Besides Iran itself, European refiners are among those with most at stake in the negotiations to revive the 2015 Iran nuclear deal and lift US sanctions on Iranian oil exports.

The negotiations hang in the balance after Iran appeared to provide a qualified response late on Monday to the draft text of an agreement proposed by EU coordinator Josep Borrell.

But an EU embargo on Russian crude that takes effect in December and the limited capacity of other Mideast producers to supply additional sour barrels has reinforced the appeal of Iranian crude in Europe, which faces a harsh winter of fuel shortages.

“It would be positive for the supply side of crude and gas [if US sanctions on Iran were lifted]. Lower prices for all of us,” said a trader with a refinery in southern Europe.

Around 1 million barrels per day of seaborne Russian Urals is currently going to Rotterdam and the Mediterranean. That’s roughly the same additional quantity of similar crude that Iran could export if sanctions were lifted, the trader noted.

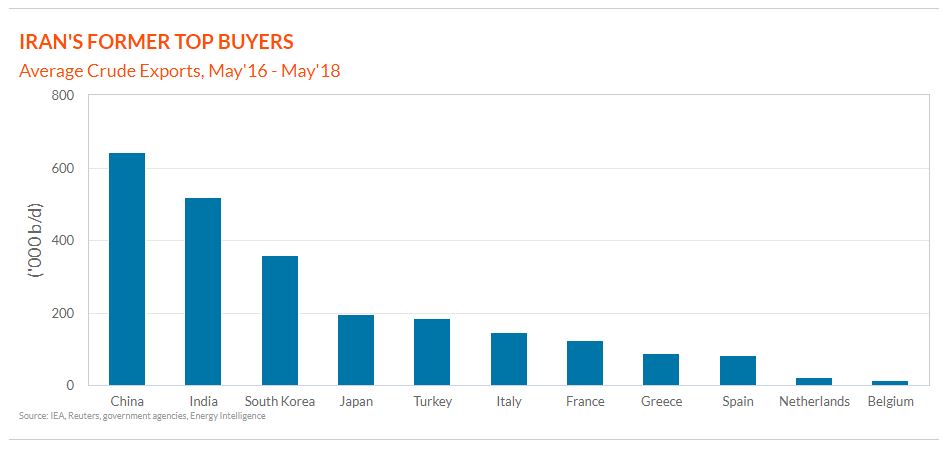

Former Buyers

Most of the Iranian crude that headed west of Suez between the lifting of multilateral sanctions in January 2016 and the unilateral US decision to reimpose them in May 2018 went to the Mediterranean — specifically Turkey, Italy, France, Greece and Spain.

Total exports to Europe and Turkey in the two years up to the return of US sanctions averaged 684,000 b/d (see table), according to data compiled by Energy Intelligence.

It took two or three months after sanctions were lifted for exports to begin, initially driven by France’s TotalEnergies, Spain’s Cepsa, Italian refiner Iplom, and Litasco, the trading arm of Russia’s Lukoil.

Greek refiner Hellenic Petroleum and Italian firms Eni and Saras soon followed that first wave of buyers.

Most of those European refiners would be willing to resume their intake of Iranian crude, with one of the larger ones telling Energy Intelligence earlier this year that they had stayed in contact with National Iran Oil Co. (NIOC) and were ready to fly to Tehran.

“The quality of Iranian crude is fine for us,” another former buyer said on Tuesday, although he admitted that concerns about compliance with US sanctions meant the company could not even talk to NIOC at the moment.

He also expressed doubt that the US and Iran would strike a deal, although some other European crude traders argue that strong European demand for Iranian oil would provide an incentive for both sides to reach an agreement.

Different World

But even if a diplomatic breakthrough allows Europe to resume imports from Iran, the demand picture has changed significantly since 2016.

Countries in northern and eastern Europe that previously took very little Iranian crude and depended heavily on Russian oil, such as Germany and Poland, could be among those most interested in signing term contracts with Iran if the chance arises.

Separately, Turkey and India — historically two of Iran’s top customers — have been snapping up discounted Russian crude, probably meaning they would have a smaller appetite for unsanctioned Iranian crude. That could divert more oil to Europe.

Source: Energyintel.com