New York — 0304 GMT: The rally in crude oil futures prices gained momentum during midmorning trade in Asia Feb. 18, drawing strength from a large estimated draw in US crude inventory reported by the American Petroleum Institute for the week ended Feb. 12, and ongoing supply disruptions in US shale production due to freezing temperatures.

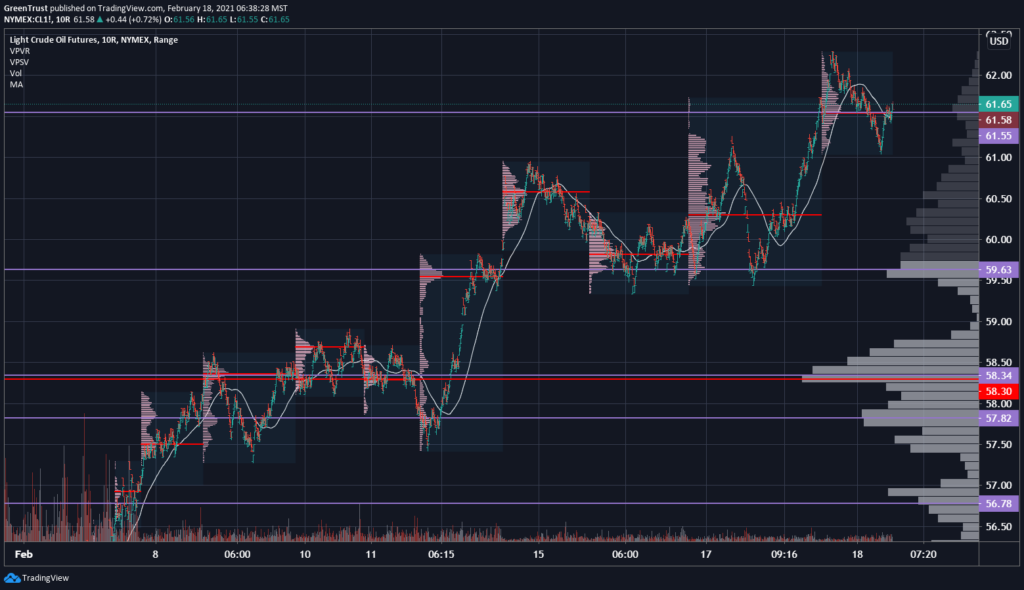

At 11:04 am Singapore time (0304 GMT), the ICE April Brent contract was up $1.12/b (1.74%) from the Feb. 17 settle at $65.46/b while the NYMEX March light sweet crude contract was up 88 cents/b (1.44%) at $62.03/b.

API’s weekly crude oil inventory report estimated a 5.8 million barrel draw in the week ended Feb. 12, higher than analysts’ expectations, contributed to the bullish sentiment in the market.

Although the report also estimated a build in gasoline inventories of 3.9 million barrels over the same period, it was still considered positive overall for prices by market participants.

Production disruptions in the US are turning out to be more severe than initially expected by analysts, further fueling the upward movement in the market.

“Extreme weather has likely shed output by 3.5 million barrels a day, a significant amount that propelled a surge in oil prices,” told Margaret Yang, DailyFX strategist, to S&P Global Platts on Feb. 18.

Analysts at ANZ said in a Feb. 18 note that there are growing fears the extreme weather will last longer than the few days originally thought, with another storm forecast to hit eastern and central US later in the week started Feb. 14.

The disruptions in oil production have been met with lower demand for crude oil, balancing the supply-demand equation to some extent.

“It is estimated that around 3.6 million b/d of refining capacity has been idled, and for now at least, crude oil production losses appear to exceed the fall in refinery operating rates,” said analysts at ING Economics in a Feb. 18 note.

Nevertheless, analysts are keeping in mind the temporary nature of the weather disruption, and focusing on other fundamental factors of support such as the global recovery of energy demand, as well as production outlook by OPEC+, to frame their overall view on the market.

Ahead of the OPEC+ meeting on March 4 to discuss production quotas for the alliance, Saudi Arabia’s Energy Minister warned against complacency in the response against the coronavirus, and said the level of uncertainty is quite high and warrants extreme caution, which may have also rallied market sentiment.

“A warning against complacency by Saudi’s energy minister may serve to boost oil prices further as the oil cartel may remain vigilant against future uncertainties and may hold back tapering should economic recovery derails from the projected path,” said Yang.

The risk of production cuts being rolled back remains amid strong oil prices, as some producers will likely push for a more aggressive easing in cuts, said analysts at ING Economics. Given the recent comments from the Saudi Arabian Energy Minister, it seems like they would support a more gradual increase in production, the analysts added.

Market participants will look to the weekly inventory reports by the US Energy Information Administration, due later Feb. 18, for fresh pricing cues.