Energy News Beat Publishers Note (ENB): Last week we released an Energy News Beat Podcast with George Friedman, Charmain of Geo Political Futures. We had a great talk about the current energy issues and Putin.

The Russian economy has ostensibly avoided disaster during a difficult year in which it faced the threat of new sanctions, dramatic fluctuations in oil prices and pandemic-induced restrictions on economic activity. Exports and investment inflows fell, but output as a whole was better than expected and better than in several other developed countries. The numbers raise questions about the Russian economy’s resilience to external pressure, and whether reforms are reducing the state’s dependence on revenues from energy exports. But although this looks like good news for Russia, the official statistics don’t cover every aspect of life in Russia. Beneath the surface, the picture is graver than it appears.

Surviving COVID-19

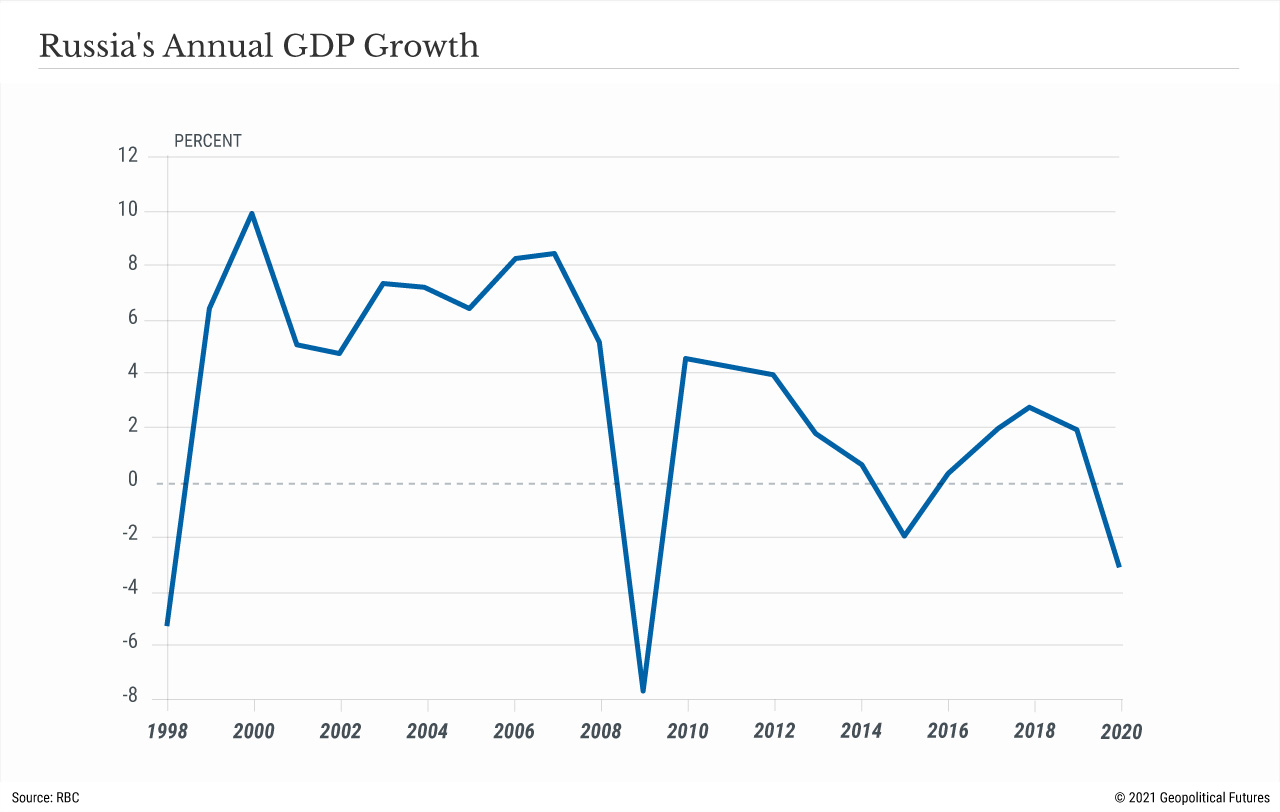

The Kremlin has certainly suffered a series of setbacks during the pandemic. Gross domestic product fell by 3.1 percent in 2020 according to preliminary estimates, the largest drop since the 2009 crisis. The federal budget deficit grew to 3.8 percent, or 4.1 trillion rubles ($54 billion). Foreign direct investment fell to levels last seen in the traumatic 1990s. Energy exports – traditionally the most important aspect of the Russian economy, accounting for more than 60 percent of all exports – hit a 20-year low, making up only half of exports. The energy sector is the main source of money for Russia’s economic and social programs, but in 2020 it accounted for only 30 percent of the contributions to the federal budget, down from 40 percent in 2019.

At the same time, the Kremlin kept unemployment and inflation largely stable. It spent an estimated 4.5 percent of GDP on coronavirus relief, and the Russian tax service may actually collect 2.5 percent more in taxes and fees in 2020 than in 2019, despite a tax deferment scheme. The decline in energy exports was partially offset by a rise in exports of precious metals and especially agricultural products and foodstuffs, which increased by 20 percent by both value and volume compared to 2019.

And contrary to concerns that the price of oil is not sufficient to form a cushion in the National Wealth Fund, in January 2021 the fund reached $183.36 billion, or 11.7 percent of GDP, which is enough not only to cover the budget deficit for several years but even to support national projects and periodic social assistance.

The Russian economy’s unexpected resilience even in the face of reduced oil cash flows raises a number of questions. Is Russia less dependent on the oil and gas trade than we thought? Has the state’s attempted transformation of the economy in recent decades succeeded? The answer in both cases is no. The Russian economy still relies on revenues from oil and gas exports, and the federal budget is still funded mainly through taxes on oil and gas extraction and sales. What’s more, there are a number of microeconomic indicators, many of which don’t factor into the official statistics, that give a more complete picture of the economic situation.

For the rest of the article, please go to GPF, Geo Political Futures

Sign up and stay in front of the Geo Political Chess Match.