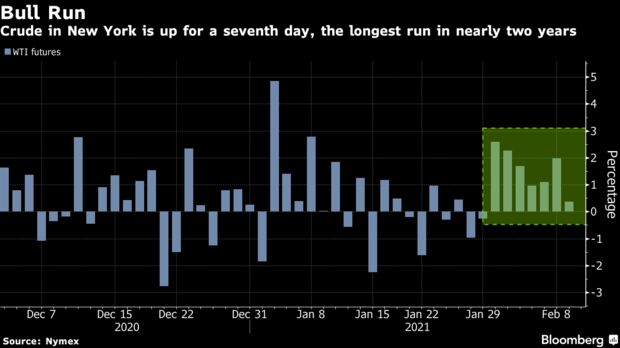

Oil rose for a seventh day in New York, the longest streak in almost two years, on continued signs the global market is tightening and demand is improving.

West Texas Intermediate futures increased 0.3% on Tuesday, rising every day this month and taking gains to 11%. Oil trader Trafigura Group talked up the prospect of a bull market in mid-year as demand recovers from the pandemic and stockpiles drain. U.S. crude inventories last week dropped for an eighth time in the last nine weeks, according to a Bloomberg survey.

There are, however, reasons to be cautious with many countries still in virus-induced lockdowns. A bright spot for the market in recent weeks has also faded with traders offering just six cargoes in a North Sea pricing window on Monday, compared with a bumper buying spree earlier this month. Brent’s relative strength index is in the most-overbought territory since 2012.

Oil’s surge since the end of October has been underpinned by Covid-19 vaccine breakthroughs and Saudi Arabia’s pledge to deepen production cuts. Slowing virus infections across the globe are raising optimism fuel consumption will continue to climb, while cold weather is pushing demand higher.

“Oil demand is expected to recover gradually in the foreseeable future, but oil supply is already playing a supportive role in the re-balancing of the market,” said Tamas Varga, analyst at brokerage PVM Oil Associates.

| PRICES |

|---|

|

While Trafigura has an optimistic outlook for the market, not all traders are in agreement. Vitol SA and Gunvor Group Ltd. have said prices may be rising too quickly, and the market may be getting ahead of itself before the impact of vaccines can be seen on demand.

Bloomberg – Updated