S&P Global Ratings believes green hydrogen, produced by splitting water via electrolysis using renewable energy, will remain expensive as a power fuel source compared with natural gas. Market projections suggest that green hydrogen costs may drop over 50% by 2030, possibly to $2 per kilogram (/kg) from $3/kg-$6/kg today, as hydrogen production scales. This requires access to low-cost renewable power at below $25 per megawatt hour (/MWh), while running electrolysis plants at 50% capacity (see “How Hydrogen Can Fuel The Energy Transition,” published Nov. 19, 2020, on RatingsDirect). Moreover, $2/kg of hydrogen would equate to an energy-equivalent natural gas cost of $17.6 per million British thermal units. Not to mention the inherent inefficiencies of converting power to hydrogen (via electrolysis) and back to power, resulting in round-trip efficiency of only 40%-45%.

This explains why even at $2/kg, hydrogen-fueled power would cost $100/MWh for baseload plants and $200/MWh for open-cycle turbines, according to a Hydrogen Council study released in January 2020. Put differently, German power producer Uniper SE’s previous CEO recently declared that EU carbon prices would need to increase to €200 per ton (/ton)-€260/ton to make burning hydrogen in converted gas-fired power plants viable. This compares with a carbon price today of about €40/ton.

Hydrogen Has A Long-Term Role In Securing Power Supply And Net-Zero Targets

Even if hydrogen is substantially more expensive than natural gas, it has the potential to provide carbon-free backup power for a prolonged period. This is an extremely important advantage over short-term time shifting solutions provided by batteries, particularly as the grid continues to rely on an ever-increasing percentage of intermittent renewable energy. Furthermore, an energy infrastructure system that is fully dependent on electrification and renewables could unintentionally subject some customers to great trouble should a storm cause a severe blackout in the middle of a very cold winter (see “It’s Time For Power To Be Firm After Texas Storm, Report Says,” published April, 6, 2021).

To ensure steady power supply, we expect regulators will increasingly focus on transmission grid interconnectivity, generation (surplus) capacity regulations, and diversity of dispatchable power. This includes existing gas plants, nuclear, hydro/geothermal, more active load management, and hydrogen-fueled power.

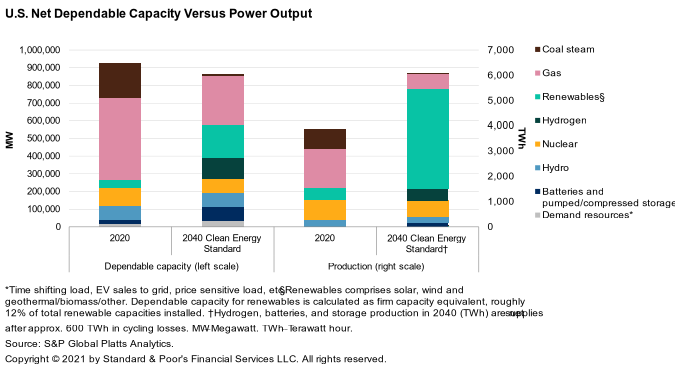

Hydrogen’s future role will likely be determined by the extent of green policies. Hydrogen-fueled power generation is unlikely to be competitive with already installed gas-fired back-up generation; therefore its importance will be strongly influenced by future environmental policies. In its most likely scenario, S&P Global Platts Analytics, a separate division of S&P Global, predicts a minimal contribution from hydrogen to the U.S. generation mix. However, under a supportive clean policy scenario, hydrogen could account for over 14% of dependable U.S. capacity by 2040, with gas still accounting for 32% (see chart 1). Still, when measuring power production, gas would only account for 10% and hydrogen 8%.

Chart 1

Another supportive factor for hydrogen-based power is that it does not require a technological breakthrough. There are currently turbines capable of operating with 100% hydrogen and hydrogen is already blended into the gas distribution system, accounting for up to 20% of the mix.

Hydrogen Pilot Projects From European And U.S. Utilities Are Gaining Momentum

Although the use of hydrogen for power generation is a long-term prospect, power producers are embarking on near-term opportunities. These may stem from electrolysis projects that seek to capture zero-priced excess from renewables (see chart 2). However, in almost all cases, pilot projects will rely on policy subsidies. As highlighted below, some subsidized projects may prompt green hydrogen’s use in power and gas blending. However, to avoid conversion losses, we expect most projects to target higher-added-value end markets, notably existing hydrogen users such as the refining, chemicals, and fertilizers industries.

Chart 2

Supported by Europe’s hydrogen strategy, including 6 gigawatts (GW) of electrolysis plants by 2024, many European utilities have started pilot projects and announced long-term objectives. Some of the most high-profile announcements include:

- Danish wind offshore giant Orsted A/S just unveiled plans for the development of a 1 GW (about 250 kilotons [kt] of hydrogen) green hydrogen production facility connected to a new 2 GW offshore wind farm in the Dutch North Sea. This follows the October 2020 announcement of a feasibility study for a 70 kt green ammonia production plant in the Netherlands using offshore wind, in collaboration with Yara.

- Spanish integrated utility Iberdrola S.A., together with Spanish fertilizer producer Fertiberia, wants to develop 800 megawatts (MW) of green hydrogen capacity with an investment of €1.8 billion until 2027. It also announced a €150 million electrolytic hydrogen production system with a capacity of 20 MW that should be completed in 2021.

- Italian integrated utility Enel SpA has unveiled its ambition to build about 120 MW of green hydrogen capacity by 2023 and more than 2 GW by 2030, with a target of more than 8% of its power plants being hybridized with hydrogen by 2030.

- French integrated utility ENGIE SA recently partnered with Total SE to develop a 40 MW electrolyzer with initial production targeted for 2024.

- German integrated utility E.ON SE aims to blend green gases in its distribution grid by 2030 or, if required, use 100% hydrogen. It is currently involved with Salzgitter AG and Linde GmbH in the construction of a 20 MW electrolysis plant.

- In the U.K., gas distribution network Northern Gas Networks Ltd. and Cadent Gas Ltd. embarked on a subsidized pilot to showcase the use of 100% hydrogen for domestic heating and cooking. This is in line with the government’s £500 million pledge for investments to generate 5 GW of low-carbon hydrogen production capacity by 2030, with the goal of creating a “Hydrogen Neighborhood” by 2023, a “Hydrogen Village” by 2025, and a “Hydrogen Town” by 2030. U.K. integrated utility SSE PLC has yet to announce a hydrogen strategy, but wants to build four gas-fired power stations fitted with carbon capture and storage (CCS) technology before 2030.

Despite the lack of a national hydrogen plan, U.S. utilities have communicated their nascent ambitions in the technology. Among them:

- NextEra Energy Inc. is investing $65 million in a project that will use excess solar energy to produce hydrogen for its Okeechobee natural-gas plant. The 20 MW electrolysis system is expected to come online in 2023 and will replace a portion of natural gas.

- Dominion Energy, Inc. is currently in the first phase of testing a 5% blend of hydrogen in an isolated gas distribution system at a Salt Lake City training facility. It intends to incorporate hydrogen more widely and eventually increase the percentage in the system.

- Arizona Public Service Co., Exelon Corp., and Xcel Energy Inc. are individually piloting projects that will demonstrate hydrogen production from nuclear power.

- Duke Energy Corp. is researching hydrogen production, hydrogen storage, and co-firing hydrogen with natural gas at its power plant at Clemson University in South Carolina.

Public-Policy Support And Investor Demand For Clean Energy Will Remain Key Drivers

The U.S. power sector is continuing to reduce emissions, with further renewable growth supported by the Biden plan. The U.S. utility and power industry has reduced greenhouse gas emissions by about 25% over the past decade, with levels now below those of the U.S. transportation sector. This was possible because the share of coal in generation output almost halved to 23% in 2019 from 45% in 2010, while gas rose to 38% from 24% and wind and solar jumped to almost 9% from 2%. However, adopting a new technology also requires comprehensive federal and state policies that encourage innovation, sponsor pilot programs, and offer tax subsidies to reduce costs during development. President Biden’s recently announced $2.3 trillion American Jobs Plan promotes the promulgation of the Energy Efficiency and Clean Electricity Standard, which will foster further renewables development in pursuit of a carbon-pollution-free power sector. It also includes a 10-year extension and phase down of investment and production tax credits for renewables and storage and a boost to research and development, including funding of demonstration projects such as floating offshore wind farms. Although there is no specific hydrogen strategy, the plan’s direction creates potential need for more hydrogen and storage. Details of the funding mechanics are currently unknown, but we expect industry hydrogen partnerships with federal and state governments will have the highest chance of succeeding, since they will reduce potential risks for companies.

Europe has billions of euros in public funding commitments to expand hydrogen technology, but reducing costs and improving ramp up will remain significant challenges. The European Commission unveiled its hydrogen strategy in July 2020. This included a target to deploy 6 GW of electrolyzers across the EU by 2024. By 2030, the objectives include at least 40 GW of electrolyzers (yielding 10 million tons of green hydrogen) and potentially another 40 GW in neighboring regions/countries like North Africa or Ukraine. Moreover, European countries’ commitments to a net zero economy by 2050 mean the industry’s decarbonization and long-term replacement of natural gas usage are more realistic prospects. However, we continue to see hurdles in developing a green-hydrogen-only strategy, not least due to the related need to massively scale up renewable capacity. We also note the challenges in scaling up hydrogen production and bringing costs down (see “Clean Hydrogen Investment Is Still A Leap Of Faith For European Utilities,” published Nov. 16, 2020).

Editor: Robert Anderson.