ENB Publishers Note: There are some things that are inevitable. Death and taxes to pay for overprinting of money. The world is in an inflation crisis. This is in part to Covid, and in part to printing money for faulty energy policies. Without having a good path from fossil fuels to renewables has resulted in the energy crisis we are now in.

Source: Geopolitical Futures

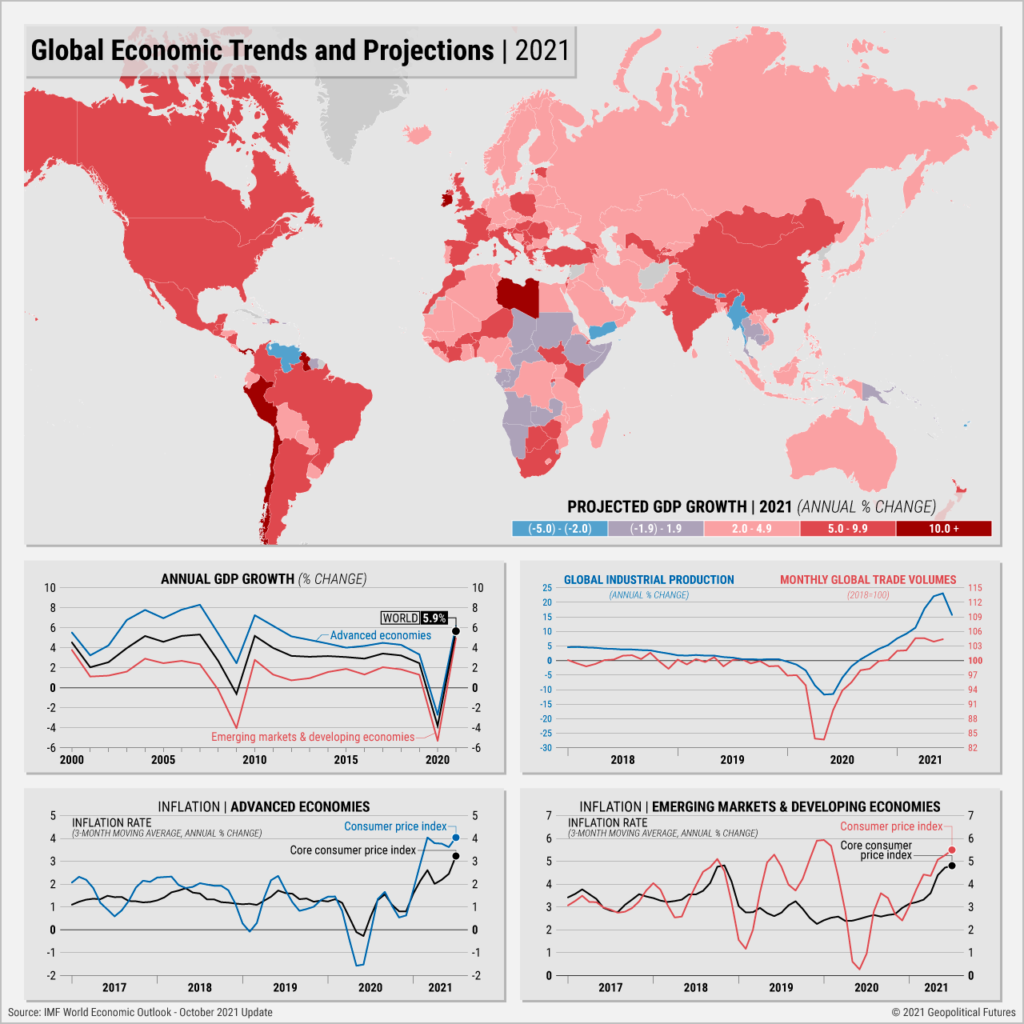

This is not our first Weekly Graphic on global economic trends, and it certainly won’t be our last. Economies around the world are still climbing out of the hole created by the pandemic, and plenty of things could derail the recovery, from supply chain shortages to rising prices.

Earlier this year the International Monetary Fund warned about disparities in the recoveries between advanced and developing economies. Differences in vaccine accessibility and governments’ fiscal capacity have widened the gap as the year went on. Another factor is inflation: Advanced economies have less poverty and thus more ability to absorb price increases, especially temporary ones, compared to developing countries, where rising food costs in particular can be devastating.

Commodity prices are another important variable. The IMF expects oil prices to increase by nearly 60 percent this year compared to their 2020 low, while non-oil commodity prices like food and metals could climb by almost 30 percent. However, higher commodity prices produce winners as well as losers. Major metals exporters like Peru and Chile, for instance, will fare better than big importers like China.