So you like the energy sector for investment – rightly so because energy is, arguably, the ultimate economic staple: heat, light, transport, air travel, shipping, chemicals, fertilisers and all of the things that make the economy tick rely heavily on products from the energy sector.

As we ran through in our previous article, investment opportunities in energy still bias heavily towards fossil fuels, old and dirty energy. Despite concerted efforts to lower fossil fuel dependence, it is unlikely that demand will fall across the next 25 years so the majors will remain financially robust for many years to come. That said, there is not much growth for the energy giants and in that same period the new, clean, green, alternative and renewable energy sector is likely to begin to take a major slice of their market share.

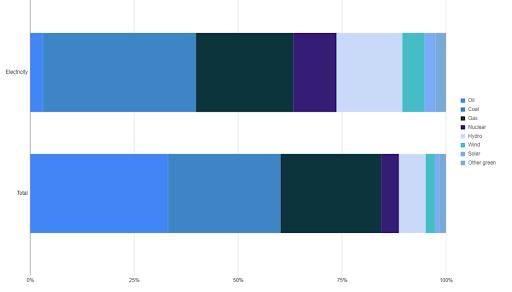

While energy consumption overall is likely to grow only fractionally faster than global GDP (growing urbanisation exceeding global drives for energy efficiency) there is significant change coming as the world seeks to decarbonise both through full replacement and by cleaning up dirty fuels. Globally clean and renewable energy today accounts for a decent slice of electricity generation (26 per cent excluding nuclear) but far less of total energy provision: just 11 per cent. That leaves a huge amount of potential expansion for clean energy, and quickly, with many targets for change set as early as 2030. The UK is well ahead of the global picture in the clean(er) energy transition (see below).

Global energy sources for electricity generation and total energy use

Source: IEA, ourworldindata.org

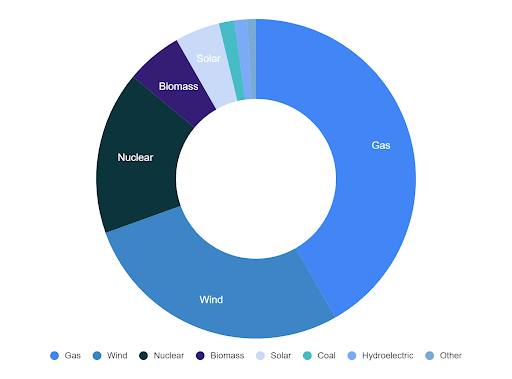

UK energy generation mix – last 12 months

Source: National Grid live statistics

So, there is a lot of potential but where to cast one’s lot in what is a sprawling field? When looking at fossil fuels there are just three choices: oil, gas or coal. However, in the clean(er) energy space, there are myriad options. In renewables there are: wind, solar electric, solar thermal, hydro, tidal, geothermal and biomass. Then there is nuclear fission (the current technology), the wünderkind of nuclear fusion, waste-to-energy (burning rubbish), various hydrogen-based applications, battery technologies, IT & AI solutions for energy management, electric vehicles (EVs – battery and fuel cell), carbon capture & sequestration, carbon credits, biofuels and synthetic fuels. On top of this are more basic energy savings technologies (eg, LED lighting or smart home energy management) and energy conservation (eg, thermal insulation).

We don’t have the space to discuss all options so will focus on what could be the most interesting technologically, although from an investment perspective it has been less sound: hydrogen.

Hydrogen – potential powerhouse?

Hydrogen is a versatile material, unlike wind or solar which can only generate electricity. It can be used to generate electricity using fuel cells for local use (domestic or industry) or it can be burned with or instead of natural gas in power stations at a grid level. It can be used in transportation to power EVs, and, although the passenger car market is largely lost to batteries, heavier and commercial vehicles are still a potential market. Hydrogen’s main use globally is to make ammonia-based fertilisers, so totally outside the energy sector. It is seen by many as a wonder fuel as its by-product on burning or converting to energy is only water and it will be, at scale, cheap to produce, although today it costs more and produces less energy than natural gas.

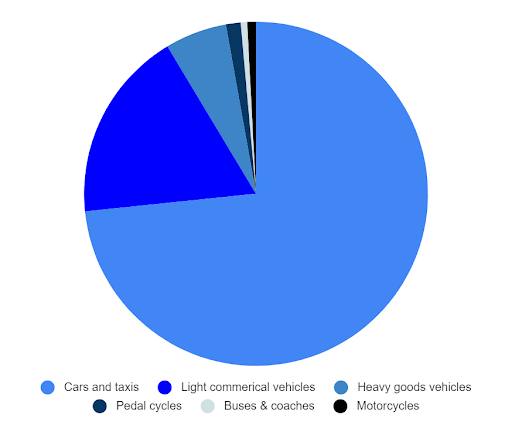

Green energy in transportation might appear almost fully focused on battery-powered passenger cars and cars do account for the lion’s share of road mileage, but around a quarter of road miles are non-car, driven by vehicles not suited to battery power (poor range, excessive weight and long recharge) and this is expected to be where hydrogen fuels cells can replace diesel. Another use for hydrogen and fuel cells is likely to be for local, micro generation of electricity for owners of large EV fleets (such as ‘last mile’ logistics – see later).

Figure 1: UK road mileage analysis

Source: UK Department for Transport

Hydrogen also has another, less obvious, use: energy storage. A problem for solar and wind electricity generation is that output is not constant and with wind, power is often not generated when it could be (known as curtailment) as demand is too low: this is why some turbines in an installation are not turning. This is wasteful (and in the UK costs bill payers an estimated £500m annually). In an ideal world all potential generation would occur and unused power stored. But there is a problem here due to the large amount of energy needing to be stored, and while at the domestic level batteries suffice, they are less suited to grid level generation. Hydrogen, however, is. Using fuel cells in reverse (in effect) ‘green’ electricity is fed in and water is electrolysed to produce hydrogen, which is then stored for either re-conversion to electricity in the same fuel cell or transported for other uses (thermal power or ammonia production).

While hydrogen is seen as a very green fuel, today its production is a major polluter. Most hydrogen is made by splitting natural gas, producing carbon dioxide that is released into the atmosphere. Only ‘green’ hydrogen production using renewable electricity is truly clean and the long-term need to decarbonise the world’s fertiliser industry provides major hydrogen and fuel cell demand outside of energy generation or transportation.

Hydrogen is accessible as a renewables sector for investors in the UK but the sector has had a terrible year in 2022, with the leading stocks down between 60 and 75 per cent. Production delays, apparent reticence by deployment partners, management change and rising interest rates (these businesses are loss making and are valued using discounted cash flows (DCFs)) created a wall of practical issues and investors tired of what increasingly looked like ‘jam tomorrow’. When we last looked at hydrogen (link and link) we concluded that to become viable, the sector needed governmental levels of investment, not corporate or pension fund levels. This is now starting to happen with the EU’s Energy Security policy and programmes to accelerate the decarbonising of various industries pledging billions to help in the accelerated manufacturing of fuel cells: €30bn (£25.7bn) at least is expected in fairly short order.

More recently the EU has also set up the ‘Hydrogen Bank’ (in joint venture (JV) with private investment) to allow businesses that want to decarbonise but baulk because investment returns cannot, today, be justified. Acting as ‘buyer of last resort’ the ‘bank’ will buy hydrogen from industry at a high price and sell it back at a hefty discount thus lowering business’s investment hurdle rates. This not just to lower reliance on Russian gas (energy security) but also to sharply accelerate the lowering of CO2 emissions.

Analysts believe that 2022’s share price weakness presents an opportunity as the sector is finally beginning to turn from being heavily conceptual into real world deployment. Buying stocks just because they have fallen a long way is often unwise, but the hydrogen story is one of solid, long-term, multi-faceted growth and could be a big investment story for 2023. We certainly look to be at a valuation low point in what promises to be a long-term high, growth story.

In the UK, investors have three stocks aligned with the hydrogen story, all of which are involved in the development of fuel cells:

Ceres (CWR) – this an IP company not a manufacturer which means that growth could scale very quickly if global industrial companies begin to make fuel cells – it has been dubbed ‘the ARM of fuel cells’ and understandably so. Its cells are fuel agnostic, meaning they can be connected to existing natural gas networks, also making that fossil fuel immediately greener. It also has JVs with global industrial manufacturer Bosch (about to roll out a global hydrogen decarbonisation strategy across its range) and Weichai, a major Chinese powertrain manufacturer. Weichai has pushed back its heavy vehicle fuel cell roll out (which hurt Ceres’ share price) but this looks to be a deferral rather than a change of heart. Both JV partners should hit their stride in 2023. Read more: Ceres Power still represents a leap of faith

ITM Power (ITM) – 2022 saw a series of missteps, primarily delays to ‘megafactory’ development and the departure of the long-standing CEO. The new CEO comes from major shareholder Linde and looks capable of putting the train back on the tracks. Peak-to-trough ITM’s share price fell 80 per cent, giving a much more palatable valuation, even if break-even seems no closer.

AFC Energy (AFC) – the smallest of the three, AFC is now making real world deployment with a great example being replacement of on-site diesel power generation with fuel cells on building sites for a number of the UK’s largest contractors and potentially widespread use along the HS2 route starting with the Euston station rebuild. These generators are more practical as they use ‘liquid hydrogen carriers’ such as Acetone or basic alcohols (eg, propanol) as their fuel source rather than liquid hydrogen. There is also a JV with Sweden’s ABB to build locally generated electricity for charging DPD’s fleet of 5,000 delivery EVs where National Grid appears to be unable to deliver capacity. These real world roll outs are likely to chime well with institutional investors.

There are also equivalent opportunities in the US through Plug Power (US:PLUG) (similarly weak performance in 2022) and Bloom Energy (US:BE), although the latter has not seen the same share price weakness. The Inflation Reduction Act (IRA) promises similar aid to that in the EU.

While we have focused on hydrogen, there are other renewable technologies although no other area has quite the same scope as hydrogen.

Wind and solar – likely to dominate but limited investment

Wind is likely to end up being the largest clean energy source, even though many hotter nations are likely better off using solar. Solar is land hungry (and often uses agricultural land) but has low capital cost, low maintenance and can be non-intrusive (ie, hidden on car park roofs – a new French government policy) but it is highly seasonal. At peak in August, the UK generates 3GW/day but at the December low only 0.15GW/day. Solar is likely to remain moderate in the UK and there is very limited UK investment scope and investors need to look to the US: First Solar (US:FSLR), Brookfield Renewable (US:BEP) and SolarEdge Technologies (US:SEDG). Investors can also become directly involved via investment in community solar projects.

Wind is a better option in the UK, especially offshore, and already generates more than a quarter of the UK’s electricity. While more capital intensive and higher maintenance than solar, it is more reliable (but still variable – in 2022 the best day saw 16GW generated and the worst day 3GW) and along with solar needs heavy investment in both storage and grid modification. Scope for investment is better but still limited largely to Greencoat UK Wind (UKW) (more of an income investment). The bulk of local investment is Scandinavian through Denmark’s Orsted (DK:ORSTED) and Norway’s Equinor (NO:EQNR), although this is also an oil producer. The US offers potentially explosive growth with Biden’s plans for a 30-fold increase in wind generation but whenever Republicans are calling the shots, wind is likely to be out of favour. Brookfield is again a major force and, tangentially, TPI Composites (US:TPIC), a turbine blade manufacturer, could be interesting. We will look at perhaps the best UK opportunity in wind, SSE (SSE), in our final part in this mini-series when we review utility companies.

Biomass – jury is out

The main fuel here in the UK is wood and the main user is Drax (DRX), the former coal-fired power station operator. Biomass contributes c.6 per cent of the UK’s electricity and nominally, this looks ‘green’ as it burns timber manufacturing offcuts, sawdust, forest clearings and trees useless for manufacturing. However, there are concerns about virgin timber being used and to scale up, there is unlikely to be enough truly surplus lumber. Also, academics suggest that wood produces more CO2 than natural gas when burned, it introduces particulate matter and removing trees lowers the planet’s absorption rate of CO2. Drax has been a stable investment but greener investors may have too many issues.