The world is in an energy crisis. Now that we got that obvious statement out of the way. We got here from 20 + years of bad world energy policies. Understanding what happened and what is going to happen is the first step of being able to create a go-forward plan that has a chance of succeeding on the road to renewables.

I was reading articles and forecasts for oil and gas for the next year. The prognosticators and forecasters are all over the map. My research team is looking at lots of data, influencing matrices, and has come down to a couple of key indicators for my prediction of $120 to $135 average oil price next year.

The number one issue facing the E&P companies is the lack of capital for drilling to even replace the normal depletion curves of oil and gas production. Without going through a myriad of examples take a look at Exxon as the poster child for the state of E&P companies and investor pressure.

Exxon has received demands from investors wanting immediate returns and this past quarter made six billion dollars and performed a ten billion-dollar stock buy back. Their CAPEX spending on drilling has not been properly funded, and they are taking the higher profits to meet the investor demands. This formula is providing the basis of a world price increase on oil (and subsequently natural gas) as drilling programs take years to implement.

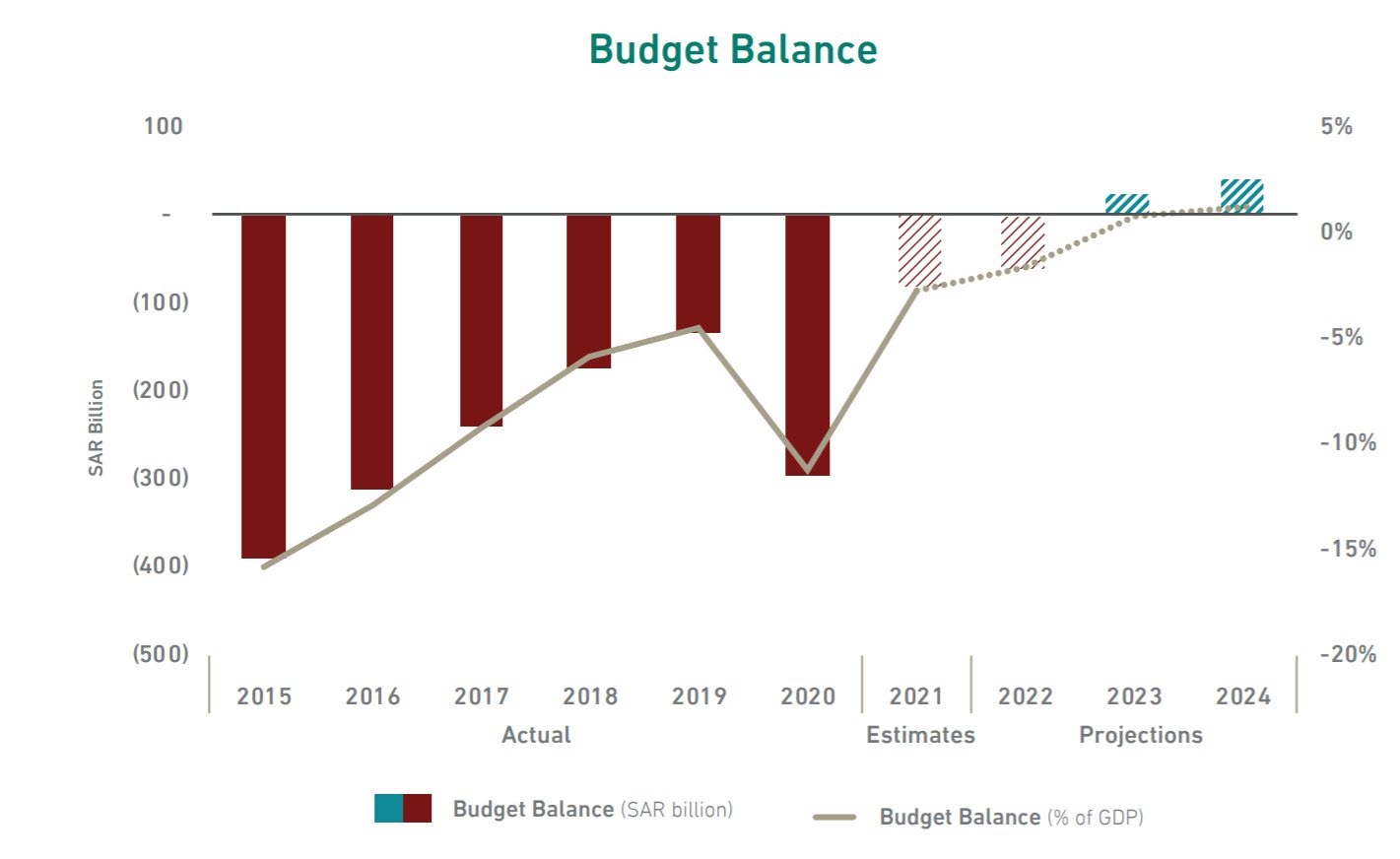

The most important indicator that is under our research team is Saudi Arabia’s actions and announced fiscal plans. Last month they announced a budget surplus by the end of 2023, with a significant excessive budget surplus in 2024. Very simply with a crayon, look at the national social services vs oil income revenues. The oil price of $120 to $135 average price starts to appear like lemon juice on invisible ink. The Saudi’s have a solid plan to move to a world renewable energy supplier by using their fossil fuel profits to fund.

We are preparing a more detailed analysis after we review some more data. Stay tuned. Below is my weekend rant. Let’s get a plan and move forward getting the lowest kWh to all citizens of the world using all forms of renewable, fossil, and nuclear with the least amount of impact on the environment. Together we can get there if we just talk to each other with reason.