An important lesson from our many supply chain snarls is that upstream shortages can cause major downstream jams.

Short on lumber? That’ll crimp wooden pallet supplies and disrupt goods transport. Short on aluminum? You’ll have to wait longer for that can of soda. Short on chips? That’ll shut down entire car plants.

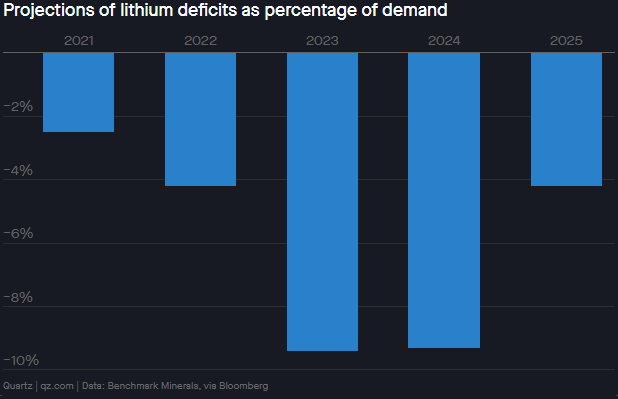

The electric vehicle supply chain is similarly exposed to raw material shortages. And there’s an added problem: investments in downstream EV factories and battery plants are outstripping investments in upstream lithium mining.

“There’s a very significant imbalance,” says Keith Phillips, CEO of mining company Piedmont Lithium, referring to the whole EV supply chain. “There’s an immense amount of capital going into the construction of vehicle plants and battery plants, and there’s not nearly enough capital going into lithium production…that means many of [the EV and battery plants] will be empty.”

Indeed, the battery materials consultancy Benchmark Minerals calculates that the downstream of EV supply chain is growing at twice the pace of upstream mining and processing. ”Something drastic needs to happen to close this gap if one of the key pillars of the [energy transition]is to exist at scale,” the consultancy’s CEO Simon Moores noted on Twitter this month.

Why are lithium mine investments lagging?

A number of factors can explain the EV supply chain’s lopsidedness.

First, lithium projects take a lot longer to build, get permitted, and ramp up, notes Phillips. He would know. Piedmont’s flagship project is slated to be one of the US’s first new and major lithium mines when it opens. But the permitting process, which Phillips says is far more complicated and lengthy than in Australia or China, has taken years and is still not completed.

Second, Phillips thinks EV companies were slow to fully appreciate the enormity of lithium demand. “In the past, these car companies haven’t had to deal with difficulties in procuring steering wheels and windshields or seats. They never really had a shortage of this before,” he said.

That’s now starting to change. Take Tesla: its CEO Elon Musk wants the company to get into lithium mining as a way to secure supplies and control costs.

On solution: a lithium-ion battery and EV trade bloc

Though the US has one of the world’s richest lithium resources (pdf), it only has one lithium mine in operation accounting for under 2% of global production.

But what if the US could work closely with allies who are major lithium producers—say Australia, which makes up 55% of world production?

To that end, the US Department of Defense (DoD) has proposed to Congress (pdf) that the definition of “domestic source” be changed in the Defense Production Act, a law passed at the beginning of the Korean War to help the US build needed war material.

Where “domestic source” is currently defined as a business that operates in or procures from the US or Canada, the DoD wants to widen that to additionally include the UK and Australia.

Phillips, whose company has a lithium project in Quebec, welcomes this proposal. With Canada’s and Australia’s lithium resources, he says, “then certainly [the US] can be self-sufficient.”

Consider it a kind of “friend-shoring” for lithium and EVs. Or as Benchmark’s Moores put it: “We think it’s the start of a new energy storage trade bloc.”

Source: Qz.com