HOUSTON, May 3, 2021 /PRNewswire/ — Oasis Petroleum Inc. (NASDAQ: OAS) (“Oasis” or the “Company”) today announced a strategic acquisition of Williston Basin assets, reported financial and operating results for the first quarter of 2021, declared its first quarter 2021 dividend, and updated its 2021 outlook to incorporate the acquisition, including an expected 33% increase to its future quarterly fixed dividend after the acquisition closes.

Williston Basin Acquisition

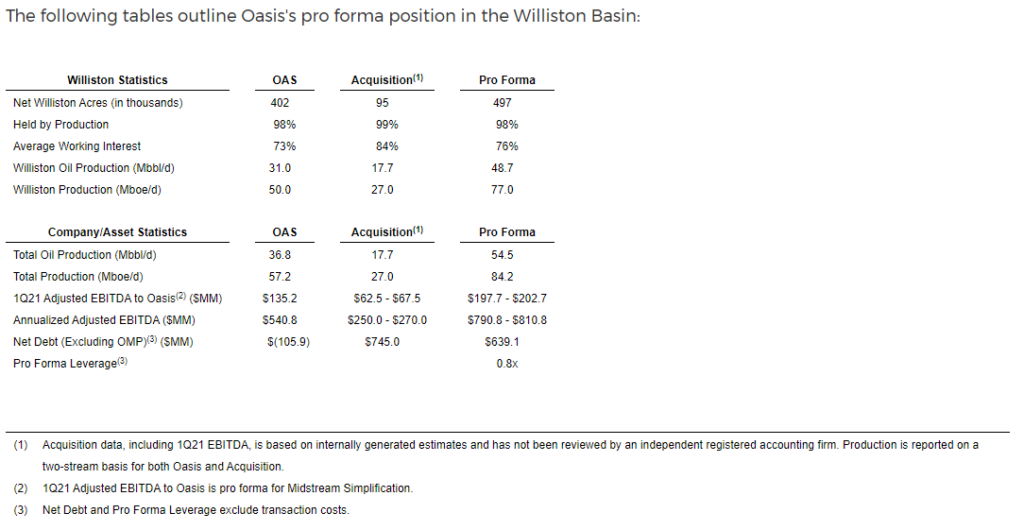

Oasis announced it has entered into a definitive agreement under which Oasis will acquire select Williston Basin assets from Diamondback Energy in a cash transaction valued at approximately $745MM, subject to customary purchase price adjustments. The consideration is expected to be financed through cash on hand (approximately $106MM as of March 31, 2021), revolver borrowings ($450MM elected commitment on $500MM borrowing base, none drawn as of March 31, 2021), and a $500MM fully committed underwritten bridge loan (expecting high yield financing to replace the bridge loan). The transaction was approved unanimously by the Board of the Directors of each company. The effective date of the acquisition will be April 1, 2021 and the closing is expected to occur in July 2021, subject to customary closing conditions.

Transaction Highlights:

- Assets purchased include approximately 27 MBoe/d of production in 1Q21 on a two-stream basis and 95,000 net acres;

- Accretive to cash flow per share and free cash flow per share in both the near and long-term before accounting for synergies. Oasis expects over $100MM of incremental field level cash flow (EBITDA less CapEx) at strip prices in 2H21;

- Allows for the return of more cash flow to shareholders, with an expected 33% increase to the quarterly fixed dividend per share post closing;

- Purchase price represents approximately $28,000 per Boe/d on 1Q21 two-stream volumes;

- Pro forma leverage of approximately 0.8x at March 31, 2021, based on 1Q21 annualized Adjusted EBITDA to Oasis, remains below Oasis’s 1.0x target and well below peers;

- Lowers 2021 reinvestment ratio to less than 55% using $55 per barrel WTI and $2.50 per mmBtu NYMEX gas for the remainder of 2021;

- Adds two to three years of top-tier locations competitive with Oasis’s existing top-tier assets;

- Lowers exploration and production (“E&P”) cash G&A exit rate guidance to $1.25 – $1.35 per BOE vs. $1.60 per BOE prior to the transaction. Provides opportunities for additional capital and operating cost savings;

- 2021 non-D&C CapEx expected to increase approximately $5MM – $10MM, reflecting additional workover costs on acquired assets. D&C capital is expected on the acquired assets in 2022;

- Committed to integrating and operating the acquired assets in an environmentally conscious, sustainable manner, consistent with Oasis’s values;

- Acquisition provides additional optionality for Oasis Midstream Partners and Oasis does not intend to slow development in OMP dedicated areas.

The following tables outline Oasis’s pro forma position in the Williston Basin:

“This exciting acquisition is a great example of how Oasis is addressing the needs of tomorrow, by taking action in our new industry paradigm, today,” said Danny Brown, Oasis’ Chief Executive Officer. “The strategic fit of focusing capital to consolidate assets in our core area, generating significant free cash flow for the benefit of the company and its shareholders, is highlighted via this acquisition. Given the significant anticipated increase in free cash flow per share, coupled with our commitment to returning capital to shareholders, we anticipate declaring a 33% increase to our dividend, raising the quarterly dividend to $0.50 per share with our quarterly declaration after the transaction closes later this year. This acquisition materially enhances scale in our core Bakken asset at an attractive valuation, with the purchase price almost entirely based on PDP and very little value attributed to the development of the top-tier inventory or potential synergies. When combining the inherently attractive acquisition price with the prudent use of our best-in-class balance sheet this acquisition creates significant accretion for shareholders across all metrics, while maintaining pro forma leverage below target, and well below that of our peers.” Mr. Brown went on to say, “I’m thankful for the hard work of all those involved in this transaction, and look forward to Oasis operating this asset in a manner consistent with our values and focus on ESG: being respectful of and engaging with all of our stakeholders, including the Three Affiliated Tribes on the Fort Berthold Indian Reservation; showing commitment to our communities and the environment; and operating in a safe and sustainable manner.”

Advisors and Financing

J.P. Morgan Securities LLC acted as strategic and financial advisor and McDermott Will & Emery acted as legal advisor on the acquisition. In connection with the acquisition, Oasis entered into a commitment letter dated May 3, 2021 with J.P. Morgan and Wells Fargo to provide a $500MM bridge facility. Wells Fargo is administrative agent on Oasis’s credit facility. Vinson & Elkins LLP and Kirkland & Ellis LLP acted as legal advisors on the financing.

1Q21 Operational and Financial Highlights:

- Completed simplification of midstream business through sale of remaining interests in Bobcat DevCo and Beartooth DevCo to OMP and elimination of IDRs (the “Midstream Simplification”);

- Best-in-class balance sheet supported by strong free cash generation in 1Q21 and no debt under the Oasis revolver as of March 31, 2021;

- Continued dedication to shareholder returns by implementing $100MM share repurchase program;

- Declared $0.375/share dividend ($1.50/share annualized);

- Net cash provided by operating activities was $190.4MM and net loss was $35.3MM;

- Adjusted EBITDA to Oasis(1) was $126.0MM and E&P Free Cash Flow(1) was $93.5MM. Assuming the Midstream Simplification occurred on January 1, 2021 and excluding $3.3MM of severance expense incurred in 1Q21, Adjusted EBITDA to Oasis would be approximately $135.2MM;

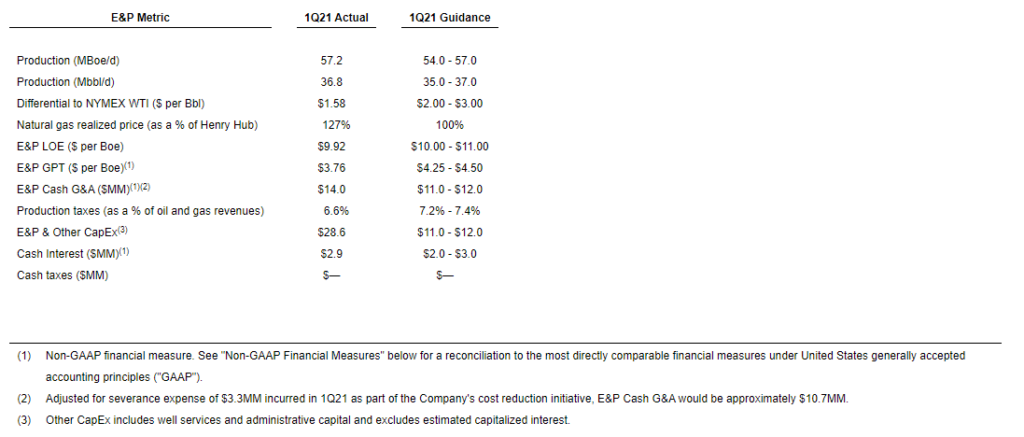

- Strong operating performance across the board on E&P metrics (see table below);

- Oasis Midstream Partners (NASDAQ: OMP) announced a $0.01/unit increase to its distribution, which is reflected in Oasis’s updated 2021 guidance;

- Continued focus on ESG with strong natural gas and liquids pipeline capture, as well as dedication to strong governance exemplified by the separation of Board Chair and CEO.

The following table presents select E&P operational and financial data for the first quarter of 2021 compared to guidance for the same period. E&P Metrics are consistent with disclosures in the Company’s investor presentation, which can be found on the Company’s website (www.oasispetroleum.com), and includes further reconciliation to consolidated numbers.

“First quarter results demonstrate outstanding operational and financial performance, strong execution, and progress towards our key strategic initiatives,” said Danny Brown. “Oasis continues to demonstrate a steadfast commitment to our new strategy of strong capital discipline and significant free cash flow generation as well as commitments to our environment, our social responsibilities and the sustainability of our enterprise. The quality of the Oasis team is impressive and their continued hard work has put our company in a great position to succeed going forward.”

“My goal is to build on the accomplishments made by management and the board in a very short amount of time. In the first quarter alone, Oasis significantly reduced its cost structure, instituted a peer-leading executive compensation program, declared an inaugural dividend, simplified its midstream business, and initiated a share repurchase program. Oasis represents a compelling investment opportunity, and we will continue to be aggressive and pursue strategies to unlock value.”

Financial and Operational Update and Outlook

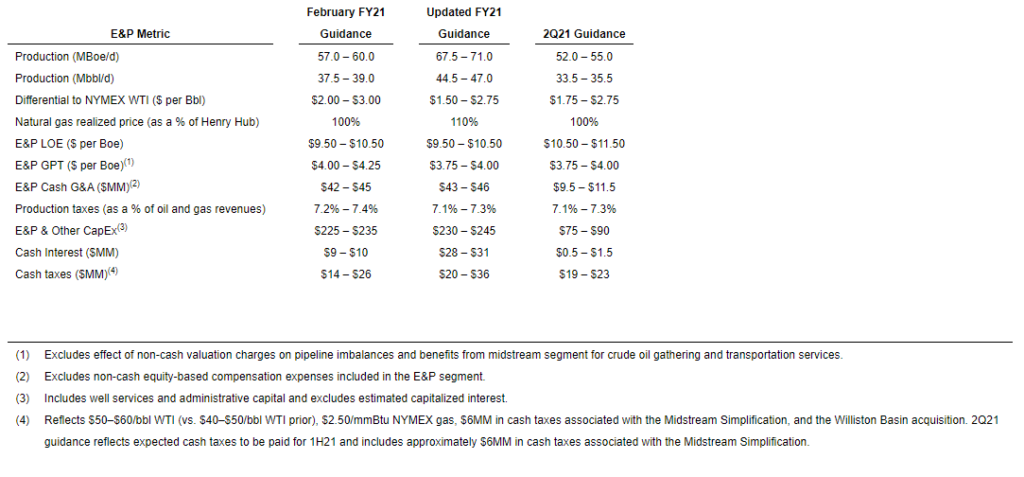

Oasis is updating its February FY21 volume and CapEx guidance to reflect 1Q21 actual performance and the Williston acquisition. For the purposes of guidance, the acquisition is modeled to close June 30, 2021. At $55/bbl WTI and $2.50/mmBtu NYMEX gas, Oasis is now expecting in excess of $200MM of free cash flow in 2021, including the impacts of hedges. The accretive transaction and the Company’s dedication to shareholder returns supports an approximately 33% increase in the dividend post closing to $0.50/share ($2.00 annualized).

Updated highlights based on adjusted E&P metrics include:

- Oasis’s original 2021 drilling and completion plan disclosed in February remains intact. Acquired volumes are expected to decline from current levels throughout 2021 as Oasis integrates the new assets and prioritizes free cash generation;

- 2021 CapEx increased $5MM – $10MM to reflect incremental workover associated with acquired assets;

- Updating oil and gas differential guidance to reflect strong 1Q21 performance and updated outlook;

- Lowering GPT and production tax guidance reflecting strong 1Q21 performance and updated outlook;

- E&P Cash G&A guidance of $43MM – $46MM, which includes the impact of $3.3MM of 1Q21 severance expense. Oasis now plans to exit 2021 at $1.25 – $1.35 per Boe, below original expectations of $1.60 per Boe;

- 2Q21 volumes are expected to be 52–55 MBoe/d (65% oil), in line with prior expectations;

- 2Q21 E&P CapEx is expected to be $75MM – $90MM reflecting deferred 1Q21 spending. Following the Midstream Simplification, Oasis no longer has CapEx for its ownership interest in OMP;

- Oasis is currently evaluating various development scenarios for 2022 and beyond with the objective of optimizing operational efficiency, returns on capital, and sustainable free cash generation.

The following table presents previously announced full-year 2021 guidance and updated guidance for full-year 2021 and the second quarter of 2021:

Progress on Strategy since Emergence

- Governance: Consistent with its dedication to ESG-related opportunities, Oasis separated the positions of Board Chair and CEO. Danny Brown was appointed CEO on April 14, 2021 and Douglas E. Brooks will continue as independent Board Chair. The Board of Directors is 86% independent. Additionally, Oasis enacted a peer-leading executive compensation program in January 2021 with 75% of incentive pay tied to returns.

- Best-in-class balance sheet: Pro forma for the announced transaction, Oasis is expected to be less than 1.0x levered, and strong free cash flow generation will drive leverage down over time. The Company is targeting leverage below 1.0x to ensure financial strength, sustainability of operations, and return of capital to shareholders.

- Capital allocation committee: The capital allocation committee continues to evaluate and influence investments, including the Williston Basin acquisition, through a rigorous, systematic framework for evaluating and approving projects and acquisitions to enhance returns. Efficiently developing Oasis’s high-quality asset base and pursuing accretive acquisitions are paramount to delivering sustainable returns of cash to shareholders.

- Cost reductions: Oasis has dramatically reduced its capital, operating, and overhead cost structure over the past two years. Additionally, the Company has identified significant further cost reductions and operating efficiencies, which it will be able to continue with the Williston Basin acquisition.

- Commitment to sustainability: Oasis is dedicated to producing a cleaner, low-cost barrel, while being engaged with local communities and conscious of stakeholder interests. The Company continues peer-leading gas capture in the Williston Basin where it is also capturing essentially all its liquids on pipeline instead of truck.

- Enterprise risk management: Oasis has codified an enterprise risk management system to ensure organizational reliability and to protect against possible disruptions. Oasis has implemented new systems to effectively manage processes and mitigate risk.

- Midstream optionality: Management took aggressive action to simplify its midstream business through the Midstream Simplification in March 2021. Management continues to believe its ownership in OMP is a source of unrecognized value and has prioritized evaluating value creation options in the near-term.

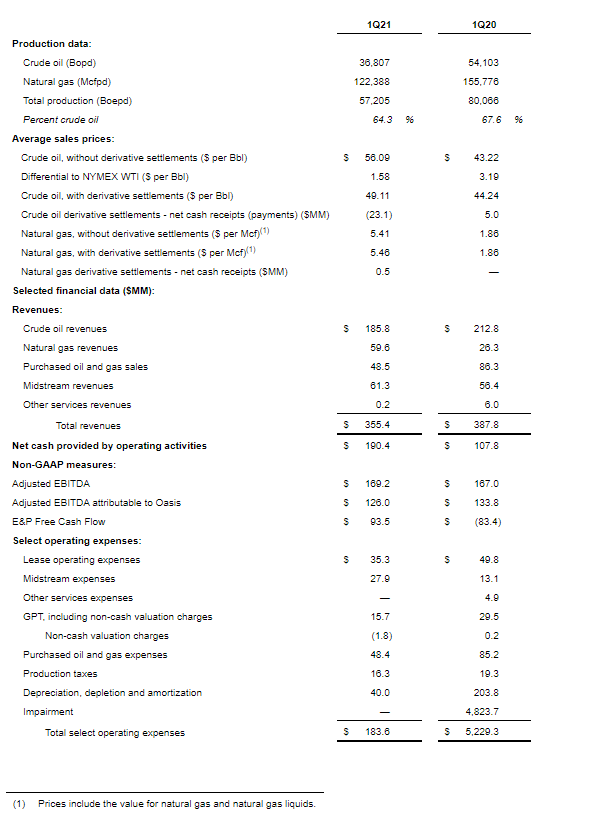

The following table presents select operational and financial data for the periods presented:

G&A totaled $20.7MM in 1Q21 and $31.2MM in 1Q20. Amortization of equity-based compensation, which is included in G&A, was $2.2MM, or $0.43 per barrel of oil equivalent (“Boe”), in 1Q21. G&A for the Company’s E&P segment, excluding G&A expenses attributable to other services, totaled $15.7MM in 1Q21 and $23.3MM in 1Q20. E&P Cash G&A (non-GAAP), excluding G&A expenses attributable to other services, non-cash equity-based compensation expenses and other non-cash charges, was $2.72 per Boe in 1Q21 and $2.29 per Boe in 1Q20. For a definition of E&P Cash G&A and a reconciliation of G&A to E&P Cash G&A, see “Non-GAAP Financial Measures” below.

Interest expense was $8.7MM in 1Q21 as compared to $95.8MM in 1Q20. Capitalized interest totaled $0.4MM in 1Q21 and $2.3MM in 1Q20. Cash Interest (non-GAAP) totaled $5.6MM in 1Q21 and $93.5MM in 1Q20. For a definition of Cash Interest and a reconciliation of interest expense to Cash Interest, see “Non-GAAP Financial Measures” below.

In 1Q21, the Company recorded an income tax benefit of $3.7MM, resulting in a 9.4% effective tax rate as a percentage of its pre-tax loss for the quarter.

In 1Q21, the Company reported a net loss of $43.6MM, or $2.20 per diluted share, as compared to a net loss of $4,310.9MM, or $13.61 per diluted share, in 1Q20. Excluding certain non-cash items and their tax effect, Adjusted Net Income Attributable to Oasis (non-GAAP) was $86.2MM, or $4.34 per diluted share, in 1Q21, as compared to Adjusted Net Loss Attributable to Oasis of $62.8MM, or $0.20 per diluted share, in 1Q20. Adjusted EBITDA (non-GAAP) in 1Q21 was $169.2MM, as compared to Adjusted EBITDA of $167.0MM in 1Q20, which included $37.4MM for derivatives monetized in 1Q20. For definitions of Adjusted Net Income (Loss) Attributable to Oasis and Adjusted EBITDA and reconciliations to the most directly comparable financial measures under GAAP, see “Non-GAAP Financial Measures” below.

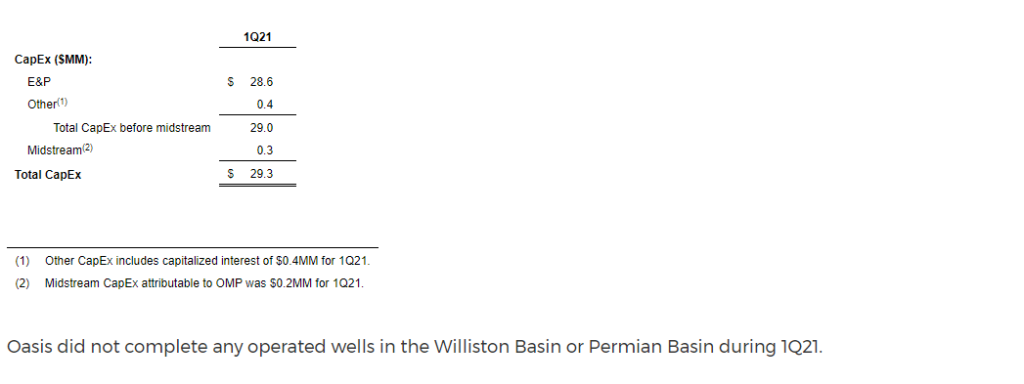

Capital Expenditures and Completions

The following table presents the Company’s total capital expenditures (“CapEx”) by category for the period presented:

Dividend Declaration

Oasis declared a dividend of $0.375 per share ($1.50/share annualized) for the first quarter of 2021 for shareholders of record as of May 17, 2021, payable on May 31, 2021.

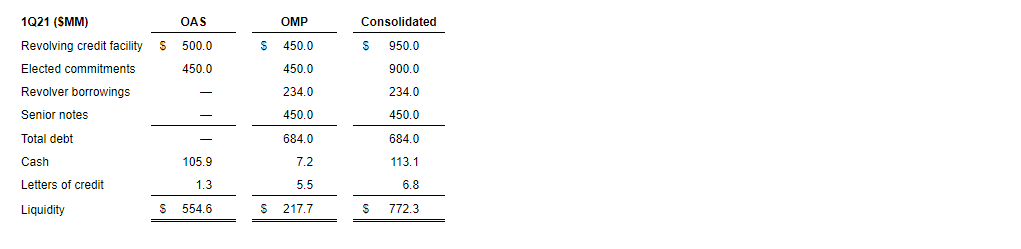

Balance Sheet and Liquidity

The following table depicts the Company’s key balance sheet statistics and liquidity. Debt is calculated in accordance with respective credit facility definitions. The debt held at Oasis and OMP is not cross-collateralized and guarantors under the Oasis credit facility are not responsible for OMP debt.

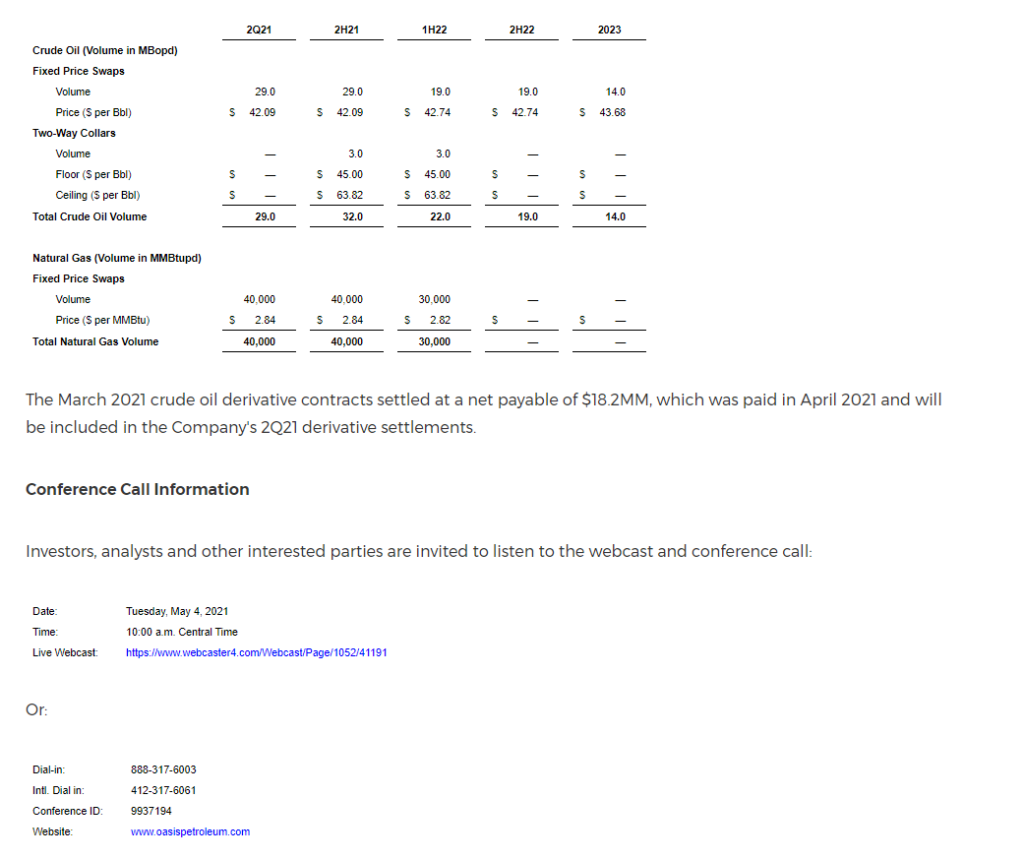

Hedging Activity

The Company’s crude oil contracts settle monthly based on the average NYMEX West Texas Intermediate crude oil index price (“NYMEX WTI”) for fixed price swaps and costless collars. The Company’s natural gas contracts settle monthly based on the average NYMEX Henry Hub natural gas index price (“NYMEX HH”) for fixed price swaps. As of May 3, 2021, the Company had the following outstanding commodity derivative contracts:

A recording of the conference call will be available beginning at 12:00 p.m. Central Time on the day of the call and will be available until Wednesday, May 12, 2021 by dialing:

|

Replay dial-in: |

877-344-7529 |

|

Intl. replay: |

412-317-0088 |

|

Replay code: |

10156060 |

The conference call will also be available for replay for approximately 30 days at www.oasispetroleum.com. Please note the conference call originally scheduled for Thursday May 6th is cancelled.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included in this press release that address activities, events or developments that the Company expects, believes or anticipates will or may occur in the future are forward-looking statements. Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include the expectations of plans, strategies, objectives and anticipated financial and operating results of the Company, including the Company’s drilling program, production, derivative instruments, capital expenditure levels and other guidance included in this press release, as well as the impact of the novel coronavirus 2019 (“COVID-19”) pandemic on the Company’s operations. These statements are based on certain assumptions made by the Company based on management’s experience and perception of historical trends, current conditions, anticipated future developments and other factors believed to be appropriate. Such statements are subject to a number of assumptions, risks and uncertainties, many of which are beyond the control of the Company, which may cause actual results to differ materially from those implied or expressed by the forward-looking statements. These include, but are not limited to, changes in crude oil and natural gas prices, developments in the global economy, particularly the public health crisis related to the COVID-19 pandemic and the adverse impact thereof on demand for crude oil and natural gas, the outcome of government policies and actions, including actions taken to address the COVID-19 pandemic and to maintain the functioning of national and global economies and markets, the impact of Company actions to protect the health and safety of employees, vendors, customers, and communities, weather and environmental conditions, the timing of planned capital expenditures, availability of acquisitions, the ability to realize the anticipated benefits from the Williston Basin acquisition, uncertainties in estimating proved reserves and forecasting production results, operational factors affecting the commencement or maintenance of producing wells, the condition of the capital markets generally, as well as the Company’s ability to access them, the proximity to and capacity of transportation facilities, and uncertainties regarding environmental regulations or litigation and other legal or regulatory developments affecting the Company’s business and other important factors that could cause actual results to differ materially from those projected as described in the Company’s reports filed with the U.S. Securities and Exchange Commission. Additionally, the unprecedented nature of the COVID-19 pandemic and the related decline of the oil and gas exploration and production industry may make it particularly difficult to identify risks or predict the degree to which identified risks will impact the Company’s business and financial condition. Because considerable uncertainty exists with respect to the future pace and extent of a global economic recovery from the effects of the COVID-19 pandemic, the Company cannot predict whether or when crude oil production and economic activities will return to normalized levels.

Any forward-looking statement speaks only as of the date on which such statement is made and the Company undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by applicable law.