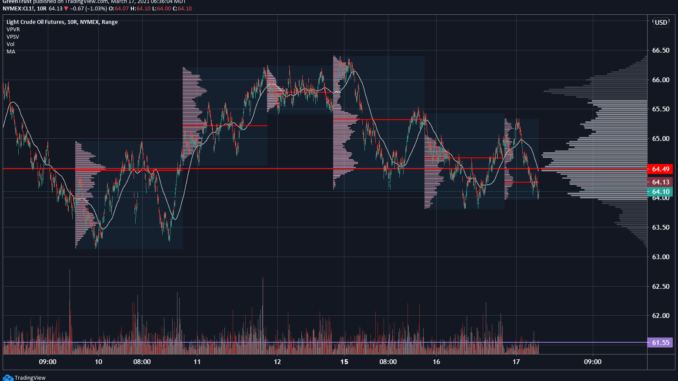

Singapore — 0216 GMT: Crude oil futures were rangebound during the mid-morning trade in Asia March 17, as a surprise draw in US crude inventories helped ease concerns over weak European demand and increased Iranian supply.

At 10:16 am Singapore time (0216 GMT), the ICE Brent May contract was down 6 cents/b (0.09%) from the March 16 settle at $68.33/b, while the April NYMEX light sweet crude contract lost 2 cents/b (0.03%) at $64.78/b.

Data from the American Petroleum Institute, released March 16, showed a surprise 1 million-barrel draw in US crude inventories in the week ended March 12. In contrast, API data released on March 9 had showed a massive 12.80 million barrel build in the week ended March 5, with March 10 data from the Energy Information Administration subsequently confirming the build.

API products data, however, was less bullish, with gasoline inventories falling by a lesser-than-expected 926,000 barrels, and distillate inventories increasing by 904,000 barrels in the week ended March 12. For the week ended March 5, the API data had shown 8.50 million barrel and 4.80 million barrel draws in gasoline and distillate inventories, respectively.

For more comprehensive inventory data, the market will now be looking towards the EIA report, scheduled to be released later in the day.

Meanwhile, concerns over European oil demand entrenched itself in the market, after a number of European countries temporarily suspended the use of the Oxford-AstraZeneca vaccine.

“Crude oil fell as the market frets over the uneven global recovery in demand,” said ANZ analysts in a March 17 note, noting the weakness in demand from Europe despite rising demand from countries such as India and the US.

“Concerns that demand could fall further have been rising as Europe’s health ministers suspend the rollout of AstraZeneca vaccine amid health concerns,” they added.

Despite tight OPEC+ production quotas, fears over rising supply are also weighing on the market, as exports from Iran have picked up.

“Still possibly capping near term prices, word on the street is that China is buying close to 1 million b/d of sanctioned Iranian crude at discounted prices, displacing oil from its usual suppliers and complicating OPEC+ efforts to tighten supply and accelerate the draw-down global inventories,” Stephen Innes, chief global market strategist at Axi, said in a March 17 note