Supply chain constraints impacting the energy storage industry have come at a “critical” stage for the sector’s development, a BloombergNEF analyst has said.

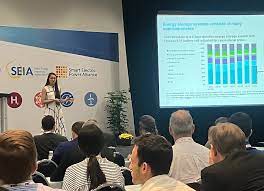

Speaking at a workshop hosted by the International Battery Energy Storage Alliance (IBESA), at the RE+ 2022 industry event in California, BloombergNEF (BNEF) energy storage analyst Helen Kou said that supply chain problems could signal a 29% reduction in forecasted deployments in the US.

The forthcoming edition of the firm’s annual battery pricing reports confirms that the constraints have also been the main driver of “significantly higher” prices along the value chain found this year over 2021, Kou said. The situation is occurring at the same time as customer demand for battery storage grows.

“I think the industry is in this really critical period, where demand is actually kind of clear. A lot of utilities want batteries to put on their grid to help firm renewable [energy generation], but supply is actually quite uncertain,” Kou said in a presentation of some of BNEF’s key findings.

Causes of the issues are well documented and include logistical bottlenecks stemming from COVID-19 and raw materials price rises for lithium batteries.

Kou noted that, for example, some battery storage project components or systems had been shipped as long ago as April 2020, a few weeks into the pandemic, but have gotten caught up in the backed-up queues of containers at ports like the Port of Los Angeles, which had on average 84 ships a day waiting to unload at the height of the pandemic.

They “still have not made it onto the grid today in 2022, because of congestion and logistics constraints,” Kou said. However, the logistics situation, although likely to remain challenging for some time, is now showing some signs of easing, BNEF believes.

Likely to remain a much longer-term problem is raw materials pricing volatility, at least until much more lithium mining capacity comes online towards the end of this decade.

‘Pretty controversial question’

All components of the various subsystems that make up a complete energy storage system have seen inflationary cost rises and higher labour costs over the past few months, Kou said, but battery cells have seen the most increases in costs.

“This is really important because the battery cell is the largest cost component of an energy storage system,” Kou said, and the cathode is the highest cost component of the battery cell.

Price spikes for key cathode materials lithium carbonate, cobalt sulfate and nickel sulfate all affected the industry. Yet although supply constraints of the latter two have eased, the growing popularity of lithium iron phosphate (LFP) batteries for the electric vehicle (EV) sector as well as for battery storage, means lithium carbonate prices “will remain elevated for some time,” BNEF has forecasted.

The firm’s analysts are often asked a “pretty controversial question,” Kou said, namely: whether battery manufacturers were inflating their costs a little bit higher than would be commensurate with commodity price increases.

“After a lot of analysis, our conclusion is that it’s not likely the case,” Kou said.

There are apparently two main reasons for that. The first being that pricing varies heavily, depending on a manufacturer’s size, scale and company strategy. The analyst pointed to data on how greatly different cathode costs were recorded by Korean manufacturers SK Innovation, LG Energy Solution and Samsung in their quarterly filings. The other reason is that so-called ‘Cathode Production Premiums’ have decreased over time.

BloombergNEF was able to calculate what these premiums added on by manufacturers were worth using spot market prices for materials used in LFP and nickel manganese cobalt (NMC) cathodes.

In 2020, the Cathode Production Premiums averaged out at about 2.8, meaning that while it cost around US$10,000 to manufacture each kilogramme of LFP cathodes material, each kilogramme was then priced at around US$28,000 to the customer. As of July 2022, that premium had eroded to a factor of 1.3.

BloombergNEF’s revision to its forecast is broadly in line with that made by rival analysis group Wood Mackenzie Power & Renewables, which recently said 2022 US deployments could be 30% less than previously expected. Alongside energy storage-specific supply chain challenges, Wood Mackenzie also pointed to the uncertain future of tariffs on imported solar modules, causing companies in the solar-plus-storage space to put some investment decisions on hold.

Wood Mackenzie does however think in spite of these challenges, total deployments could reach 13.5GWh for the year and more than 50GWh later this decade. As also acknowledged by BloombergNEF’s Helen Kou, it is clear there is demand for energy storage even with the challenging logistics and price dynamics.