The largest mall landlord has shed 38% of its shopping centers since 2012. It saw what was coming. So here’s one more.

By Wolf Richter for WOLF STREET.

Simon Property Group [SPG], the largest mall landlord in the US, whose mall count has been shrinking for a over a decade, is planning to walk away from another mall, and from its debt, to add to the series of malls it sent back to lenders since before the pandemic, this time, the second largest mall in Pennsylvania, the 1.7 million square-foot Philadelphia Mills outlet mall.

Simon Property’s brand name – “A Simon Center” – has already been removed from the mall entrance, according to locals talking about it on Reddit.

Simon owes $259 million on the property, according to the Philadelphia Business Journal. The loan matured in June, and Simon failed to pay it off. The lenders are holders of Commercial Mortgage-Backed Securities (CMBS), now represented by the special servicer. The debt has been in and out of special servicing even before the pandemic.

When Simon bought the property in 2007 as part of this acquisition of Mills Corp, the property was appraised at $370 million. The City of Philadelphia has recently assessed the property value at $101 million, which would represent a 73% haircut. But when the original mortgage of $278 million was securitized in 2007, buyers of the CMBS felt pretty good about the $278 million loan being backed by $370 million in collateral.

Simon is now in talks with the special servicer to hand over the mall to let the CMBS holders worry about the losses and what to do with the mall.

Like many malls across the US, Philadelphia Mills has been beset for years with store closings and cash-flow issues, as part of the phenomenon that we’ve called since 2017 the Brick and Mortar Meltdown, largely brought about by a relentless shift in the way Americans shop: online, which has sent scores of large brick-and-mortar retail chains into bankruptcy and liquidation. To avoid losing more stores at their malls, Simon and Brookfield, the second largest mall landlord in the US, have teamed up to buy some retailers out of bankruptcy, including the operating assets of JC Penney, in November 2020.

Leases of two of the anchor tenants at Philadelphia Mills expire this year: Burlington Coat Factory’s in August (129,000 square feet), and AMC Theaters’ by the end of 2024 (68,000 square feet). AMC has been in a years-long battle to survive by hook or crook the movie theater meltdown. Then, in 2026, Marshalls’ lease (70,000 square feet) will expire.

If those leases aren’t renewed or extended, “That is going to have a residual effect,” Jonathan Ramel, VP at Morningstar Credit, told Bisnow. “I covered this in 2007, and this mall, when it went through its first iteration and it lost some big tenants, it was able to recover. But in this time and day, it might be much more challenging.”

The original 2007 mortgage matured in 2019 but was extended for a year; it then was extended again in 2020 during the pandemic. Extend and pretend can go on for years, but not forever.

But Simon paid interest through June on a $200 million portion of the loan, the A1 note and the A2 note. There are also a B1 note ($54 million) and a B2 note ($36 million), according to Bisnow.

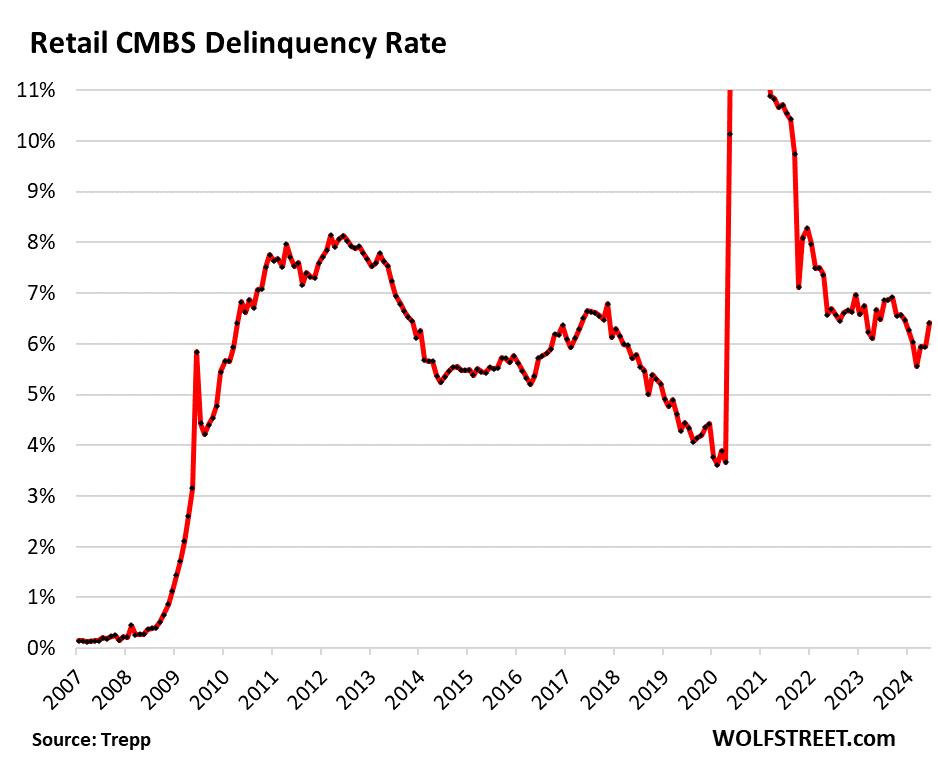

The CMBS delinquency rate for mortgages backed by mall properties rose to 6.4% in June, as the balance of delinquent loans rose by $525 million, including four mall loans with balances of over $100 million each, according to Trepp. This likely doesn’t yet include the $200 million in Simon loans because the interest was current through June.

Simon walked away from malls across the US since before the pandemic, including Independence Center near Kansas City, Missouri, which in 2019 generated what was then the largest loss ever for mall CMBS holders.

Simon has also sold malls, including to the public. Since 2012, it has shed 122 shopping centers of all types, or 38% of all its shopping centers, going from 317 shopping centers in its annual report for 2012 to just 195 in its Q1 2024 Supplement.

This mall-count reduction includes the spinoff of 98 shopping centers through the public listing of Washington Prime Group in 2014. Washington Prime Group’s shares zigzagged lower from the $190 range in 2014 to nearly nothing after the mall REIT filed for bankruptcy in July 2021 (the ticker of those shares was WPG). Simon saw in 2014 what was coming and got rid of those malls; investors didn’t and got wiped out.

And for your amusement, here are ecommerce sales, which jumped by 8.6% year-over-year in Q1, to a record $289 billion seasonally adjusted. For the four-quarter period, ecommerce sales rose to $1.12 trillion. Over the four years since the start of the pandemic, ecommerce sales have exploded by 90%.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/