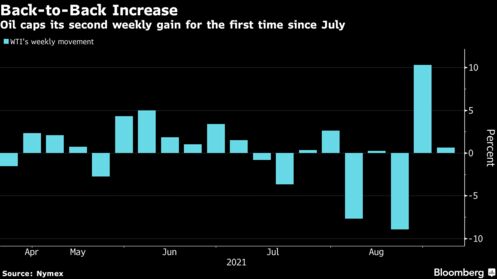

Oil in New York posted its second weekly gain as the impact of Hurricane Ida continues to snarl U.S. oil production, though prices edged lower Friday following a weak U.S. jobs report.

West Texas Intermediate futures capped a gain 0.8% for the week despite shedding 1% Friday. The deceleration in hiring reflects growing fears of the delta variant of Covid-19 and complicates a potential decision by the Federal Reserve to begin scaling back stimulus. Traders exiting positions ahead of the long weekend in the U.S. and Canada also exerted some downward pressure on prices Friday afternoon.

“At this point, Ida storm has been quite supportive for oil due to the production disruptions. But as the region recovers and shuttered capacity slowly returns, Ida will be less and less of a supporting factor,” said Bart Melek, head of commodity strategy at TD Securities. Longer term, it will be all about OPEC+, and the delta-variant coronavirus impact on demand, he added.

Oil climbed this week as the market appears set to remain in deficit even as the Organization of Petroleum Exporting Countries and its allies push ahead with reviving supply. OPEC+ has said crude stockpiles in developed countries are falling and an economic recovery is accelerating.

There have been signs of revival in Asia, where Covid-19 infections had surged. China’s independent refiners are buying more crude and gasoline consumption in India is improving. The return of Iranian supply, meanwhile, looks even further away.

“Oil prices continue to trade at relatively elevated levels despite OPEC+ reaffirming plans to normalize output and Covid-19 demand woes still present,” said Jens Pedersen, senior analyst at Danske Bank.

“Oil prices continue to trade at relatively elevated levels despite OPEC+ reaffirming plans to normalize output and Covid-19 demand woes still present,” said Jens Pedersen, senior analyst at Danske Bank.