With a looming sense of deja vu all over again, US equity prices have decoupled ‘hopefully’ from monetary policy expectations in recent weeks as the ‘pause/step-down/pivot’ narrative combined with extreme positioning to prompt yet another squeeze higher…

Source: Bloomberg

This in turn prompted a significant easing in financial conditions (easiest since mid-September), despite terminal rate expectations hitting cycle highs above 5%…

Source: Bloomberg

This, as Nomura’s Charlie McElligott details below, is a major problem for The Fed… again.

Macro-wise into Fed, anything less that a full-throated Fed “hawkish” clampdown will be taken as “dovish” message relative current pricing expectations (give markets an inch and they’ll take a mile), continuing on that theme of “step-down” / “downshifting” following the Brainard / Daly comms a few weeks back, and then the “tightening tap-out lite” from RBA and BoC (but also too, Norges indicating a slowing, Riksbank indicatng a lower terminal, SNB not committing to more big hikes etc)

All of that “past peak hawkish” messaging has contributed to an impulse EASING in financial conditions over the past month (Dollar and Real Yields BIG moves lower / easier, Credit Spreads massively tighter, Equities Vol and Skew smashed), which has then unwound a meaningful amount of prior Fed “tightening” efforts…but perversely at the same time we continue to see Core CPI stuck higher and Labor / Wages remain way to strong to see a commensurate reduction in demand-side inflation

Accordingly, anything less than hawkish perfection will look like a de facto EASING from Fed vs expectations, which then risks stoking economic “animal spirits” and triggering further “wealth effect” before we’ve seen anything remotely in the ballpark of “clear and convincing” evidence that inflation is being tamed = NO BUENO

Nevertheless, Terminal Rate now sitting at 5.01% for May23 following yday’s JOLTs print, iterating “high for longer” – which perversely means “bigger cuts” when they do ultimately happen (EDM3EDZ3 Jun23-Dec23 ED$ spread 10 days ago was pricing “just” 25bps of implied cuts – but now, to 41bps of implied cuts in that 2H23 window)

So why is Terminal hanging around north of 5.00% still, despite this “step-down” momentum?

Because the reality of the Fed now is that yes, they can’t hike at this magnitude forever – so the pace of hikes is inevitably going to slow…

HOWEVER, that “peak of the Pace” where Fed hikes step-down in magnitude is mutually-exclusive from the idea of being at “peak Terminal,” which is going to be tied to the Fed requiring far-greater confidence that we are convincingly “past-peak CPI”…

…and we simply are not there yet, which the numbers remain “sticky higher” despite all of the signs of progress with lower energy and used car prices, port unclogged, shipping costs hammered, the unwind of the inventory bullwhip = disinflationary impulse etc

I think the Fed “has to” message “hawkishl-y” today in order to reverse the recent easing in FCI and take control back before “spiking the football on the 1 yard line” while Core Inflation, Labor and Wages continues to run-hot…

…otherwise, FCI will ease powerfully further into de-facto RATE CUTS against still “too high” inflation!

But, as McElligott notes, even if The Fed goes full-hawk-tard, there is still a risk since the obvious “pain trade” is higher in stocks:

What I’m most worried about then with Equities then is a scenario where even with a HAWKISH Fed message today – we end-up seeing yet-another counter-intuitive Equities RALLY (say off of an initial shock lower)…because the recent “muscle memory” has seen the same, as evidenced by the booming Stocks recovery off the post the most recent CPI-upside surprise shocker.

Many investors are at risk of being “trapped in their under-positioning” into year-end, with increasingly illiquid market depth and less Dealer balance-sheet as they begin to protect PNL, further crimped by risk-management VaR models with too many Vol shocks in recent lookbacks limiting ability to facilitate size…so covering means lifting already very wide offers on diminishing liquidity.

Macro-wise, gun-to-head tactical trades for “Dovish” Fed today would be Nasdaq / ARKK upside, Crude upside (the stuff that’s been smashed by “hawkish CBs” >> growth slowdown implications)…but a “Hawkish” Fed should mean a push back into the trend trades – Long Dollar trades, Short 2Y-5Y, Long Energy Eq / Short Tech Eq, Short Credit – both as a function of complacency (credit just doesn’t mark LOL and in-fact impulse “impulse tightened” during this recent “FCI Easing”), but too, on actual default-risk uptick, where “Bad data is Bad news” into increased likelihood of “hard-landing” recession, due to Fed needing to stay diligent on “tight FCI” maintenance.

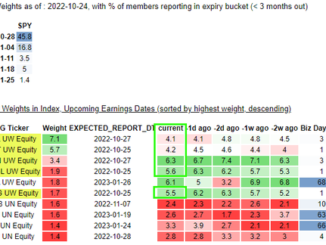

But, looking-out into next week and a half, just a spectacular amount of event-risk.

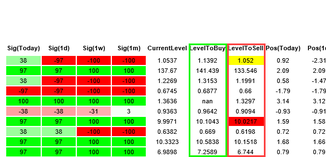

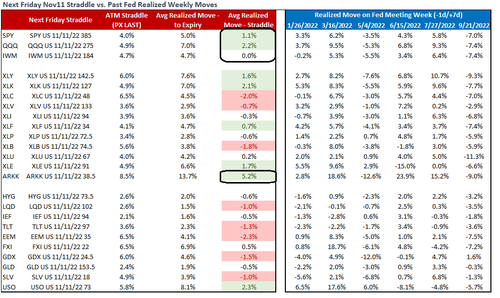

The 1-day implied moves for today’s event (1.6% for SPX, 2% for RTY and NDX) are almost perfectly in line with the average move on fed day over the past 6 meetings.

But the option market seems a bit too focused on the event itself. The days following the Fed day have actually exhibited a significant amount of volatility since this hiking cycle began as the ‘data dependent Fed’ gets their first dose of inflation data and Fed speakers come out of blackout.

From the Tuesday close pre-Fed to the following Friday (so 8 trading days total), QQQs have had an avg absolute price change of 7% over the six fed meetings YTD. Next Friday’s QQQ Straddle is priced at <5.00%. SPX has moved 5% on average through that next week of the Fed yet next week’s SPX straddle is offered at 4%. ARKK has moved 13.7% with next week’s straddle offered at 8.5%.

Next week we get both mid-term election results on Nov 8th and CPI on Nov 10th. Nomura’s Henry Homes thinks Nov 11th options are the best value buys on the board to capture all these events.

As SpotGamma explains in the brief video below, short dated IV for the S&P is near 40% suggesting traders are looking for a 2% move today…

SpotGamma suggests traders should consider downside insurance via long puts ahead of 2PM. The threat of potential heavy downside volatility was reinforced by the ~60 handle SPX decline yesterday AM. Note this is not a view that traders should be short into FOMC – but one that downside protection/skew is cheap, and may pay off well if the Fed sparks lower markets.

Specifically the two near term target areas (i.e. next 2-3 sessions) are 4000 to the upside, and 3600 to the downside. We do anticipate heavy options volume (both 0DTE and “real” longer term flow) forming out of today’s events, and so we will be watching for key levels to form outside of those bounds for next week.