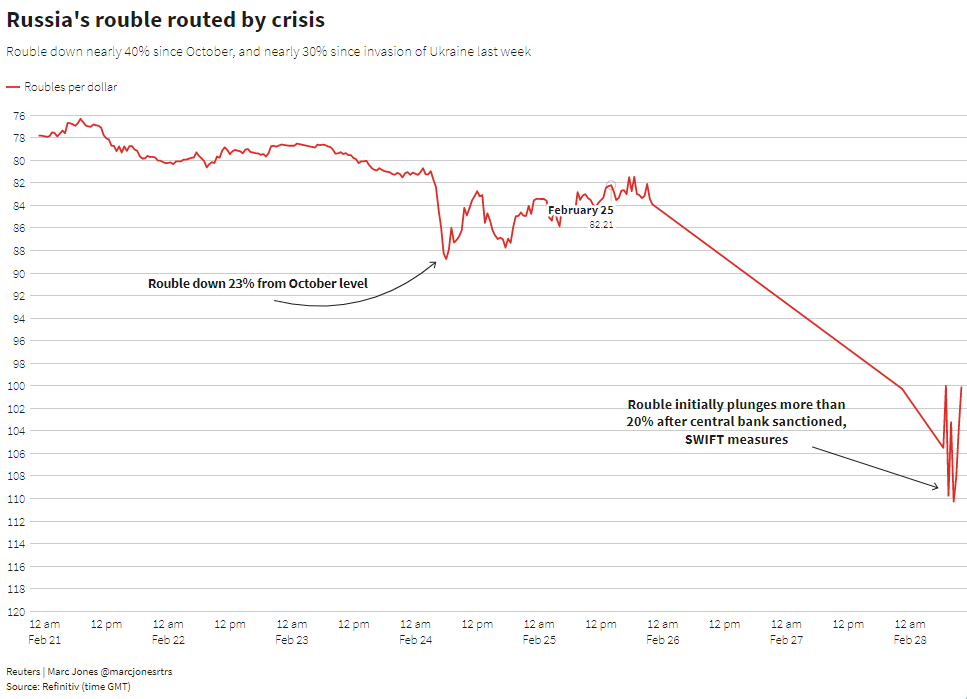

NEW YORK/LONDON, Feb 28 (Reuters) – The Russian ruble hit record lows on Monday while world stocks slid and oil prices jumped after the West ramped up sanctions against Moscow over its invasion of Ukraine, including blocking Russian banks from the SWIFT global payments system.

Russia’s central bank hiked its key interest rate to 20% from 9.5% to bolster the ruble and fight inflation. Authorities told export-focused companies to prepare to sell foreign currency as the ruble slid as much as 32% before recouping some losses. read more

As an economic crisis loomed in Russia, the fallout of tougher sanctions from the West imposed over the weekend rippled across financial markets, especially in Europe where the main German and French bourses fell more than 3% in early trade.

European banks were hit hard, with those most exposed to Russia, including Austria’s Raiffeisen Bank (RBIV.VI), UniCredit (CRDI.MI) and Societe Generale (SOGN.PA), falling between 9.5% and 14%. The wider euro zone index (.SX7E) of 22 major banks lost 5.7%, but the pan-regional STOXX 600 stock index closed down a scant 0.09% as sentiment improved at its close.

However, talks on a ceasefire ended without a breakthrough and a member of the Ukrainian delegation said the discussions were difficult as the Russian side was biased, news that darkened the mood on Wall Street.

The Dow Jones Industrial Average (.DJI) slid 1.17% and the S&P 500 (.SPX) lost 0.98%. The Nasdaq Composite (.IXIC) fell less, down 0.4% as investors bet the Federal Reserve will be less aggressive hiking interest rates. MSCI’s all-country world equity index (.MIWD00000PUS) was down 0.59%.

Markets are likely to remain choppy in the near term, analysts said. While valuations have fallen and some risks have been priced into the market, it’s not time to derisk, Solita Marcelli, chief investment office for the Americas at UBS Global Weather Management, told clients in a note.

“Investors trying to trade off geopolitical events can easily get whipsawed,” Marcelli said, noting that sell-offs based on geopolitical events have been brief in the past.

Oil prices surged after Russian President Vladimir Putin on Sunday put nuclear-armed forces on high alert. read more

The ramp-up in tensions heightened fears that oil supplies from the world’s second-largest producer could be disrupted, sending Brent crude futures up 3.13% to $101.00. U.S> futures rose 5.5% to $96.63 per barrel after hitting their highest since 2014 last week. read more

The global economy faces significant economic and financial turmoil in Russia, the world’s 11th largest economy, that will spill across its borders, analysts warned.

Even if Western governments allow the purchase of oil and gas from Russia, markets need to digest unavoidable disruption to hedging contracts, insurance coverage and energy markets, said Christopher Smart, chief global strategist at Barings Investment Institute.

“If Russian entities are effectively blocked from exchanging their money into the world’s reserves currencies, will the Russian government allow the foreign debts to be paid?” he said.

SAFE-HAVENS SHINE

As uncertainty continued to grip markets, investors sought the safety of the dollar, Swiss franc and Japanese yen.

The euro fell 0.55% to $1.1205, while the yen strengthened 0.51% to 114.98 per dollar.

Sovereign bonds such as U.S. Treasuries and German Bunds — considered among the safest global assets — remained in strong demand.

The 10-year Treasury yield was down 12.1 basis points at 1.863% and equivalent German yields were down 4.7 basis points at 0.109% .

Money markets continued to push back rate hike expectations with investors now pricing roughly 30 basis points (bps) worth of tightening from the European Central Bank in total this year, down from 35 bps late last week. read more

Gold rose 0.6% to around $1,899.20 an ounce.

MSCI’s Russia equity index slid 25.5% (.MIRU00000PUS), while London and Frankfurt-listed Russian equity exchange traded funds (ETFs) tanked between 37% and 53% (XMRC.DE), (CSRU.L), (HRUB.L) as investors dumped Russian assets.