WASHINGTON – Oil companies have for decades pulled billions of dollars of natural gas from Alaska’s rugged North Slope, only to pump it back underground once it’s been separated from the crude oil they are seeking.

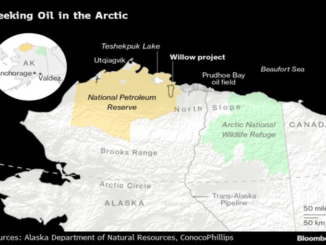

More than 800 miles from the closest ice-free port accessible to ships, the North Slope has no natural gas pipeline and thus no market for companies such as Exxon Mobil and Conoco Phillips to sell their gas into.

Now a planned $44 billion project that would pipe gas the length of Alaska to an LNG terminal outside Anchorage stands to change all that as state officials, with the support of the Biden administration, seek to breathe new life into the state’s declining oil and gas industry by shipping the gas across the northern Pacific to South Korea and Japan.

Decades in the making, the project has confounded developers and engineers for years, entailing not only planning to build a pipeline across some of the nation’s most rugged and frigid wilderness but doing so at a price that can compete with a flood of new LNG projects coming online along the Gulf Coast, the Middle East and Australia. All at a time energy analysts are projecting demand for oil and gas to peak within the next two decades as nations respond to climate change.

“It seemed like this thing was dead,” said Clark Williams-Derry, an analyst with the nonprofit Institute for Energy Economics and Financial Analysis. “This project isn’t cheap to begin with, and then you have all the question marks about what the LNG market will look like a decade from now. There’s many reasons to think this isn’t going to happen, but without this project, that gas is stranded.”

Oil companies began drilling on the North Slope in the late 1960s, and within a decade were moving oil to tankers in southern Alaska on the Trans Alaska Pipeline System. At the time, gas was viewed as a waste product, too cheap to be warrant the expense of building another pipeline.

That calculus began to change in the run-up in natural gas prices in the 2000s, and by 2013 the state of Alaska had partnered with Exxon, Conoco Phillips and BP, which later sold its stake on the North Slope to Houston oil company Hilcorp, to build a gas pipeline and LNG terminal connected to the North Slope.

They spent hundreds of millions of dollars on the preliminary engineering, only to watch global oil and gas markets collapse in 2014 following the boom in U.S. shale production. By 2017 the oil companies had pulled out of the project, handing it over to state-owned Alaska Gas Development Corp.

The prospects looked grim. A 2016 analysis by the research firm Wood Mackenzie found that in order to make the sort of profit investors would expect, the Alaska LNG project would need to sell gas at $11.70 per million British Thermal Units, far above what LNG was selling for in Asia at the time.

But state officials plugged ahead, shifting to a tolling model through which they charged customers a fee to liquefy their gas as opposed to selling the LNG itself – reducing their risk. They also decided to finance the project largely through loans to lower their costs, reducing their projected price for LNG to $6.70 per mmBTUs, competitive with LNG plants on the Gulf of Mexico if they can pull it off.

Change in fortune

When Russian troops invaded Ukraine last year, driving up gas prices in Europe and Asia to well in excess of $15 per mmBTUs, Alaska LNG suddenly looked like it could be a viable project.

“The impact of the Russian invasion of Ukraine tipped the world’s energy market on its head,” said Frank Richards, president of the Alaska Gas Development Corp. “What we see is increased interest from allies in Japan and Korea in having a reliable source of supply, and we have a stranded asset we can offer at a stable price.”

And they have the ostensible support of the Biden administration, with U.S. Ambassador to Japan Rahm Emanuel hosting a meeting of top officials from both countries in Tokyo last year to “discuss how Alaska LNG can provide stable, sustainable and affordable energy sources to Japan.”

Last month the Department of Energy renewed an export license for the project that had been previously approved by the Trump administration, following Biden’s decision to allow Conoco Phillips to move ahead on its controversial Willow oil project on the North Slope.

But deep questions remain as to whether Alaska LNG will actually go ahead, including whether it can clear a series of lawsuits by environmental groups arguing the federal government has failed to adequately assess the greenhouse gas emissions the project will generate.

They claim those emissions will be far in excess of LNG projects along the Gulf Coast because of the energy demands of pumping gas more than 800 miles from the North Slope – almost twice the distance from West Texas’ Permian Basin to the Gulf Coast. At the same time, they are questioning whether the project is necessary considering the flood of LNG projects already under construction along the Gulf Coast.

Timing questioned

In the best-case scenario, Alaska LNG wouldn’t begin delivering gas to customers until 2030. And environmentalists argue the project is only going ahead because of a $30 billion federal loan guarantee authorized by Congress in 2004 as part of a larger spending deal.

“Is this going to lead to more exports, or this is a project we don’t really need and you’ve built a bunch of infrastructure you don’t need?” Nathan Matthews, an attorney with the Sierra Club, said. “Europe is rapidly going to renewables, so whether the same demand (for gas) will be there a decade from now is a question. From a climate perspective we sure hope there won’t be.”

Alaska officials are planning to have their financing in place by early next year and have hired Goldman Sachs to advise them.

But it could be a tough sell. None of the oil companies operating in the North Slope have so far agreed to invest in the project, according to a spokesman for the Alaska Gas Development.

Both Exxon and Conoco said they supported the project but only in terms of selling their natural gas into the pipeline. Hilcorp did not respond to a request for comment.

To some degree, the high upfront costs of the project are expected to be offset by the low cost of natural gas production on the North Slope, federal tax credits for carbon storage and the short shipping distance from Alaska to Asia compared with the Gulf Coast. But finding investors willing to cough up $44 billion is not going to be easy.

“And that’s if they don’t have cost overruns, which is a big risk for whoever takes this on,” Williams-Derry of the Institute for Energy Economics said. “The only thing that might keep this thing afloat is this web of subsidies. Maybe you get equity investors from Japan and Korea with the condition you use their manufacturers and ship builders, so it’s just they get cheap fuel but a boost to their boat building industry.”

Only time is running out.

In its analysis Wood Mackenzie pointed out it expects global gas demand to peak by 2040, steadily declining in the years following as wind and solar energy take a larger share of the global energy market.

Alaska LNG is planning to export gas to Asia at least through the early 2060s, with the export license awarded by the Biden administration last month good for 30 years.