10% over the 10% inflation rate assumed for the initial 2022 budget.”

Callon’s production guidance comprises 64% oil, 19% natural gas liquids and 17% natural gas.

“As we have worked with our oilfield services partners over the last few months to amend and extend several key agreements, visibility into our capital cost structure for the remainder of 2022 has dramatically improved,” said CEO Joe Gatto. “We have taken multiple steps to ensure reliable access to top-tier service and consumables providers for all of 2022 and are extending these contracts into 2023.

“While service costs have increased as the industry faces significant inflationary pressures, we remain committed to a disciplined spending program with an expected capital reinvestment rate that is now tracking at less than 50%.”

Having recently completed a 10-well project in the Eagle Ford and a seven-well co-development project in the Permian Midland, Callon’s remaining completion activity for the third quarter is planned for the Permian Delaware, management said.

The program “will include continued testing of larger completion designs that have produced favorable results in wells placed online earlier this quarter,” the firm said.

Callon’s backlog of drilled but uncompleted (DUC) wells, meanwhile, is expected to exceed 50 wells at the end of the quarter, “at which time the company will reduce its drilling rig count to six rigs.”

On the natural gas marketing front, Callon “has advanced its natural gas offtake strategy in the Permian Basin and recently entered into multiple agreements for firm transportation to the Gulf Coast for approximately 75,000 MMBtu/d which are expected to be in effect beginning in mid-2023,” management said. “Callon plans to use this capacity for its ‘take-in-kind’ residue gas volumes, providing additional flow assurance and reduced pricing exposure to Waha basis.”

Cost inflation and labor shortages have hindered the ability of Lower 48 producers to ramp up supply amid current high commodity prices and market tightness.

Drilling and completions are nonetheless on the rise, with Texas leading the way. The Permian and Eagle Ford combined to account for 66% of active drilling rigs in Lower 48 unconventional production basins as of Friday (June 3), according to the latest tally from Baker Hughes Co.

The DUC well count across the principal onshore plays stood at 4,223 as of April, down from 6,611 in the same month a year ago, according to the Energy Information Administration.

Source: Naturalgasintel.com