Authored by Darlo Perkins via TS Lombard blog,

There is beautiful irony in macroeconomics, a sort of inherent Minsky dynamic, or universal Goodhart law, that means that just when everyone thinks something is definitively true, it turns out to be spectacularly false. In fact, worse than that, the false belief usually sows the seeds of its own destruction. Our whole pseudo-science is susceptible to that famous Mark Twain quote “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” We see this most clearly in the long pendulum swings between fiscal and monetary orthodoxy. Just when the Keynesians think they have won the argument, they have to face their historic nemesis – stagflation. And when policymakers think they can solve all the world’s problem with monetary policy alone, they always end up in some version of the liquidity trap. We also see these dynamics on a more granular level. Ignore the banking system, as the authorities did in the early 2000s, find yourself in a banking crisis. Regulate the banks, and push financial bubbles into shadow banking and institutional investors. Financial markets are viral. To control is to distort.

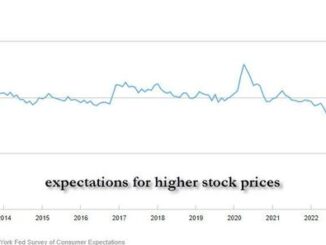

It is with this sense of irony, bordering on superstition, that we should rethink everything that has happened over the past decade. The 2008 crisis shocked everyone. As an industry, financial markets suffered a sort of collective PTSD. Investors spent the next decade looking for black swans that never arrived. The euro crisis in 2010. The debt limit in 2011. The euro crisis again in 2012. Oil in 2014. China in 2014, and in 2016, and in 2019, and again 2021. Mallmageddon in 2018. The thing that happened in repo markets – that nobody fully understood – in 2019. Sellside economists analyzed every potential threat in excruciating detail, looking for that one problem their clients feared most – “another Lehman moment”. And policymakers reacted in the same, hypersensitive way to every potential market threat. The authorities had their own PTSD to deal with. Nobody wanted to return to the crisis of 2008, with its chaotically arranged market communiques and rescue packages finalized at 4am. At every opportunity, central banks cut interest rates and added more QE. Deep down they knew these policies would do little to help their economies, but they seemed very effective at propping up asset prices. And with inflation showing no obvious signs of life, there was no real cost to this endless monetary lifeline. What harm would it do?

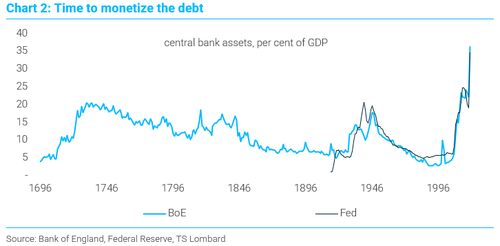

Inflation didn’t budge, in large part, because fiscal policy was continuously, and egregiously, too tight. Only China – the one part of the world that weaponized its state balance sheet – was able to move the dial on the global CPI. But every brief burst of reflation quickly sizzled out, as soon as the stimulus was reversed. Overall, the global fiscal-monetary policy was deeply disinflationary. If yields at 800 year lows didn’t make this point blindingly obvious, negative nominal rates – which everyone scrambled to explain when they first appeared – should have settled the debate. When Adam Tooze eventually writes his volume on this whole unfortunate story, his chapter on NIRP will be the part that stands out for being particularly bizarre. Negative interest rates were the “tell”. When investors will pay governments for the privilege of lending them money, it is clear that the old rules of economics have broken down. Now there is no limit on government debt. And deflation takes over from inflation as the dominant challenge facing central banks. It is no wonder that MMT was “winning” in the 2010s. When rates are zero, everything MMT says is true. MMT just reminded the mainstream things it had forgotten. And the mainstream resented it.

After 5 years of investors asking me to identify “the end of the cycle”, the black swan arrived from something few had imagined (as is the way with black swans) – the COVID pandemic. And by then, policymakers and investors had taken the “new rules” of the 2010s for granted. Secular stagflation would never end. Moderate inflation, let alone prices rising at “double digits”, was something that seemed unimaginable. So policymakers put everything they had learned into practice. Central banks immediately backstopped the shadow bank system. The Fed widened its swap lines for dollar liquidity. And governments, knowing that monetary policy would not be enough, launched their biggest fiscal support programme since World War II. There were no questions about whether we could “afford it” anymore, and inflation was something only “boomers” cared about. The policy response was extremely successful. By freezing the credit cycle – bankruptcies fell to historic lows – the authorities prevented a depression.

The irony was that the COVID was nothing like the global financial crisis. In the end, this was a supply shock, not just a demand shock. The combination of lockdowns and income support was highly inflationary, which the spasms and reflexivity of international supply chains amplified. For a while, there were good reasons to think this inflation episode would be transitory – prices would not fall, but inflation would come down. Yet the supply problems continued, first in labour markets, and then with the war in Ukraine. Stagflation beckoned. For central banks this was unacceptable, so they raised interest rates aggressively, as if their credibility depended on it. No central banker wanted to become a case study in monetary failure. But governments will have different ideas. For elected officials, inflation is a “cost of living crisis”, and a reason to provide fresh rounds of fiscal support – especially if/when central banks drive their economies into recession. And after the cost of living crisis, there will be further pressure on the public finances from climate change, ongoing energy shortages, decarbonomics, defence spending, and the emerging cold war between the world’s strategic geopolitical opponents. So, in the 2020s, we could find ourselves in a radically different situation to the 2010s. Inflation will always be a little too high (as opposed to too low), and with both monetary and fiscal policy pivoting a full 180 degrees, we will again have a “tug of war”, but a battle that pushes firmly in the direction of higher interest rates, rather than the disinflation and NIRP of the post-GFC era.

What is the point of this rear-view mirror rundown of the last decade? When you look back at the entire period, it feels as if there was a certain inevitability to where we have ended up – and where we are headed. Despite what some pundits thought, Japan-style deflation was never the endgame. For most democratic societies, inflation is the only socially-acceptable way out. We tried the “orthodox approach” of austerity last time. Now the “unorthodox approach” beckons…