Private equity funds are emerging as a major financing source for new critical minerals projects, with traditional bank financiers taking a lesser role as risk perception grows, members of the UK’s Critical Minerals Association said at an event in London, UK, in the week ended July 8.

Traders, streamers, off-takers and end-users who are anxious to secure supplies of critical minerals including lithium, cobalt, nickel, silicon, niobium, rare earths and graphite, are also coming to the fore as financiers. Governments in the future are expected to be more supportive as they build up their own lists and stockpiles of materials that are used increasingly for applications in energy transition, including in electric-vehicle batteries and wind towers as well as defense, participants at the event said.

Initiatives by the US, Canada, the EU and the UK to develop critical minerals infrastructure and supplies were highlighted at the event.

“We’re seeing a transition in this space,” said David Rhodes, managing director of Endeavour Financial, a financier that has helped raise $10 billion for miners worldwide. He described the changes as positive. “Private equity and traders are getting into the financing of strategic metals. Government support to the sector also helps to give the sector confidence — we’ve just got to get this going.”

Guy de Freitas, head of business development at Horizonte Minerals, which is developing nickel and ferronickel projects in Brazil, noted that with the financing changes in the sector, capital availability is now the key constraint on moving projects forward.

“Capital markets are moving too slowly and putting too many eggs in the downstream [basket], so that now the downstream sector needs to become an enabler of financing upstream,” de Freitas added. “Offtake is critical to our lenders. Finance from companies, including Glencore, is now very important.”

During the event, speakers also referred to carmakers to eye mining investments to secure key battery metals for their EV initiatives. US-based EVs manufacturer Tesla in 2020 announced a plan to invest in lithium mining and last year struck up a partnership with Prony Resources, partly owned by commodities trader Trafigura, which took over the VNC New Caledonia nickel mine and processor when miner Vale withdrew from the project.

Robin Birchall, CEO of Giyani Metals, which has an early-stage manganese project in Botswana, highlighted the growing role of manganese as a critical metal in a scenario where interest in lithium and cobalt usage in EV batteries may wane due to their high prices.

Constant battery chemistry changes reflect the changing risk profiles of battery metals and critical minerals generally, he said.

Battery grade lithium carbonate was assessed at Yuan 470,100/mt ($70,214/mt) July 8 on a delivered, duty-paid China basis, stable on the day but down Yuan 4,900/mt on the week, according to Platts’ assessment from S&P Global Commodity Insights.

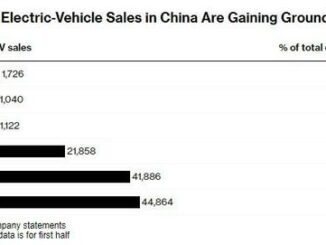

Despite bullish demand and recovery of the overall EVs market, demand for nickel-manganese-cobalt batteries, one of the many types of batteries deployed in EVs, remained weaker than lithium iron phosphate battery demand within domestic China, according to market sources.

Independence from China

Emerging priorities in the critical minerals sector include environmentally and socially responsible production, the importance of making offtake available to financiers to repay the financial support received, links with governments and a move toward independence from China’s overriding dominance in the critical minerals sector, according to Jonathan Henry, chair of the CMA’s international working group.

China currently processes 100% of the world’s graphite, well over 90% of its manganese, and more than 70% of its cobalt, Birchall said in a presentation.

The UK Parliament is set to publish a white paper on the relevance of ESG to critical minerals mining July 18, Henry noted.

Stances taken by different governments toward definitions and funding of critical minerals sectors are currently quite diverse, Rhodes pointed out. While the UK is now embarking on setting up its critical minerals strategy, with the help of some grants from organizations such as Innovate UK, the EU is set to launch a Eur2 billion ($2.04 billion) raw materials fund in early 2023 to finance critical minerals and is currently seeking both public and private sector money for this fund, he said.

Australia has an AUS$2 billion ($1.37 billion) critical minerals facility, including new mineral processing projects, while Canada has earmarked nearly $4 billion for exploration projects and infrastructure development for the supply chain of critical minerals.

The US “dwarfs the rest” with $40 billion available to be deployed into energy transition with loans available for more than 30 projects, including for rare earth elements and other critical minerals. This also includes $3 billion for investments in refining battery materials, according to information presented by Rhodes. However, “we believe the main focus of the US [in critical minerals] is defense,” the financier said.

Source: Spglobal.com