- Oil prices erased losses and jumped on Tuesday morning following the SPR release announcement

- Despite the seemingly big number, 50 million barrels, the U.S. release actually equals around two and a half days of American petroleum consumption

- Other countries are said to go for much smaller releases

Oil prices erased losses and jumped on Tuesday morning following the announcement from the U.S. Administration that it would make available 50 million barrels of oil from the Strategic Petroleum Reserve (SPR) to lower said oil prices.

As of 9:27 a.m. EST, WTI Crude prices were back above $77, having erased earlier losses and trading up by 1.30% at $77.75. Brent Crude prices returned to the $80 mark, and were approaching $81, as they had risen by 1.73% to $80.96.

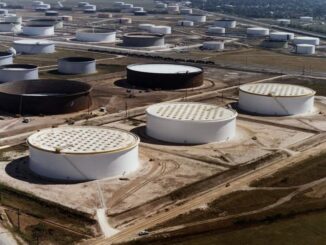

The headline for the oil market on Tuesday morning was the announcement of US President Joe Biden that the Department of Energy would release 50 million barrels of oil from the SPR in a bid to lower high gasoline prices in a coordinated effort with other major oil-consuming nations. The SPR release from the United States is being carried out in parallel with other major energy-consuming nations, including China, India, Japan, the Republic of Korea, and the United Kingdom.

Despite the seemingly big number, 50 million barrels, the U.S. release actually equals around two and a half days of American petroleum consumption, which was at 20.5 million barrels per day (bpd) in the pre-pandemic 2019.

The other countries are going for much smaller releases, and the message seems to be that major oil consumers are coordinating efforts to try to lower high prices, while OPEC+ sticks to its guns over its oil production plan.

The oil market, however, has largely priced in SPR releases, as last week’s slide in prices showed. Analysts also point out that one-off sales from strategic reserves cannot do much to move oil prices significantly lower.

“We think Strategic Petroleum Reserves are not a sustainable source of supply and the effect of such market intervention would only be temporary,” Barclays’s analysts wrote in a note before the release, as carried by Reuters.

Last week, Goldman Sachs said that the market had already priced in a concerted release of crude from national reserves.

“There is a growing risk that OPEC+ responds to an SPR release by pausing planned supply increases,” ING strategists Warren Patterson and Wenyu Yao said on Tuesday before the U.S. announcement of the SPR release.

“The prospect of retaliation from OPEC+ does leave the potential for further volatility in oil markets,” ING said.

By Tsvetana Paraskova For Oilprice.com