-

Vitol’s views echo those of Wall Street banks such as Goldman

Global oil markets could tighten even more with Russian flows being disrupted and producers such as Libya experiencing supply problems, according to Vitol Group, the world’s biggest independent crude trader.

That could push prices higher still after they soared to more than $115 a barrel in the wake of Russia’s invasion of Ukraine.

“We have plenty of twists and turns to come,” Mike Muller, Vitol’s head of Asia, said Sunday on a podcast produced by Dubai-based consultant and publisher Gulf Intelligence. “While I think the world is already pricing in the fact there’ll be an inability to take in a serious amount of Russian oil in the western hemisphere, I don’t think we’ve priced in everything yet.”

His views echo those of several commodity hedge funds and Wall Street banks such as Goldman Sachs Group Inc., which says oil could reach $150 in the next three months.

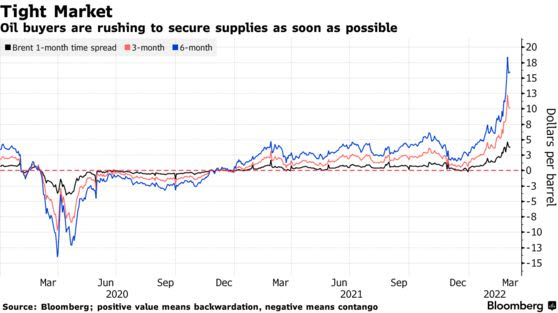

The market could see “steeper backwardation,” Muller said, referring to a bullish pattern whereby near-term futures are more expensive than later ones because physical traders are rushing to secure supplies as soon as possible. The one-month time spread for Brent is already at the highest level of backwardation in at least a decade.

Crude surged last year as global economies and energy demand rebounded from the coronavirus pandemic. It’s up another 50% in 2022.

Energy exports have been exempted from U.S. and European sanctions on Moscow. But traders, shippers, insurers and banks are increasingly wary of taking on or funding purchases of Russian barrels. The country, which normally exports about 5 million barrels of crude every day, saw its Urals grade offered at record discounts last week.

Source: Bloomberg