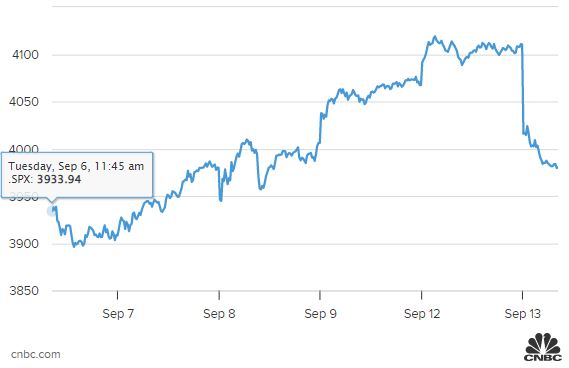

Stocks fell sharply on Tuesday after a key August inflation report came in hotter than expected, hurting investor optimism for cooling prices and a less aggressive Federal Reserve.

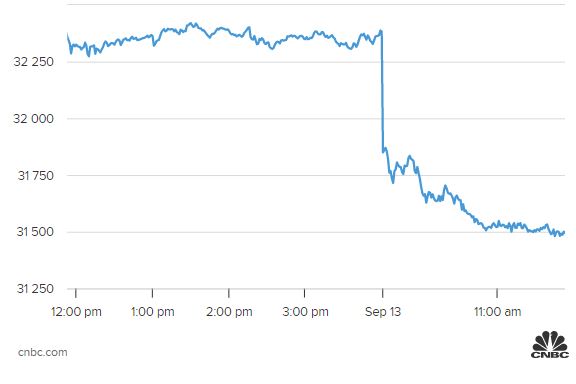

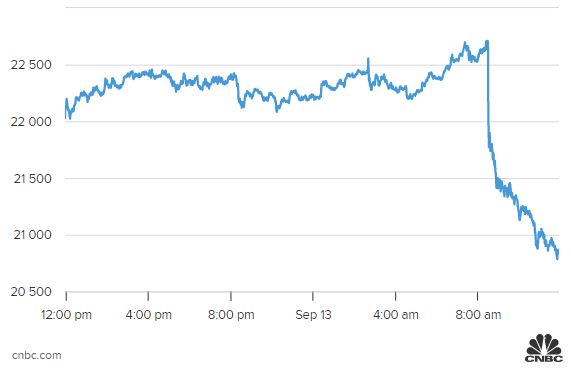

The Dow Jones Industrial Average slid 900 points, or 2.8%. The S&P 500 dropped 3.2%, and the Nasdaq Composite sank 4.1%. More than 490 stocks in the S&P 500 fell, with Facebook-parent Meta dropping 7.9% and Caesars Entertainment losing 7.3%.

The drop erased a large chunk of the recent rally for stocks, but the S&P 500 is still up about 2% from its Sept. 6 close of 3,908 and comfortably above its mid-June levels, when it fell below 3,700.

“The velocity of this move has been breathtaking, however the market has recovered substantially off of recent lows. That this 4,000 level is still holding for the S&P 500 does reveal the fact that markets are bothered, but markets are not panicking,” said Jeff Kilburg, founder and CEO of KKM Financial.

The August consumer price index report showed a higher-than-expected reading for inflation. Headline inflation rose 0.1% month over month, even with falling gas prices. Core inflation rose 0.6% month over month. On a year-over-year basis, inflation was 8.3%.

Economists surveyed by Dow Jones had been expecting a decline of 0.1% for overall inflation, with a rise of 0.3% for core inflation.

The report is one of the last the Fed will see ahead of their Sept. 20-21 meeting, where the central bank is expected to deliver their third consecutive 0.75 percentage point interest rate hike to tamp down inflation. The unexpectedly high August report could lead the Fed to continue its aggressive hikes longer than some investors anticipated.

The moves comes after four straight positive sessions for U.S. stocks, which were bolstered in part by the belief of many investors that inflation had already peaked.

“The CPI report was an unequivocal negative for equity markets. The hotter than expected report means we will get continued pressure from Fed policy via rate hikes,” said Matt Peron, director of research at Janus Henderson Investors. “It also pushes back any ‘Fed pivot’ that the markets were hopeful for in the near term. As we have cautioned over the past months, we are not out of the woods yet and would maintain a defensive posture with equity and sector allocations.”

The sell-off was particularly painful in high-growth tech stocks. Cloudflare fell about 10%, while Unity Software sank more than 11%. Shares of direct-to-consumer auto retailer Carvana slid more than 12%, making it one of the worst performers on the New York Stock Exchange.

First Solar bucks sell-off, hits 11-year high

One of the market’s rare bright spots on Tuesday comes from the clean energy space.

Shares of First Solar ticked up about 0.45% amid the broad market declines. The stock hit its highest level since June 30, 2011.

First Solar has been on a hot streak recently and is up about 16% over the past month.

—Jesse Pound, Gina Francolla

Yields on the 3-month T-bill pop to highest level since 2008

The yield on the 3-month U.S. T-bill jumped to a high of 3.325% on Tuesday morning. It’s the highest level since Jan. 2, 2008, when the 3-month yield climbed as high as 3.58%.

The spread between the 3-month yield and the 10-year Treasury also narrowed, reaching a low of 1.03 – and the lowest level since Aug. 30 when the spread was as low as 0.49. The spread between the 3-month and the 10-year rates are a key indicator that the New York Federal Reserve watches closely to measure the likelihood of a recession.

Bond yields across the board have jumped following the release of a hotter-than-expected consumer price index report for August. Investors are banking on tougher moves from the Fed to keep inflation in check.

—Darla Mercado, Gina Francolla

Only 30 stocks in the S&P 1500 are higher

Tuesday’s sell-off was so broad that only about 30 stocks in the S&P 1500 index — which compiles the components in the S&P 500, S&P 400 Midcap and S&P 600 Small Cap — traded higher.

Cross Country Healthcare was the best performer, gaining just 2.7%. Other positive names on the day include Corteva, CF Industries and Albemarle.

The overall index traded more than 2% lower on Tuesday.

— Fred Imbert

Stocks continue to fall

The losses for stocks have steadily deepened since the market open, with the Dow now off more than 800 points and the S&P 500 down nearly 3%. Facebook-parent Meta has dropped more than 7% and is one of the worst performers in the S&P 500.

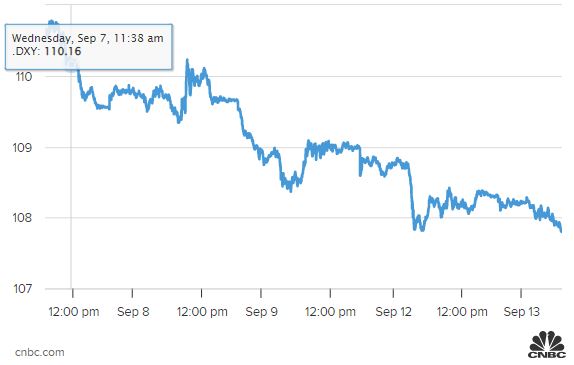

U.S. dollar strengthens after CPI report

The U.S. dollar strengthened against a basket of other currencies Tuesday after the August CPI report came in higher than expected, throwing cold water on hopes that inflation had already peaked.

The dollar index gained about 0.9% to 109.26. Both the pound and the euro fell against the dollar. The pound slipped 1.05% to $1.155 and the euro fell 0.87% to $1.003.

Cloud computing ETF pares loss after tumbling more than 6.3% at the open

WisdomTree Cloud Computing ETF (WCLD) was recently down a little less than 4% after opening as much as 6.3% lower, at which point it was on pace for the worst day since June 13th.

Shortly after the open, the Cloud ETF was led lower by Braze (off more than 20% after Monday post-market earnings), and declines of 9% or more from BigCommerce, Fastly, Cloudflare and Toast.

Bitcoin tumbles with the broader market following CPI data, just after hitting a recent high

Bitcoin plunged with the broader market after CPI data released early Tuesday showed inflation rose more than expected in August.

The largest cryptocurrency by market cap had just hit a nearly one-month high of $22,764.49 Tuesday, before tumbling, according to Coin Metrics. It was last down about 5% at $21,253.25.

Unlike other cryptocurrencies, bitcoin is highly correlated with stocks and its price movements are largely driven by macro data and events.

Long road to go until inflation is in check, strategist says

Investors are getting a rude awakening that high inflation could be here to stay after August’s hot CPI report.

“Today’s CPI reading is a stark reminder of the long road we have until inflation is back down to earth,” said Mike Loewengart, head of model portfolio construction at Morgan Stanley. “Wishful expectations that we are on a downward trajectory and the Fed will lay off the gas may have been a bit premature.”

Prior to Tuesday, the S&P 500 gained for four days in a row and had enjoyed its first winning week in four.

“The market has been on a winning streak these last few days so it shouldn’t be a surprise to see it take a breather as investors come to the realization that inflation may remain elevated for longer,” Loewengart said.

Stocks fall sharply at the open

Stocks tumbled at the open on Tuesday as investors reacted to the hot August inflation report.

The Dow opened down more than 500 points. The S&P 500 was down about 2%, and the Nasdaq Composite lost almost 3%.

Fed could now raise three-quarters of a point in November too, Nomura says

Next week’s Federal Reserve policy meeting is bound to raise the fed funds lending rate at least three quarters of a percentage point (75 basis points), but there’s even a remote, outside chance that the central bank hikes by a full percentage point next week, according to Nomura economist Rob Dent.

“In terms of the Fed, this feels like it absolutely locks in 75 for the September meeting but maybe increasing the risk for 100, though that’s not the base case,” Dent said. “People will have to consider that they could raise 75 basis points in November, given how strong this report is,” Dent said, referring to the miserable August inflation numbers.

August showed surprisingly broad based inflation, Dent said. Previously, “we saw this tug of war between goods moderating and services remaining strong. This is not a tug of war. They both moved up,” said Dent. “Right now I think the Fed is going to be looking at this with a lot of concern. This is no good news across this report.”

Market prices in bigger than 75 basis point rate hike for next week

Traders are betting that the August inflation report will force the Federal Reserve to be more aggressive in the near and longer terms with its rate hikes.

The Fed has widely been expected to hike by three quarters of a point, or 75 basis points next week. The hot CPI report now has some investors thinking a 1 percentage point hike is possible.

“Probably 75 (basis points) is the most likely play, but the market is pricing 79 basis points. So there’s a shot at 1,” said Michael Schumacher of Wells Fargo.

In the fed funds futures market, expectations for the terminal rate, or rate where the Fed is expected to stop hiking, also shot up.

“It exploded. It’s 4.19 and it was at 3.99” before CPI, Schumacher said. That means traders are betting the Fed will take fed funds target to 4.19% by March. The fed funds rate range is currently 2.25 to 2.5%.The market had been trading on the view that if CPI showed moderation, the Fed might be able to pause its rate hiking early next year. The last CPI report was a surprise to the downside, and the jobs number was strong.

“This ends the whole fairy tale that the Fed would get three good reports in a row.” Said Schumacher. “Too bad, Cinderella, it’s after midnight.”

Tech leading the decline following the CPI report

After inflation unexpectedly rose in August and rates surged, technology shares were leading the way lower in premarket trading.

Shares of Amazon and Tesla fell 3% apiece in early trading. Microsoft and Alphabet shed 2% each. Nvidia lost 4%. Traders fear higher rates will slow the growth of the tech sector and expose their relatively high valuations, not to mention cause investors to shed risk.

Declines were broad in premarket trading with most stocks in the S&P 500 set to decline. Banks were down on fears the Federal Reserve will push the economy into a recession. Bank of America and JPMorgan each lost about 1.5%.

Energy shares declined on recession fears as well. Exxon and Chevron each fell about 1%.

Treasury yields soar after hot CPI report

U.S. Treasury yields jumped on Tuesday as investors bet that a hot inflation reading will keep the Federal Reserve aggressive in tightening monetary policy.

The yield on the benchmark 10-year Treasury note surged 7 basis points, trading at 3.43%. The yield on the 30-year Treasury bond was up about 4 basis points at 3.55%.

Meanwhile, the yield on the two-year Treasury, soared 14 basis points to 3.70%, hitting its highest level since November 2007. Yields move inversely to prices, and a basis point is equal to 0.01%.

Inflation rises 0.1% in August even after decline in gas prices

The consumer price index unexpectedly rose month over month in August even as gas prices eased, the Bureau of Labor Statistics reported.

The index gained 0.1% for the month and was up 8.3% year over year. Economists polled by Dow Jones expected a month-over-month decline of 0.1%.

Core CPI, which strips out volatile food and energy costs, rose 0.6% from July and 6.3% year over year.

Stock futures reverse, fall after inflation report

A surprisingly hot CPI report led to a quick reversal in stock futures. Dow futures, which were up more than 200 points shortly before 8:30 a.m., were down more 300 points following the release. Nasdaq 100 futures saw a negative swing of nearly 3%.

Stocks face risks in the short-run as earnings estimates get hit, Bernstein says

Economic headwinds and investor pessimism presents downside risk for stocks, especially in Europe, according to Bernstein.

Strategists Sarah McCarthy and Mark Diver said in a note to clients on Tuesday that earnings estimates in Europe could be cut another 10% or more, putting pressure on equities.

“The European market is up 4% from the start of September, but down 13% year to date (in local currency terms). We expect further downside in the short run as in our view a) the earnings downgrade cycle has further to run and b) we expect more outflows from equity funds. Sentiment measures are not pessimistic enough yet to take a bullish stance on positive short-term returns,” the note said.

Europe isn’t the only area showing weakness. The Bernstein note also said that global equity funds have seen three straight weeks of outflows.

Treasury yields slide ahead of CPI

U.S. Treasury yields were in retreat on Tuesday morning less than an hour before the release of a key inflation report.

The yield on the benchmark 10-year Treasury note and the 2-year Treasury were lower by about 5 basis points each, trading at 3.314% and 3.525% respectively. The yield on the 30-year Treasury bond was down about 4 basis points at 3.477%.

Bond yields move opposite of price, and a basis point is equal to 0.01%.

Treasury yields have moved higher in September as Federal Reserve officials have pledged to continue their fight against inflation even if it causes short-term damage to the economy.

Steer clear of Rent the Runway, Barclays says

Barclays downgraded shares of Rent the Runway to neutral from outperform, citing concerns over the company’s active subscriber growth.

“The significant deterioration in Active Customer trends in the quarter (QoQ active sub growth slowed to -8% in 2Q vs Street +7%, decelerating from +17% in 1Q) suggest that RENT is more susceptible to macro pressure on the aspirational consumer than we expected,” analyst Michael Binetti wrote in a note.

Rent the Runway shares fell more than 22% in the premarket after the company announced it was laying off 24% of its corporate workforce.

Dollar falls for fifth day in a row

The dollar index, which tracks the U.S. currency’s performance against six others, fell for a fifth straight day, potentially giving stocks a boost. Many large U.S. companies get a big chunk of their revenue from outside the U.S., meaning that a weaker dollar could boost their revenue.

The index traded 0.5% lower at 107.76.

Chinese EV maker BYD can rally nearly 40%

BYD, a Chinese electric vehicle maker, could make big gains going forward, according to Barclays.

“BYD (Build Your Dream) became the #1 global EV maker in terms of deliveries in 2Q22, dethroning Tesla from that pedestal for the first time, and its triple-digit revenue growth rate is likely to continue for the rest of 2022, despite its already sizable base,” analyst Jiong Shao wrote in a Tuesday note.

The analyst also has a $40 per share price target on the stock, implying upside of 38% from Monday’s close.

UK unemployment hits 48-year low while real wages fall sharply

U.K. unemployment fell to 3.6% in the three months to July, its lowest since 1974.

The economic inactivity rate, meanwhile, rose by 0.4 percentage points to a five-year high of 21.7%.

The Office for National Statistics attributed the change to a rise in long-term sickness designations and students leaving the jobs market. The increasing tightness of the labor market may fuel further inflationary pressure and cause headaches for the Bank of England.

Annual growth in real wages — taking into account inflation — excluding bonuses fell by 2.8% in the three months to the end of July.

“People will understandably be looking to their employers for help during the cost of living crisis while Andrew Bailey will be hoping that businesses don’t up salaries too high too quickly and compound inflation,” said Marcus Brookes, chief investment officer at Quilter Investors.

“However, the U.K. must brace for discontent amongst the public sector with strikes over pay continuing as budgets are stretched.”

UBS plans to boost dividend; shares rise in pre-market

UBS Group plans to increase its dividend by 10% to $0.55 per share and expects its 2022 share repurchases to exceed $5 billion, the Swiss bank said on Tuesday.

UBS shares were indicated 1.2% higher in pre-market activity after what ZKB analyst Michael Klien called surprise news.

European stocks rise slightly

European stocks were cautiously higher on Tuesday morning as global markets geared up for the latest reading of U.S. inflation.

The pan-European Stoxx 600 was up 0.3% in early trade, with food and beverage stocks adding 0.8% to lead gains as most sectors and major bourses inched into positive territory. Retail stocks slid 0.4%.

CNBC Pro: Want to invest in real estate? These REITs are among analysts’ favorites

Real estate investment trusts — or REITs — are coming back to the spotlight after a volatile year for many asset classes.

Analysts from Morgan Stanley and Citi highlight REITs from two sectors that they say could outperform the wider market, and remain resilient in a recession.

Fed actions this month could be ‘nonevent’ for asset prices, Ameriprise says

The upcoming September Federal Reserve meeting, where the central bank is expected to raise interest rates, is likely already priced into the market, according to Ameriprise chief market strategist Anthony Saglimbene.

“In our view, central bank actions this month are likely a nonevent for asset prices,” he wrote in a Monday note. “However, incoming economic data over the coming weeks and months and its influence on policy actions next year could play a much more significant role in shaping stock direction over the intermediate term.”

Markets now expect the Fed to hike rates by 0.75 percentage point, meaning that assets may not move much if that is the central bank’s decision. A consumer price index report Tuesday that’s in-line with expectations may also not move the needle.”

“Unless inflation figures last month changed substantially more than expected, including Wednesday’s update on the August Producer Price Index (PPI), we believe a 75 basis point hike from the Fed is essentially locked in at this point,” he said.

Relief rally is likely bear market bounce, Wells Fargo says

The recent relief rally in stocks is likely another bear market bounce and investors should position for more choppiness ahead, according to Wells Fargo.

“Year-do-date, the outperformance of defensive, high shareholder payout, high-quality and low-valuation stocks reminds investors of the hallmark of a bear market,” global portfolio and investment strategist Chao Ma wrote in a Monday note.

Such recoveries happen in nearly every bear market and many are quickly reversed, leaving investors with regrets, they added.

“Although it is difficult to predict the bottom of a bear market, in the past, market bottoms were typically preconditioned by over-pessimistic market sentiment and a sign of definitive improvement in the underlying economic or market issue,” Ma said. “We believe we are not there yet in either regard.”

In the meantime, Ma recommends investors look for defensive stocks with low volatility, high dividends and share repurchase yields. He also says investors should go for high quality names with profitability and leading market share and affordable market price.

U.S. stock futures rise ahead of Tuesday CPI report

U.S. stock futures were higher Monday night as Wall Street looks ahead to the August consumer price index report set to be released Tuesday morning. The report will give investors an update on the inflation situation in the U.S. and is one of the last pieces of data the Federal Reserve will see ahead of its September meeting.

Dow Jones Industrial Average futures gained 55 points, or 0.17%. S&P 500 and Nasdaq 100 futures climbed 0.18% and 0.21%, respectively.