OPEC Lambasts Anti-Oil Sentiment, Warns of Underinvestment

– OPEC+ compliance with its collective targets keeps on worsening with the 19 members underperforming by 2.6 million b/d, just as the oil alliance prepares for its June 3-4 meeting.

– Meanwhile, OPEC+ production has edged lower to 42 million b/d as production shut-ins in Iraqi Kurdistan, industrial action at Nigerian loading terminals, and slightly lower Russian output weighed on supply.

– Simultaneously, OPEC has voiced its dissatisfaction with the IEA’s discouraging investment in the oil industry, saying these misguided narratives will only imperil economic growth and sustainable development.

– According to OPEC, the global oil industry still needs some 1.6 trillion of new investment downstream, arguing that the lack of refinery investment in OECD countries will result in further supply tightness.

2. Oil Majors Face Tough Choices Ahead Of Shareholder Meetings

– With the windfall profits of oil majors remaining firmly in the public eye, most Western majors are facing troublesome annual shareholder meetings over the next two weeks, trying to fend off pressure from environmentalists.

– The annual meeting of Shell (LON:SHEL) was already disrupted last year and the 2023 version might turn even more acrimonious as the company reviews its pledge to reduce oil output by 1%-2% per year by 2030.

– ExxonMobil poured some cold water on ESG expectations, saying that society would not accept the degradation in global standards of living that would arise from the IEA’s Net Zero policy scenario, deeming the likelihood of reaching net zero by 2050 as “remote”.

– The discrepancy between the market valuation of European and US oil companies largely stems from the latter having lesser pressure from environmental activist groups.

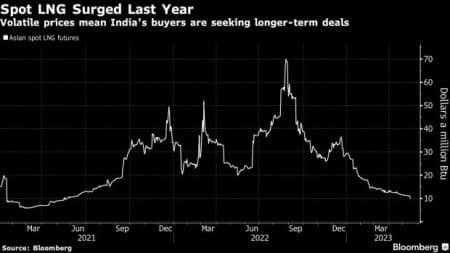

3. India in Talks for Long-Term LNG Supply Deals

– Availing themselves of the lowest spot LNG prices in two years, India’s LNG buyers are seeking decades-long supply contracts to lock in volumes of liquefied natural gas, wary of future spot shortages.

– According to Bloomberg, India’s Petronet, GAIL, and Indian Oil are all in talks with LNG suppliers in the US, Qatar, and the UAE for deals that last for 20 years, a sea change in a country that hasn’t signed a long-term deal since 2021.

– According to Kpler data, India has been importing 1.98-2.00 million tonnes of LNG in April-May, the highest month-on-month readings since late 2021, with approximately 50% of imports coming from Qatar.

– India seeks to increase the utilization of natural gas from 6% of the nation’s power generation capacity to at least 12%, decreasing pollution in a coal-dominated industry.

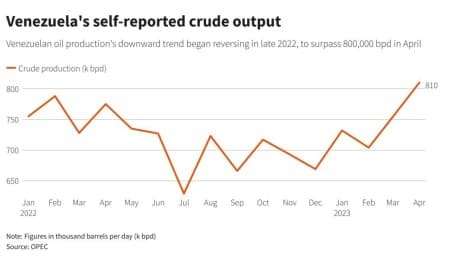

4. Clamping Down on Corruption, Venezuela Dreams Big

– Venezuela’s crude production has been on the increase since February and surpassed the 800,000 b/d threshold for the first time since December 2021, buoying Caracas’ hopes of an output revival.

– The anti-corruption crusade that was launched by PDVSA’s new CEO Pedro Tellechea seems to have yielded the desired results, despite the missing 21 billion in accounts receivable.

– The new corporate strategy stipulates that PDVSA is to expand crude production by 390,000 b/d by year-end to reach 1.17 million b/d, as well as boost refining by 20% to add some 100,000 b/d of fuels for the domestic market.

– The Venezuelan national oil company sees the restart of the Petromonagas oil upgrader (due to happen in June) as a key element in the production uptick, out of service since December 2022.

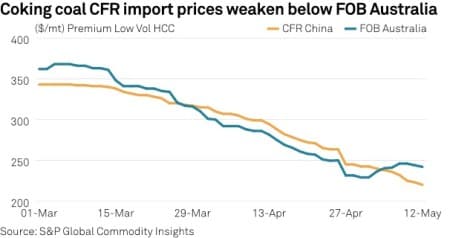

5. Steel Weakness Drags Coking Coal Prices Down

– Coking coal prices have been falling off the cliff lately, marking their third consecutive monthly decline in Asia, with delivered prices to China shedding almost 50% over the past two months.

– As Australian FOB prices of coking coal moved above Chinese import prices, the likelihood of seeing a resumption in flows there is low, China will most probably rely on Mongolian and Russian met coal.

– China’s steel production in April fell 3.2% month-on-month to 92.64 million tonnes, as only a quarter of Chinese steel mills remained profitable by the end of the month.

– The Chinese government has reportedly capped the annual production of its steel mills in 2023 at 1.018 billion tons, unchanged from 2022, seeking to control oversupply.

6. Lower Grain Prices Halt Food Inflation, Headwinds Remain

– The extension of the Black Sea grain deal will be adding to the deflationary trends in agricultural commodities as FAO’s world food price index continues its downslide for the fifth consecutive month.

– In the US agriculture markets, CBOT corn futures traded below $5 per bushel for the first time since 2021, losing more than 20% of value since the beginning of this year.

– The US Department of Agriculture expects wheat stocks-to-use in the 2023-24 season to fall to 13.9% by mid-2024, the lowest exportable ratio since 2008, as falling wheat prices create more demand.

– The second half of 2023 might see a return to rising food prices, especially if forecasts of the weakest rice production in 20 years and the worst US HRW wheat harvest since 1957 materialize.

7. China’s Unconvincing Recovery Squeezes Zinc Market into Contango

– After years of being one of the star performers of the base metals pool, zinc prices have been plummeting recently as weak demand recovery in China was overpowered by a rebound in supply.

– Three-month zinc prices at the London Metal Exchange have fallen to their lowest since December 2020, currently trending at $2,490 per metric tonne and down 20% since the beginning of the year.

– As some 60% of zinc usage comes from galvanized steel used in construction and carmaking, China’s lukewarm post-pandemic recovery in both segments has capped demand whilst refined zinc production is set for a 3.1% year-on-year recovery.

– Even though zinc inventories remain low by any historical yardstick, investment funds have moved their futures positioning to a net short for the first time since Q2 2020.