Harold Hamm, one of the richest and most prominent shale wildcatters, is finally taking a stake in North America’s biggest oil field.

Continental Resources Inc., the shale driller created and controlled by Hamm, agreed to acquire assets in the Permian Basin from Pioneer Natural Resources Co. for $3.25 billion. Continental will pay cash for the assets in the Delaware Basin, a subregion of the massive Permian, Pioneer said in a statement Wednesday.

Acquiring the drilling rights across 92,000 net acres will allow Continental to generate an extra half billion dollars in annual free cash flow next year at current commodity prices, the Oklahoma City-based explorer said in a separate statement.

“These Permian assets contain the key strategic components common to all of our assets with significant untapped potential to enhance performance through optimized density development, wellbore placement, operational efficiencies and further exploration,” Jack Stark, Continental’s chief operating officer, said in the statement.

Record free cash flow in the U.S. shale patch is driving a return to asset sales and corporate consolidation, particularly as private-equity backed producers ramp up output and seek to monetize their holdings. Investors have largely rewarded drillers for deals focused on a singular field, rather than expanding into new territories.

While output from other U.S. oil fields is flatlining or falling, the Permian’s multi-layered tiers of oil-soaked rock continue to thrive. ConocoPhillips inked a deal in September to acquire Royal Dutch Shell Plc’s Permian assets in September for $9.5 billion in cash, a move that will boost the American explorer’s footprint in the world’s most-prolific shale field.

Continental has dropped more than 6% since Reuters broke the news of the pending deal in the final minutes of Wednesday’s regular U.S. equity-trading session. Pioneer shares were unchanged in after-market trading.

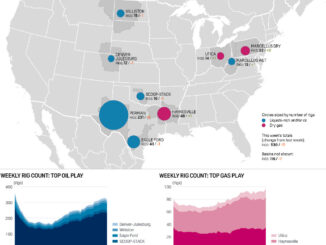

Until now, Continental has focused on the Bakken shale in North Dakota, where it’s the largest operator, and the Scoop and Stack plays in Oklahoma. The company, which trades under the ticker “CLR,” also recently added drilling rights in Wyoming’s Powder River Basin to its portfolio.

“The market may not like CLR getting into a new basin at this point in the commodity price cycle,” Leo Mariani, an analyst at Keybanc Capital Markets Inc., wrote Wednesday in a note to investors.

The Permian wells to be acquired by Continental pump the equivalent of about 50,000 barrels of oil a day, Pioneer said. The Delaware Basin comprises the western half of the Permian; the eastern section is called the Midland Basin.

“This transaction returns Pioneer to being 100% focused on its high-margin, high-return Midland Basin assets, where we have the largest acreage position and drilling inventory,” Pioneer Chief Executive Officer Scott Sheffield said in the statement. – Souce : Bloomberg