-

Storm spurs refiners, pipeline networks to suspend operations

-

OPEC+ expected to endorse oil supply increase at midweek meet

Oil edged higher in New York as offshore explorers assess damage from Hurricane Ida and as investors shift focus to an OPEC+ meeting that could see more supply added to the market.

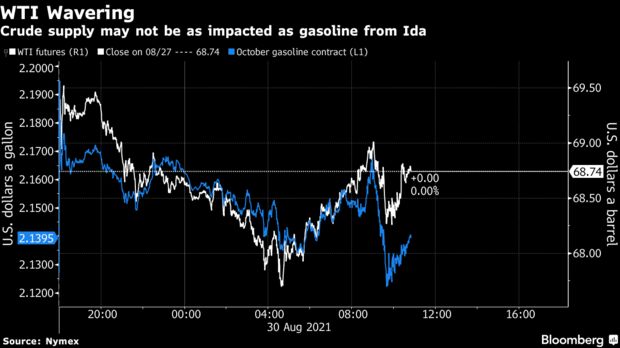

Futures in New York were trading just over $69 a barrel after falling as much as 1.6% earlier. While Gulf of Mexico producers had shut in about 1.7 million barrels a day of crude output ahead of the storm, refineries in Louisiana may be slower to bring back operations.

“The market is regarding the impact on crude production as minimal at this point from Ida unlike refining,” said Bart Melek, head of global commodity strategy at TD Securities. “This means less demand for feed as refiners have a reduced capacity, which could see crude scarcity worries go away.”

Gasoline futures spiked more than 4% earlier in the session before paring their advance. About 2.11 million barrels a day of refining capacity –about 12% of the U.S. total — was being shut or brought to reduced rates at plants along the Mississippi River on Sunday.

Both crude oil and gasoline have been hit by volatile trading this month as investors weighed the challenge to consumption posed by the resurgence of the pandemic in parts of Asia, the U.S. and Europe. Meanwhile, the Organization of Petroleum Exporting Countries and its partners will meet later this week and are expected to go ahead with an increase in output.

Hurricane Ida pummeled New Orleans and the Louisiana coast overnight with lashing rain and ferocious gusts, leaving much of the region without electricity and bracing for widespread floods. The storm drove a wall of water inland when it thundered ashore Sunday as a Category 4 hurricane and reversed the course of part of the Mississippi River.

After Ida passed the Gulf, a flyover by the U.S. Coast Guard on Sunday afternoon showed Royal Dutch Shell Plc-operated Mars, Olympus and Ursa crude and natural gas platforms remained on location.

“We expect a more rapid return of oil production than refining production in the region,” Goldman Sachs Group Inc. analysts wrote in a note Monday. It’s too early to determine how long refineries in the region will remain shut, they said.