Tesla is lower by about 6% in pre-market trading on Thursday morning after the company missed on revenue estimates and continued to note vehicle delivery issues during its conference call.

The stock whipsawed higher after the headline numbers initially hit yesterday afternoon, but settled lower in after hours trading yesterday. This morning, the stock continues to lag lower.

On the afternoon conference call yesterday, CEO Elon Musk said the company is pushing forward with production despite the current macroeconomic climate.

Musk said: “To be frank, we’re very pedal to the metal come rain or shine. We are not reducing our production in any meaningful way, recession or not recession.”

He continued: “The public at large realizes that world’s moving towards electric vehicles, and it’s foolish to buy a new gasoline car at this point because the residual value of that gasoline car is going to be very low. So, we’re in a very good spot.”

“I wouldn’t say it’s recession-proof but it’s recession-resilient, because basically the people of Earth have made the decision in large part to move away from gasoline cars,” he added.

Musk, like his biggest fan Cathie Wood, was also critical of the Federal Reserve. He stated: “The Fed’s decisions make sense if you’re looking in the rear-view mirror not if you’re looking out the windshield.”

As we noted yesterday, Musk may still need to shore up additional funds to consummate his pending takeover of Twitter, which he also commented on during yesterday’s call. “The long-term potential for Twitter is an order of magnitude greater than its current value,” he said.

As we reported in our earnings wrap-up yesterday:

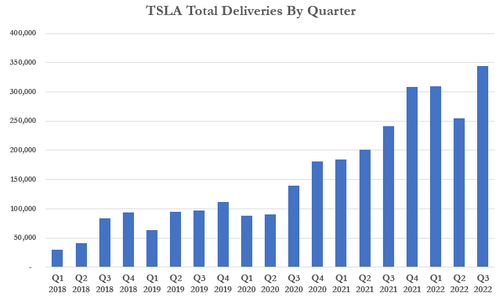

Revenue was a record $21.45BN, up 55% Y/Y, which however missed the est. of $22.09BN; The company blamed the strong dollar (FX resulted in -$250MM hit), as well as production and delivery bottlenecks. It was TSLA’s first revenue miss since Q3 2021.Adj EPS $1.05, beating the median est. $1.01 and up 69% Y/Y (GAAP EPS $0.95, up 98%)Free cash flow $3.3BN, beating the estimate of 2.89$ millionAutomotive Gross Margin 27.9%, missing est. 28.4%Gross Margin 25.1% missing est. 26.6%, and down from 26.6% Y/YAdjusted EBITDA $4.97BN, up 55% Y/YCash and cash equivalents $21.107billion, +31% y/y, missing the estimate of $21.79 billionCapEx was $1.80 billion, less than the exp. $1.92BN: quarterly capex first broke $1 billion in the third quarter of 2020, and it’s been trending higher ever since as Musk launched construction of two new assembly plants in Austin and Berlin.Tesla still sees 50% avg annual growth in vehicle deliveries

We noted yesterday that some commentators were quick to dissect the earnings, noting that TSLA revs were light by a few %; the gross margin was light by ~50bps prob due to low ZEV credit; the company underspent opex by on order of 300M, so it beat eps by .05; and while cash flow was well ahead of street estimates by 15-20%; ASPs were actually lower sequentially by ~4%.

Loup Ventures’ Gene Munster confirmed that ASPs, or average selling prices, were lower than expected, which likely explained why the company missed on revenue. “Tesla is a company that typically has been beating numbers, and the reaction your seeing is that people are a bit taken aback by the fact that they missed,” Munster said.

We noted that this is Tesla’s first revenue miss since Q3 2021. As for EPS, Tesla also hasn’t missed in a very long time. The last time adjusted profit fell short of estimates was in the fourth quarter of 2020.

Per Bloomberg, here are new analyst takes after the report heading into the rest of the week:

Morgan Stanley (overweight, PT $350)

Tesla posted a clean 3Q earnings beat despite lower regulatory credits, rising input costs, FX headwinds and logistics/plant ramp-up inefficienciesGoing into the quarter “had expected cost inflation related to logistics/shipping as well as adverse timing differences related to supplier payments given significant input cost inflation on the battery and non-battery side”Tesla’s FY23 outlook is still at risk due to lingering macro uncertaintiesGoldman Sachs (buy, PT $305)

Cuts estimates due to lower average selling prices and in turn a more measured expectation on gross margin improvement in 2023/2024Citi (sell, PT $141.33)

Although the outlook commentary was encouraging, expect Tesla shares to trade lower due to the 3Q gross margin missSee Tesla shares revert to trading on “macro/industry data points that inform on the 3Q outcome and 2023 outlook”Piper Sandler (overweight, PT $340)

See investors focusing on automotive gross margin miss”Bears may also be latching onto commentary regarding demand, which is lower than it otherwise would be if not for recessions in China”Jefferies (buy, PT $350)

Tesla’s 3Q numbers were “a tad light on auto revenue and gross margin” partly due to foreign currency headwinds”Continued strong execution and confident outlook more than support current consensus”

The earnings come following Tesla’s disappointing “AI Day”, in which it revealed its “Optimus” humanoid robot. While the sell side might still be sticking with Musk, AI and robotics professionals had a different take on the company’s robot reveal.

Recall, the automaker broke total delivery records for Q3, despite the fact that it missed expectations from Wall Street for the quarter. Tesla reported 343,830 deliveries for Q3 2022.