Energy News Beat Publishers Note: This means Russia and other countries that do not have the best interests of the United States has won. We are now at their mercy.

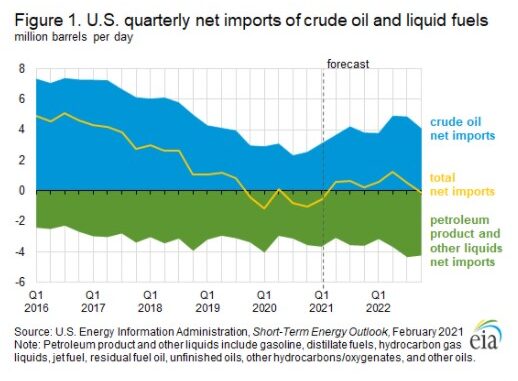

More petroleum (including crude oil and refined products) was exported from the United States in 2020 than was imported. U.S. net imports (gross imports minus gross exports) of petroleum declined from 670,000 barrels per day (b/d) in 2019 to an estimated -700,000 b/d in 2020. The U.S. Energy Information Administration’s (EIA) February 2021 Short-Term Energy Outlook (STEO) estimates that 2020 marked the first year that the United States was a net petroleum exporter on an annual basis. Declining net imports of crude oil primarily drove this change from being a net importer to a net exporter (Figure 1). In 2021 and 2022, EIA expects the United States to return to being a net petroleum importer, averaging 230,000 b/d in 2021 and 550,000 b/d in 2022.

The STEO model forecasts petroleum trade in terms of net imports rather than gross imports and gross exports. In 2020, 81% of the decline in net imports of petroleum was crude oil. EIA expects that increasing crude oil imports will drive the growth in net petroleum imports in 2021 and 2022 and more than offset declines in refined product net imports. In 2020, net imports of crude oil fell to a low of 2.3 million b/d in the third quarter, down from 3.9 million b/d in the third quarter of 2019. EIA forecasts that net imports of crude oil will increase, averaging 3.7 million b/d in 2021 and 4.4 million b/d in 2022. EIA expects that more imports of crude oil will be needed because crude oil inputs to U.S. refineries will increase more than domestic crude oil production.

Total U.S. demand of petroleum products—as measured by product supplied— declined by an estimated 2.5 million b/d (12%) in 2020. U.S. petroleum demand dropped significantly in the first half of 2020 because of responses to the COVID-19 pandemic, but it increased in the second half of the year. EIA expects petroleum consumption to continue to recover from the effects of the pandemic as the vaccines for COVID-19 become more widely distributed and travel and economic activity increase. EIA forecasts total U.S. petroleum demand will grow by 1.4 million b/d (7%) in 2021 and 1.0 million b/d (5%) in 2022.

In the second quarter of 2020, U.S. refiners responded to the pandemic-driven drop in petroleum product consumption, high inventories, and reduced profitability by implementing steep cuts in refinery runs (Figure 2), which dropped 2.6 million b/d to an average of 13.2 million b/d. In the third and fourth quarters of 2020, product consumption increased, and refiners increased runs to average 14.0 million b/d in the second half of 2020, which was still less than the second half of 2019 average of 16.6 million b/d. Annual refinery inputs of crude oil declined 2.3 million b/d (14%) in 2020. EIA expects refinery runs to increase by 0.9 million b/d (6%) in 2021 and by 1.1 million b/d (7%) in 2022 as domestic and foreign petroleum demand increase.

U.S. crude oil production declined by an estimated 0.9 million b/d (8%) to 11.3 million b/d in 2020 because of well curtailment and a drop in drilling activity related to low crude oil prices. Changes in oil prices typically affect changes in tight crude oil production in the U.S. Lower 48 states with about a six-month lag. EIA expects the rising price of crude oil that started in the fourth quarter of 2020 will contribute to more U.S. crude oil production, which EIA forecasts to reach 11.0 million b/d in the third quarter of 2021, the most quarterly production since the first quarter of 2020. EIA expects production in 2021 to average 11.0 million b/d and increase steadily through the end of 2022, resulting in average growth of 0.5 million b/d in 2022. Despite forecasting increasing production in 2021 and 2022, EIA expects less U.S. crude oil production than in 2019.

EIA forecasts increases in net crude oil imports in 2021 and 2022 because domestic crude oil production and inventory draws alone will not meet the needs of U.S. refineries (Figure 3). In 2021, EIA forecasts a 1.0 million b/d increase of net crude oil imports will be required to fill a widening gap between increasing refinery inputs of crude oil and declining domestic production. Although EIA expects crude oil production will grow in 2022, growth in refinery crude oil inputs is expected to be larger, resulting in a 0.7 million b/d increase in net crude oil imports. As a result, EIA expects the United States to revert to being a net importer in 2021 and 2022.

U.S. average regular gasoline and diesel prices increase

The U.S. average regular gasoline retail price increased more than 5 cents to $2.46 per gallon on February 8, 4 cents higher than the same time last year. The East Coast price increased 6 cents to $2.44 per gallon, the Gulf Coast price increased nearly 6 cents to $2.16 per gallon, the Midwest and Rocky Mountain prices each increased nearly 5 cents to $2.36 per gallon and $2.33 per gallon, respectively, and the West Coast price increased more than 4 cents to $3.00 per gallon.

The U.S. average diesel fuel price increased more than 6 cents to $2.80 per gallon on February 8, 11 cents lower than a year ago. The Midwest price increased more than 7 cents to $2.75 per gallon, the Gulf Coast price increased nearly 7 cents to $2.57 per gallon, the West Coast and Rocky Mountain prices each increased nearly 6 cents to $3.26 per gallon and $2.70 per gallon, respectively, and the East Coast price increased more than 5 cents to $2.85 per gallon.

Propane/propylene inventories decline

U.S. propane/propylene stocks decreased by 4.5 million barrels last week to 51.5 million barrels as of February 5, 2021, 5.2 million barrels (9.2%) less than the five-year (2016-2020) average inventory levels for this same time of year. Gulf Coast, East Coast, Midwest, and Rocky Mountain/West Coast inventories decreased by 1.7 million barrels, 1.2 million barrels, 1.1 million barrels, and 0.5 million barrels, respectively.

Residential heating fuel prices increase

As of February 8, 2021, residential heating oil prices averaged nearly $2.67 per gallon, almost 7 cents per gallon higher than last week’s price but more than 24 cents per gallon lower than last year’s price at this time. Wholesale heating oil prices averaged nearly $1.84 per gallon, almost 12 cents per gallon above last week’s price and more than 9 cents per gallon above last year’s price.

Residential propane prices averaged nearly $2.23 per gallon, almost 2 cents per gallon higher than last week’s price and nearly 24 cents per gallon above last year’s price. Wholesale propane prices averaged more than $1.09 per gallon, more than 4 cents per gallon above last week’s price and almost 54 cents per gallon above last year’s price.